April 14, 2025

U.S. equity futures are higher in Monday morning trading (S&P futures +1.2% | Nasdaq futures +1.5% | Dow futures +0.9%), extending Friday’s rally where all major indexes gained over 1.5%, capping a strong week (S&P +5.5%, Nasdaq +7%). Global markets also firm, with Hong Kong up nearly 2.5% overnight and Europe gaining over 2%. Treasuries are mostly firmer with a steepening curve following last week’s ~50 bp surge in 10Y yields. The dollar index is down 0.7% after falling ~3% last week. Gold is off 0.2%. Bitcoin futures +1.7%. WTI crude +0.8%.

Drivers:

- Electronics tariff exemption seen as the key risk-on catalyst, with AAPL and NVDA among the top perceived beneficiaries. However, officials including Trump and Lutnick later clarified this is a temporary move, with electronics still set to be included in sector-specific semiconductor tariffs.

- Markets also supported by signs of rate stabilization and speculation that last week’s tariff pause may have marked peak volatility, opening the door for systematic buying.

- Broader sentiment also helped by the continued unwind of the “US exceptionalism” narrative amid dollar softness and safe-haven reappraisal.

On the calendar:

- NY Fed 1-, 3-, and 5-year inflation expectations due this morning.

- Fed Governor Waller speaks at 13:00 ET; Harker and Bostic speak this evening.

- This week’s data highlights include Empire Manufacturing (Tues), Retail Sales, Industrial Production, and Powell (Wed), and Philly Fed + Housing Starts (Thurs).

Corporate Highlights:

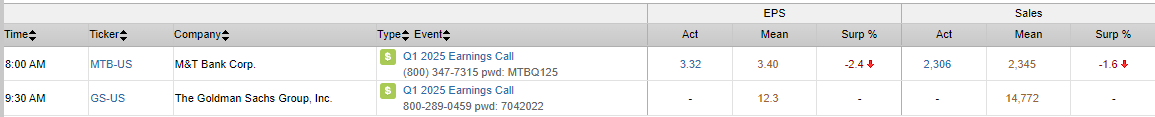

- GS and MTB report earnings this morning.

- AAPL accelerating production in India and Vietnam to take advantage of 90-day tariff exemption.

- META and GOOGL face regulatory headwinds, with NYT spotlighting upcoming court battles with the FTC and DoJ.

- AMGN hit with antitrust suit over access to biosimilar Erelzi.

- KKR reportedly nearing deal to acquire OSTTRA JV for ~$3B.

- X back in focus after Trump reiterated U.S. Steel should not fall into foreign hands.

- CROX urging expense control amid tariff-driven supply chain risks.

Equities ended the week on a high note with broad-based gains (Dow +1.56%, S&P 500 +1.81%, Nasdaq +2.06%, Russell 2000 +1.57%). The S&P 500 posted its best week since November 2023 and the Nasdaq its strongest since November 2022, though both indices have only logged two up weeks out of the last eight. Gains were supported by technical tailwinds, positioning, and signs the Fed stands ready to stabilize market functioning if needed. Treasuries finished mixed with a flatter curve; the 30Y yield remains elevated after this week’s sharp backup. The dollar index fell another 0.9% on Friday, capping a 3% weekly loss. Gold rallied 2.1% to a fresh record and was up nearly 7% for the week. Bitcoin futures gained 5.5%. WTI crude rebounded 2.4%.

Economic data continued to support a disinflation narrative, at least pre-tariff. March PPI came in much cooler than expected: headline -0.4% m/m (vs. +0.2% est) and core -0.1% (vs. +0.3% est), driven by declines in energy and services prices. However, April’s inflation readings are likely to reflect tariff impacts. The University of Michigan’s preliminary April sentiment reading missed at 50.8, lowest since June 2022. Inflation expectations surged: 1-year rose to 6.7% (highest since 1981), and 5-10 year to 4.4%.

Trade tensions remain elevated. China hiked its tariff rate on U.S. goods to 125%, saying it will not escalate further but criticized the U.S. approach. Xi Jinping called on the EU to join China in pushing back on “bullying.” Meanwhile, Trump threatened tariffs on Mexico. Uncertainty around the feasibility of negotiating dozens of bilateral trade deals during the 90-day pause remains a concern. Fed officials (Williams, Collins) reiterated a patient approach but flagged upside inflation risks and pledged readiness to intervene if market liquidity deteriorates.

S&P 500 Sector Performance (from Friday):

Outperformers: Tech (+2.56%), Materials (+2.99%), Energy (+2.50%)

Underperformers: Consumer Discretionary (+1.09%), Communication Services (+1.10%), Utilities (+1.18%

Company News by GICS Sector:

Financials:

- JPM (+4.0%): Beat on Q1 EPS, NII, and revenue; strong equities trading (+48%) offset modest NIM miss. Raised 2025 NII outlook slightly.

- WFC (flat): EPS beat driven by lower provisions and expenses. However, NII and NIM light, and full-year guidance seen as a stretch.

- MS (+1.4%): Beat on EPS, led by equity trading; wealth management missed on margins and revenue.

- BLK (+2.3%): EPS beat with solid margin performance; long-term inflows light, but organic base fee growth supported by ETFs and private markets.

- BK (+1.4%): EPS/revenue beat; strong NII, but weaker investment management fees and FX trading.

- AXP (+1.7%): Upgraded to Buy at BofA; cited resilient customer base, manageable credit risk, and defensible earnings.

Industrials:

- HII (+7.6%): Upgraded to Buy at GS; cited attractive valuation and strong U.S. defense spend tailwind.

- MLM (+3.5%): Preannounced Q1 revenue in line, EBITDA above; CFO stepping down for new role at CNH.

- HOG (+4.9%): Reportedly exploring a sale of its finance unit, potentially valued at $1B+.

- JOBY (-1.5%): Downgraded to Equal Weight at MS; noted tariff-related headwinds to eVTOL growth backdrop.

Consumer Discretionary:

- THS (+7.4%): Preannounced Q1 EBITDA ahead of guide; reaffirmed FY outlook and noted cost-saving measures.

- CNK (+2.8%): Upgraded to Overweight at JPM following CinemaCon updates; optimism around Amazon MGM theatrical content.

- FIVE (-2.1%): Bloomberg reported company canceled China-bound shipments in response to tariff pressure.

- WBD (-1.6%): Board member John Malone stepping down; will serve as chairman emeritus.

Information Technology:

- LOGI (flat): Pulled FY26 guidance citing tariff uncertainty.

- BRKR (+1.8%): Preannounced Q1 revenue above consensus; announced new partnership with Ridom GmbH.

Communication Services:

- VZ (+1.9%): Upgraded to Outperform at Evercore ISI; highlighted stronger wireless subscriber trends and growth in business segment.

Materials:

- MLM (+3.5%): Also included under Industrials; positive readthrough on profitability despite executive transition.

Energy:

- Sector broadly higher (+2.5%) amid crude oil rebound. No major company-specific headlines.

Eco Data Releases | Monday April 14th, 2025

S&P 500 Constituent Earnings Announcements | Monday April 14th, 2025

Data sourced from FactSet Research Systems Inc.