April 15, 2025

S&P futures are modestly higher in early Tuesday trading following a quiet Monday session where U.S. equities finished higher, marking the S&P 500’s first consecutive gains since the early April tariff shock. Defensive sectors led, while Asia and Europe both saw broad gains overnight. Treasuries are narrowly mixed after Monday’s rally, the dollar is flat, gold is up 0.6%, Bitcoin futures are up 1.3%, and WTI crude is little changed.

No major directional catalysts in play. Trade remains the dominant theme, with the White House launching national security probes into pharmaceuticals and semiconductors—a move widely expected. Markets still seeing some relief from recent tariff off-ramps (90-day delay, electronics exemptions, and talk of auto relief), and some optimism surrounding low bar for early trade deals, with U.S.-Japan talks scheduled Wednesday. Positioning dynamics, especially systematic buying, are also providing support, though sentiment still leans toward “sell the rip” due to persistent Trump 2.0 uncertainty.

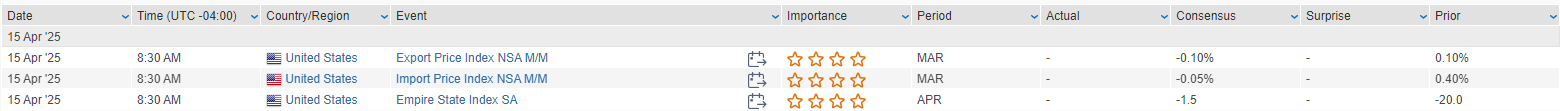

Macro focus: Empire State manufacturing and March import prices out this morning. Fed Governor Cook speaks tonight after last signaling concern over upside inflation risk but reaffirming a patient policy approach. Key data Wednesday includes March retail sales (+1.4% est. headline, +0.6% core), industrial production, and NAHB housing index, ahead of Fed Chair Powell’s speech. Thursday brings jobless claims, housing starts, and Philly Fed.

Corporate Highlights

- JNJ: Q1 beat, raised FY sales guidance but held EPS steady (including tariff costs).

- PNC: Slight beats on NII and NIM.

- MC-FR (LVMH): Q1 sales unexpectedly declined, weighing on luxury sentiment.

- NFLX: Reportedly targeting a $1T market cap, doubling revenue and tripling operating income by 2030.

- AMD: Said to be receiving revised offers for AI server assembly plants.

- LOW: Announced $1.325B acquisition of Artisan Design Group.

- BA: Chinese government reportedly told airlines to halt new deliveries.

- AMAT: Acquired a 9% stake in Dutch chip equipment maker BESI as a strategic investment.

- BP: CNBC highlighted company as a potential takeover target.

- ON: Scrapped bid for ALGM due to lack of engagement from target’s board.

U.S. equities ended higher Monday (Dow +0.78% | S&P 500 +0.79% | Nasdaq +0.64% | Russell 2000 +1.11%), rebounding through the afternoon despite midday softness. The S&P 500 and Nasdaq posted a second straight weekly gain, supported by easing inflation concerns, a pullback in yields, and ongoing hopes for more targeted tariff exemptions. Treasuries rallied, steepening the curve after last week’s aggressive bond selloff. The dollar index declined another 0.5%, extending its multi-day slide. Gold dipped 0.6% after Friday’s record close, while Bitcoin futures gained 1.3%. WTI crude was marginally higher.

Markets were lifted by relief around the tariff exemption on electronics, though officials quickly reiterated that the move is temporary, with sector-specific tariffs (notably on semis) still expected. Trump also floated potential auto tariff exemptions, which helped sentiment. The tone was also supported by dovish Fedspeak, particularly from Governor Waller, who suggested any inflation from tariffs would be temporary and that a recession would bring forward rate cuts. NY Fed’s March Survey of Consumer Expectations showed rising short-term inflation expectations, but labor market confidence declined.

Looking ahead, the week features retail sales, industrial production, and Fed Chair Powell’s speech on Wednesday. On Tuesday, Empire Manufacturing and import prices are on deck, with additional Fedspeak expected throughout the week.

S&P 500 Sector Performance & Corp Highlights (Monday April 14)

- Outperformers: Real Estate (+2.15%), Utilities (+1.75%), Consumer Staples (+1.64%), Health Care (+1.18%), Materials (+1.09%)

- Lagging: Consumer Discretionary (-0.10%), Energy (+0.25%), Communication Services (+0.25%), Tech (+0.63%)

Information Technology

- AAPL (+2.2%): Benefited from tariff exemption on smartphones and computers; also accelerating production in India and Vietnam during 90-day grace period.

- NVDA (+): Announced plans to build AI supercomputers entirely in the U.S. over the next 12–15 months.

- PLTR (+4.6%): NATO acquired the company’s Maven Smart System; terms not disclosed.

- INTC (+): Nearing a deal to sell its Altera chip unit to Silver Lake for ~$9B.

Financials

- GS (+1.9%): Q1 revenue and EPS beat expectations; record equities trading offset weaker FICC and investment banking. Announced $40B buyback.

- MTB (-): NII missed and guidance was cut; credit quality and buybacks were positives.

- CERT (+11.5%): Preannounced Q1 revenue above consensus and initiated $100M share repurchase plan.

Health Care

- AMGN (-): Hit with antitrust suit over biosimilar access to Erelzi.

- PFE (-): Discontinued development of obesity drug due to liver injury risk; GLP-1 sector names like VKTX (+10.6%) rallied in response.

- DVA (-3.0%): Disclosed ransomware attack that affected parts of its network, though patient care continues.

Industrials

- MP (+21.7%): FT reported the Trump administration is planning to stockpile critical ocean-derived metals.

- LUV (-2.4%): Added to Citi’s Focus List as a Sell; flagged weaker travel demand and strategic risks.

Consumer Discretionary

- HOG (+4.9%): Reportedly evaluating sale of its finance arm in a deal valued at over $1B.

- FIVE (-): Reported to have canceled some China-bound shipments due to tariff impacts.

- CROX (-1.9%): Bloomberg reported internal memo urging cost discipline amid tariff-driven supply chain volatility.

- H (+3.1%): Downgraded to Neutral at Goldman Sachs due to China exposure and contract structure concerns.

Communication Services

- META (-): FTC opened antitrust trial; regulators argue the company has avoided competition via acquisitions.

- GOOGL (-): Also facing upcoming DoJ trial, per NYT article spotlighting regulatory scrutiny across big tech.

- WBD (-1.6%): Board member John Malone stepping down, will serve as chairman emeritus.

Materials

- DD (+3.5%): Upgraded to Overweight at KeyBanc; tariff-related selloff seen as overdone with room to rebound on de-escalation.

- VKTX (+10.6%): See Health Care; part of broader GLP-1 trade.

Eco Data Releases | Tuesday April 15th, 2025

S&P 500 Constituent Earnings Announcements | Tuesday April 15th, 2025

Data sourced from FactSet Research Systems Inc.