February 18, 2026

S&P futures are up 0.6% following a mixed start to the holiday-shortened week. Yesterday saw weakness in software, metals, staples, and energy, while financials, airlines, and biotech outperformed.

Overnight, Asian markets were mostly higher in thin holiday trading, with the Nikkei up just over 1%. European equities are up ~0.8%. Treasuries are weaker with yields up ~2 bp across the front and belly of the curve. The dollar index is up 0.1%. Gold +0.7%, silver +3.4%, Bitcoin futures +0.7%, and WTI crude +0.3%.

There is no clear catalyst behind the firmer tone in futures. AI remains central to the narrative, with NVIDIA (NVDA) and Meta Platforms (META) higher following a multi-year collaboration announcement. Under-the-surface volatility remains elevated, particularly in software, which continues to serve as ground zero for AI disruption debates. Broader index stability is being supported by double-digit earnings growth and a resilient macro backdrop.

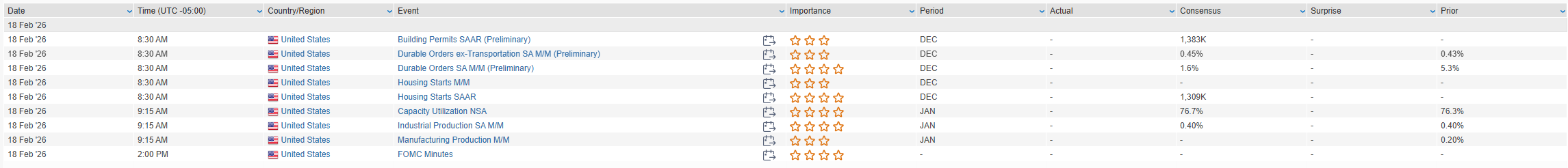

Today’s macro focus includes durable goods orders, housing starts, and industrial production, along with a $16B 20-year Treasury auction. Fed Governor Bowman speaks at 13:00, and January FOMC minutes are released at 14:00. Looking ahead, Walmart earnings Thursday morning and a potential Supreme Court ruling on tariffs Friday are key near-term catalysts.

Corporate Highlights

- NVIDIA (NVDA) / Meta Platforms (META) – Announced multi-year AI collaboration.

- Palo Alto Networks (PANW) – Shares pressured as FY26 organic growth reiterated; limited upside to NGS ARR.

- Cadence Design Systems (CDNS) – Gained on guidance viewed as better than feared.

- Devon Energy (DVN) – Q4 beat on volumes and lower expenses; highlighted FCF optimization progress.

- MKS Instruments (MKSI) – Beat and guided higher, though expectations remain elevated.

- Axcelis Technologies (ACLS) – Down sharply on softer Q1 revenue outlook despite strong Q4.

- Toll Brothers (TOL) – Beat and reiterated FY26 guidance.

- Hormel Foods (HRL) – Positive Q1 preannouncement.

- Caesars Entertainment (CZR) – In line overall; strength in Digital offset softer regional trends.

- Sandisk (SNDK) – Lower following announcement of $3B+ secondary offering.

- Republic Services (RSG) – Revenue light amid Environmental Services softness.

- La-Z-Boy (LZB) – Guided below expectations citing macro and weather headwinds.

U.S. equities finished modestly higher Tuesday (Dow +0.07% | S&P 500 +0.10% | Nasdaq +0.14% | Russell 2000 Flat) in a session characterized by underlying rotation and mixed macro signals. Treasury yields rose at the front end (2-year +3 bp to 3.44%), while the long end was little changed, extending the flattening trend with a slightly bearish tilt. The dollar strengthened (DXY +0.3%), while commodities reversed recent gains—gold fell 2.9% back below $5,000, silver dropped 5.7%, and WTI crude declined 0.9% amid more optimistic U.S.–Iran headlines.

Economic data was mixed. The February Empire State manufacturing survey missed expectations, though new orders improved and employment returned to expansion. However, input and selling prices jumped. The NAHB housing index unexpectedly declined to its lowest level since September, with affordability cited as a key headwind. ADP weekly private payroll growth averaged 10K over the past four weeks, marking a third consecutive improvement.

Fedspeak leaned cautious but flexible. Chicago Fed President Goolsbee reiterated that several rate cuts remain possible this year if inflation continues trending toward target. Governor Barr emphasized patience, while San Francisco Fed President Daly noted policymakers must remain alert to AI’s economic impact.

Geopolitics remained fluid. U.S.–Iran nuclear talks reportedly agreed on “guiding principles,” though no deal is imminent, while tensions in the Strait of Hormuz briefly resurfaced. Markets also await a potential Supreme Court ruling on tariff authority later this week.

Tuesday’s modest index gains masked active rotation beneath the surface. Financials and select mega-cap tech stabilized, while software and staples came under pressure. M&A and activist activity intensified, underscoring corporate willingness to pursue strategic change despite macro crosscurrents. Markets remain balanced between resilient economic data and growing structural questions around AI disruption, labor dynamics, and capital allocation discipline.

Sector Highlights

Performance reflected a rotation back into Financials and Real Estate, while defensives and commodities-linked groups lagged.

Outperformers:

Real Estate (+1.03%), Financials (+0.99%), Technology (+0.49%), Industrials (+0.45%)

Underperformers:

Consumer Staples (-1.51%), Energy (-1.37%), Materials (-1.16%), Communication Services (-0.60%), Utilities (-0.36%), Healthcare (-0.19%), Consumer Discretionary (-0.02%)

Money-center banks and select mega-cap tech drove the cap-weighted index higher, while software weakness offset broader tech gains. Equal-weight indices trailed as leadership narrowed.

Information Technology

Mega-cap tech outperformed selectively, with AAPL, NVDA, and AMZN providing support.

- Apple (AAPL) continued strength amid reports it is accelerating development of AI-powered wearables.

- ServiceNow (NOW) saw executives cancel regular stock sales to reassure investors.

- Kyndryl Holdings (KD) surged 11% after filing a delayed 10-Q and confirming no financial restatement.

- Fiserv (FISV) gained nearly 7% on reports activist Jana has taken a stake.

Financials

- JPMorgan Chase analysts noted smaller banks may face consolidation pressures tied to AI investment burdens.

- Munich Re announced workforce reductions partly tied to AI efficiencies.

Consumer Discretionary

- Norwegian Cruise Line Holdings (NCLH) rose 12% after activist Elliott reportedly built a 10%+ stake.

- Tripadvisor (TRIP) gained nearly 10% as activist Starboard confirmed board nomination plans.

- Southwest Airlines (LUV) rose following an upgrade citing earnings upside from operational changes.

- Rivian (RIVN) fell 7% after a downgrade.

Communication Services

- Warner Bros. Discovery (WBD) confirmed it would reopen merger talks with Paramount Global (PSKY), which indicated willingness to raise its offer.

Healthcare

- Masimo (MASI) surged 34% after agreeing to be acquired by Danaher Corporation (DHR) for ~$10B.

- Danaher Corporation (DHR) declined on deal dilution concerns.

- Medtronic (MDT) slipped despite earnings beat as guidance remained cautious.

- Labcorp (LH) eased on light revenue growth.

Industrials & Materials

- Vulcan Materials (VMC) fell on weaker EBITDA guidance.

- Knife River (KNF) gained 16% on margin expansion and backlog strength.

Consumer Staples

- General Mills (GIS) dropped 7% after cutting fiscal outlook, citing a challenging consumer environment.

Energy

Oil weakness weighed broadly as geopolitical headlines eased.

Eco Data Releases | Wednesday February 18th, 2026

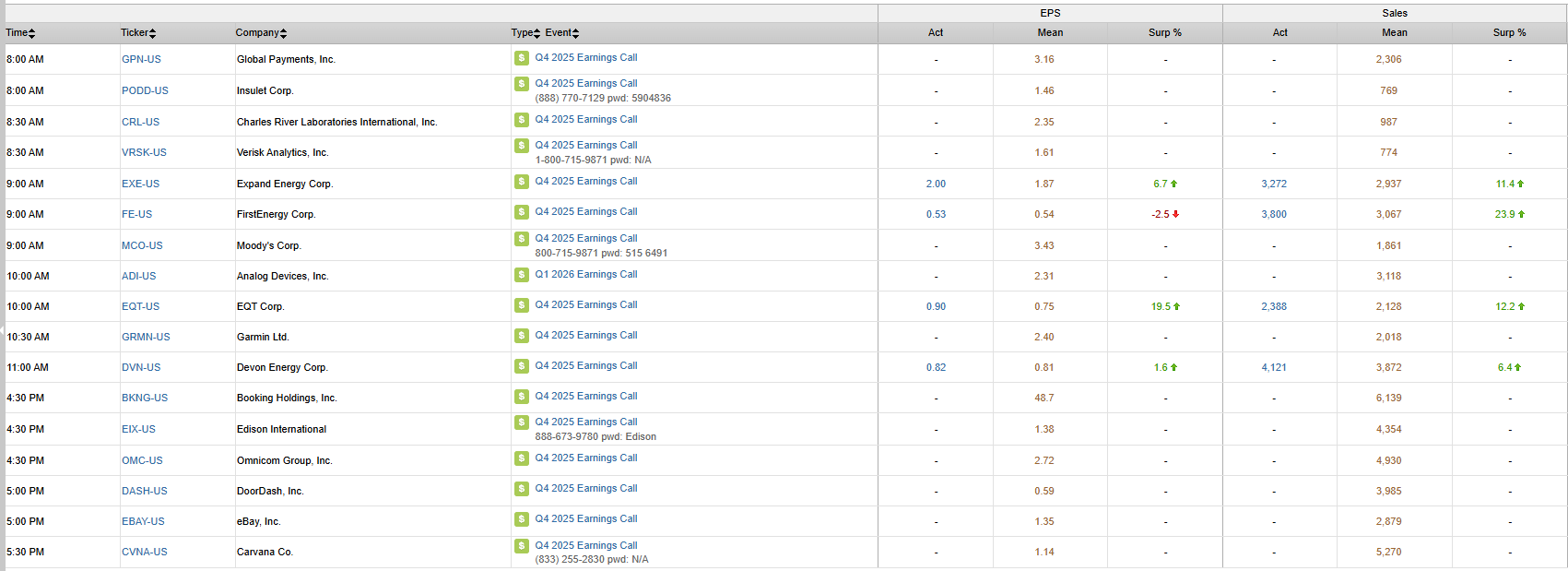

S&P 500 Constituent Earnings Announcements | Wednesday February 18th, 2026

Data sourced from FactSet Research Systems Inc.