February 4, 2026

S&P 500 futures +0.1% in early Wednesday trading, reversing some initial weakness. This follows a mostly lower Tuesday session, with technology—particularly software—the primary drag, pushing the Nasdaq down nearly 1.5%. Cyclicals provided some offset, and small caps finished modestly higher.

Overnight, Asian markets were mixed with South Korea and China among the stronger performers, while Japan lagged. European markets are mixed in early trade. Treasuries are firmer with yields down 1–2 bp and the curve flattening. The dollar index is up 0.1%, led by yen weakness. Gold (+2.7%) and silver (+7.1%) continue to rebound amid elevated metals volatility. WTI crude +1.1%, while bitcoin futures are marginally lower.

Markets remain relatively quiet ahead of key macro data and the next wave of mega-cap earnings, with Alphabet (GOOGL) reporting after the close today and Amazon (AMZN) tomorrow. The ongoing software selloff tied to AI competition remains a focal point, though broader pro-cyclical rotation and positive macro surprise momentum continue to cushion sentiment.

Corporate Highlights

- NVIDIA (NVDA): CEO dismissed concerns that AI will replace software tools; company reportedly nearing a $20B investment in OpenAI as part of a new funding round.

- Advanced Micro Devices (AMD): Beat and guided above consensus on datacenter strength; upside partly supported by China demand, though expectations were high.

- Amgen (AMGN): Product revenue beat and guidance strong; Street positive on new-product momentum.

- Super Micro Computer (SMCI): Beat and raised guidance; highlighted strong AI server demand.

- Lumentum (LITE): Shares higher on upside revenue guidance and optimism around laser opportunities.

- Mondelez (MDLZ): 2026 organic sales and EPS guidance light.

- Chipotle Mexican Grill (CMG): Q4 results better than feared, but flat 2026 comp guidance disappointed.

- Take-Two Interactive (TTWO): Raised bookings guidance.

- Skyworks Solutions (SWKS) and Cirrus Logic (CRUS): Benefited from iPhone-related strength.

- Texas Instruments (TXN): Reportedly in talks to acquire Silicon Labs (SLAB) for ~$7B.

Macro & Events

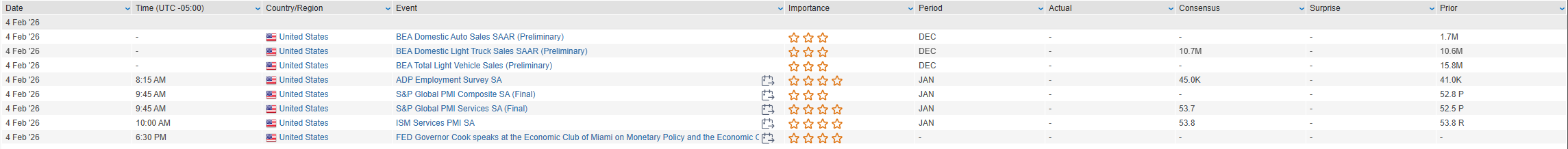

- Today: ADP private payrolls (consensus +45K), ISM services (expected 53.5 vs 53.8), and the Treasury quarterly refunding announcement.

- Fed: Governor Cook speaks this evening.

- Thursday: Initial jobless claims.

- Friday: Preliminary University of Michigan consumer confidence; January employment report remains delayed due to the government shutdown.

U.S. equities finished lower Tuesday (Dow -0.34% | S&P 500 -0.84% | Nasdaq -1.43% | Russell 2000 +0.31%) but closed off the worst levels as investors rotated away from concentrated tech exposures toward select cyclicals and defensives. The dominant theme was renewed pressure in software and parts of the AI ecosystem, offset by a continuation of the “run-it-hot” macro narrative following Monday’s strong ISM manufacturing surprise. That dynamic supported industrial cyclicals, materials, and homebuilders, even as index-level performance was weighed down by tech concentration and CTA positioning concerns.

Rates were little changed to modestly firmer, retracing part of Monday’s data-driven backup, with yields down 0–2 bp. The dollar index slipped 0.2%, while AUD strength remained the standout in FX following the RBA hike. Commodities were volatile but constructive: gold jumped 6.1% and silver 8.2% as last week’s selloff continued to look positioning-driven rather than narrative-based. WTI crude rose 1.7% amid elevated geopolitical tensions, while bitcoin futures fell 3%, briefly touching their lowest level since November 2024.

Headlines also included the formal end of the partial government shutdown (though the January employment report remains delayed), continued debate over OpenAI funding and AI competition, a White House affordability push tied to a proposed large-scale homebuilding initiative, and rising geopolitical risk following reports of U.S.–Iran friction.

Sector Highlights

Leadership rotated toward real assets and defensives. Energy, Materials, Consumer Staples, Utilities, and Industrials outperformed, supported by commodity strength, cash-flow visibility, and the resilient growth narrative. Technology was the clear laggard as software and AI-adjacent names sold off on competition and funding concerns, while Communication Services, Health Care, Consumer Discretionary, and Financials also trailed. The session reinforced an ongoing rotation away from concentrated tech exposure toward broader, macro-sensitive leadership.

Information Technology

- Palantir Technologies (PLTR): Strong post-earnings move; revenue growth accelerated to ~70% y/y, margins expanded sharply (Rule of 40 score ~127%), and guidance highlighted leverage to AI demand across commercial and government customers.

- Teradyne (TER): Big beat and raise; AI-related demand a key driver with growth expected across all segments in 2026.

- NXP Semiconductors (NXPI): Shares lagged as guidance underwhelmed relative to TXN, with revenues still reflecting a sequential decline and sluggish auto demand.

- Rambus (RMBS): Q1 product revenue guidance came in light; inventory normalization expected but near-term headwinds remain.

- Gartner (IT): Sharp selloff after FY26 Insights revenue guidance missed expectations, overshadowing beats elsewhere in the model.

- Fabrinet (FN): Down on concerns around muted Datacom growth despite otherwise solid results.

- NVIDIA (NVDA): Reuters reported OpenAI dissatisfaction with recent chip offerings; CEO Jensen Huang denied a rift and reiterated plans to invest in OpenAI.

Communication Services

- Walt Disney (DIS): Named Parks head Josh D’Amaro as CEO effective March 18; stock lagged amid broader entertainment weakness.

- Alphabet (GOOGL): Bloomberg reported plans to significantly expand its footprint in India, including new space in Bangalore.

Consumer Discretionary

- Rocket Companies (RKT): Shares advanced after management said mortgage loan production is tracking toward a four-year high.

- Lennar (LEN) and LGI Homes (LGIH): Among homebuilders higher following reports of a proposed large-scale “Trump Homes” affordability initiative.

- LegalZoom (LZ): Pressured as legal software sold off after Anthropic launched a new AI legal tool.

Consumer Staples

- Walmart (WMT): Became the first retailer to reach a $1T market capitalization.

- PepsiCo (PEP): Q4 results slightly better than feared; guidance reiterated; company announced price cuts on select snack brands.

Health Care

- DaVita (DVA): Strong quarter with beats across EPS, revenue, and operating income; FY26 guidance ahead; announced $200M investment in Elara Caring.

- Merck (MRK): Beat on Q4 results; FY26 guidance a touch light, partly reflecting acquisition impacts.

- Novo Nordisk (NVO): Warned 2026 sales could decline 5–13% amid rising obesity-drug competition and U.S. pricing pressure.

- Pfizer (PFE): Beat earnings but shares fell after underwhelming obesity-drug data from its Metsera acquisition.

Financials

- PayPal (PYPL): Sold off sharply after weak Q4 results, softer FY26 outlook, and announcement of CEO transition.

- Blue Owl Capital (OWL): BDCs pressured on continued concerns over software exposure across portfolios.

- Banco Santander (SAN): Confirmed acquisition of Webster Financial for $12.2B in a cash-and-stock transaction.

Energy

- Marathon Petroleum (MPC): Earnings takeaways highlighted strength in refining and marketing.

- Crude-linked equities outperformed as oil rebounded on geopolitical headlines.

Industrials

- Woodward (WWD): Beat and raised guidance; strong commercial aftermarket and defense demand.

- FedEx (FDX): Upgraded at Wells Fargo on catalyst path tied to investor day and upcoming results.

- W.W. Grainger (GWW): Mixed quarter; margins resilient though volumes lagged expectations.

Materials

- Archer-Daniels-Midland (ADM): Shares fell on weak revenue and conservative 2026 guidance tied to biofuel policy uncertainty.

- Industrial and precious metals producers benefited from the sharp rebound in metals prices.

Eco Data Releases | Wednesday February 4th, 2026

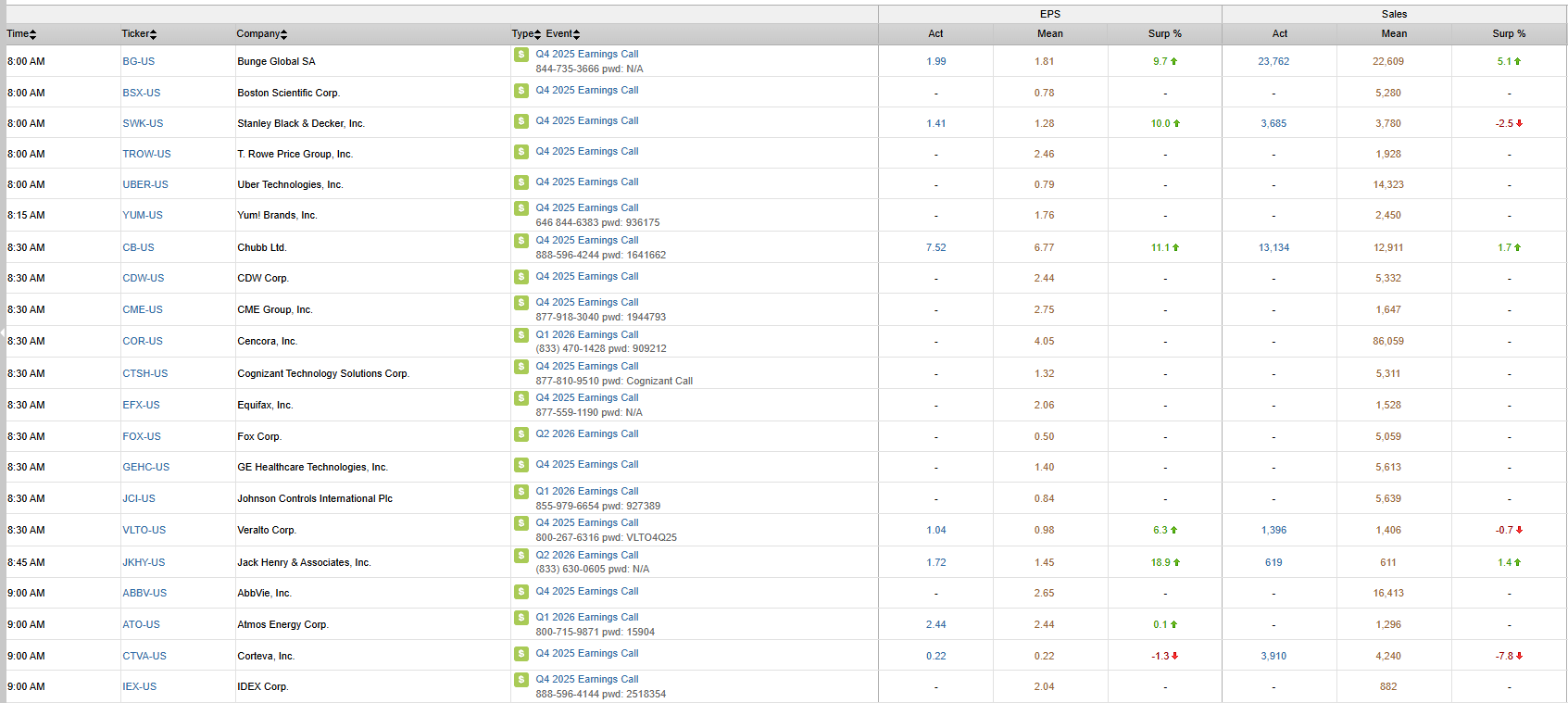

S&P 500 Constituent Earnings Announcements | Wednesday February 4th, 2026

Data sourced from FactSet Research Systems Inc.