July 2, 2025

S&P futures +0.1% following a mixed session Tuesday that saw the S&P and Nasdaq pull back after record-setting gains earlier in the week. Market action reflects continued rotation out of Q2’s top performers, particularly large-cap tech, with positive breadth elsewhere. Treasury yields rose overnight, steepening the curve as the long end added 3–4 basis points. The dollar firmed slightly, while gold rose modestly. Bitcoin futures rallied 2.5%, and WTI crude climbed 1.2%, nearing session highs.

Policy focus remains on the fate of President Trump’s “Big Beautiful Bill”, which passed the Senate Tuesday and is now back in the House. While Trump is pushing for passage by July 4, dissent among House Republicans and travel-related delays for some members may hinder that timeline. On the trade front, Trump reiterated he will not extend the reciprocal tariff pause beyond the July 9 deadline and expressed pessimism about a deal with Japan due to agricultural issues.

With markets heading into a quieter holiday stretch, attention is on labor data. June ADP private payrolls are due today, with consensus at +115K following May’s weak +37K reading. Thursday’s nonfarm payrolls report is expected to show similarly modest job growth (+115K) and a slight uptick in the unemployment rate to 4.3%. No Fed speakers are scheduled today; Chair Powell on Tuesday reiterated a data-dependent stance, saying no meeting is off the table for rate adjustments.

Company-Specific Headlines

- AMZN: Jeff Bezos sold $737M in stock under a prearranged trading plan.

- TSLA: China sales rose slightly in June, ending an eight-month losing streak.

- JPM, BAC, WFC, C: Big banks announced new buybacks and dividend increases after passing Fed stress tests.

- KKR: Launched a $5.6B takeover bid for Spectris plc.

- INTC: CEO reportedly considering a major shift toward contract manufacturing, per Reuters.

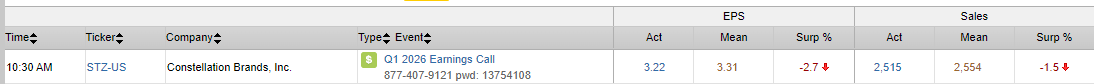

- STZ: Sales came in light; company reaffirmed full-year EPS guidance.

- NSANY: Will recall ~444K U.S. vehicles over engine concerns.

- PARA: Settled lawsuit with Trump over a 60 Minutes interview for $16M.

- FDP: Filed Chapter 11 and is exploring a sale as part of a stakeholder-backed plan.

- GBX: Beat earnings and raised full-year margin guidance.

U.S. equities posted a mixed performance on Tuesday (Dow +0.91%, S&P 500 -0.11%, Nasdaq -0.82%, Russell 2000 +0.94%), with the Dow and Russell 2000 rising strongly while the S&P 500 and Nasdaq dipped modestly following Monday’s record-setting session. The S&P had entered the day at its most overbought technical level since July 2024, setting the stage for profit-taking in megacap tech. Market action reflected a clear rotation from momentum to value, with the equal-weight S&P gaining and value outperforming momentum by 270 basis points, according to StreetAccount.

Treasuries sold off, reversing some of Monday’s strength. The policy-sensitive 2-year yield jumped 7 basis points, and the 10-year rose 4 bp, after falling in six of the previous seven sessions. The yield curve flattened, and the dollar slipped slightly (-0.1%), while gold rallied 1.3% and Bitcoin futures fell 2.1%. WTI crude rose 0.5% amid broad-based gains in the energy complex.

On the policy front, the Senate passed President Trump’s $3.3T “Big, Beautiful Bill” on a narrow 51-50 vote, with Vice President Vance casting the tie-breaker. Passage came after concessions to swing votes like Sen. Murkowski. The bill, which includes sweeping tax cuts and spending reductions, now heads to the House, where deeper Medicaid and clean energy cuts may face stiffer resistance. GOP leaders are aiming for a July 4 signing but face a tight window.

Trade developments remained in flux. The Financial Times reported the White House may pursue phased agreements to meet the July 9 reciprocal tariff deadline, while Trump indicated a deal with Japan is unlikely before then and floated a 30–35% tariff. Talks with India appear more promising, with Treasury Secretary Bessent calling a deal “very close.”

Fed Chair Powell, speaking at the ECB’s Sintra conference, reiterated his “wait and see” stance on rate cuts, stating monetary policy remains “modestly restrictive.” While Powell acknowledged that a majority of Fed officials expect a cut this year, he made clear no meeting is off the table and refused to respond to Trump’s renewed criticism or discuss his future beyond his term ending in May 2026.

On the economic data front, the June ISM Manufacturing Index came in at 49.0, a slight improvement from May but still in contraction. New orders remained weak (46.4), prices stayed elevated (69.7), and employment softened further (45.0). Separately, the June S&P Global Manufacturing PMI beat expectations at 52.9, with strong output and rising input costs. The May JOLTS report showed job openings rose to 7.77M, led by gains in hospitality and finance, while hiring and quits rates were little changed. Construction spending fell 0.3% month-over-month, missing expectations. The June labor cycle continues tomorrow with ADP payrolls, ahead of Thursday’s nonfarm payrolls release (expected +115K).

Information Technology (-1.13%)

- PRGS -13.0%: Q2 EPS beat but revenue only in line; analysts noted weak software license performance despite optimism around ARR and Nuclia AI acquisition.

- COIN -4.3%: Fell after Ault Markets announced plans for a new decentralized crypto exchange in 2026.

- WOLF +98.1%: Surged after filing for Chapter 11 restructuring; expects to emerge by Q3 2025.

Communication Services (-1.19%)

- TSLA -5.3%: Declined following Trump’s critical social media post; delivery concerns ahead of Wednesday’s Q2 report. Musk assumed control of U.S. and European sales operations.

- WBD -4.5%: Fell as Advance/Newhouse sold 100M shares in a block trade.

- AMZN: In focus after reports it may soon have more robots than humans in its warehouse workforce.

Consumer Discretionary (+0.18%)

- KTB +6.7%: Added to Goldman Sachs’ Conviction List, citing strength in core business and Helly Hansen acquisition.

- NKE +3.3%: Upgraded to Buy at Argus; cited product strength and digital channel momentum.

- SG -2.2%: Downgraded at TD Cowen due to concerns over same-store sales growth.

Consumer Staples (+0.76%)

- HAS +4.3%: Upgraded to Buy at Goldman Sachs; strong demand for “Magic: The Gathering” and improved toy segment outlook despite tariff uncertainty.

Energy (+0.80%)

- Oil prices rose 0.5%, helping lift the sector. Russia’s crude shipments remained near a two-month low, while U.S. gas prices are poised to hit their lowest Independence Day level since 2021.

Financials (+0.53%)

- No major stock-specific headlines, but sector benefited from rising yields and value rotation.

Healthcare (+1.39%)

- DXCM -4.3%: Dropped alongside CGM and infusion pump peers after CMS proposed competitive bidding; analysts expect limited impact to CGMs but more uncertainty for pump makers.

- SOLV +2.7%: Upgraded to Buy at Argus, citing strong Q1 performance and business model transformation.

Industrials (+0.30%)

- BA: Announced CFO transition, effective August 15.

- ALGT +6.2%: Upgraded at Evercore ISI; praised flexible model and return to leisure-focused strategy post-Sunseeker Resort sale.

- PKG +7.6%: To acquire GEF’s containerboard business for $1.8B in cash.

Materials (+2.28%)

- Sector outperformed on M&A and price recovery.

- PKG acquisition news drove optimism across packaging and paper stocks.

Real Estate (+0.58%)

- Helped by rate volatility and rotation into defensives. No major headlines.

Utilities (+0.34%)

- Slight gains amid falling dollar and sector rotation. No company-specific updates.

Eco Data Releases | Tuesday July 2nd, 2025

S&P 500 Constituent Earnings Announcements | Tuesday July 2nd, 2025

Data sourced from FactSet Research Systems Inc.