S&P futures are up 2.2% Wednesday morning, following a broad rally Tuesday with all major U.S. indexes rising over 1%. In global markets, Asian trading was mixed as Japan climbed over 2.5% and Hong Kong dropped more than 2%, while European markets gained nearly 1%. Treasuries faced pressure with a bear-steepening curve; the 10-year yield has increased over 80 basis points since mid-September. The dollar index rose by nearly 1.5%, gold gained 1.5%, Bitcoin futures surged 7%, WTI crude fell 1.7%, and copper was down 2.5%.

The market is buoyed by election-related optimism, with Trump potentially returning to the White House and a “Red Sweep” expected to reduce political uncertainty. A retreat in the VIX (now below 20) and year-end seasonality, particularly in election years, also lend support. November is historically the third-best month for equity inflows. Corporate buybacks are resuming as blackout periods end, and last week marked a potential peak for mutual fund year-end selling.

No major U.S. economic reports are due today, but the Treasury will auction $25 billion in 30-year bonds after a strong 10-year note auction on Tuesday. Thursday will bring Q3 nonfarm productivity, labor costs, and initial claims data. The Fed is expected to announce a 25-basis-point rate cut, with Powell likely emphasizing data dependency.

In earnings, MCHP provided weak guidance, citing inventory correction and seasonality, while EXAS cut its FY guidance. SMCI sharply declined after missing September and December sales expectations, though no misconduct is suspected. IFF beat expectations but disappointed with Q4 EBITDA guidance. MASI exceeded healthcare segment forecasts, QLYS beat and raised guidance, and RVLV had an EBITDA beat. BGS missed due to slower-than-expected sales recovery. SWIM met expectations, tightened FY guidance, and is up 150% YTD, while IRBT announced a 16% headcount reduction.

U.S. equities closed higher on Tuesday, with the Dow up 1.02%, S&P 500 rising 1.23%, Nasdaq advancing 1.43%, and the Russell 2000 up 1.88%. All sectors ended in positive territory, with notable outperformance in big tech (especially Tesla and Nvidia), software, semiconductors, credit cards, machinery, airlines, cruise lines, homebuilders, and China tech stocks. Relative underperformers included energy, steel, agricultural products (like Archer-Daniels-Midland), pharmaceuticals, life insurers, chemicals, and casinos.

Treasuries were mixed, with a flattening yield curve following a strong 10-year note auction. The dollar index fell 0.4%, while gold finished slightly higher, up 0.1%. Bitcoin futures rose by 3.4%, and WTI crude ended up 0.7%. Investors showed optimism on economic resilience, supported by ISM services data and reduced fears around Treasury supply. Upcoming events include the FOMC announcement and Powell’s press conference on Thursday, and initial claims data for labor costs.

GICS Sector Summary:

Information Technology

- Palantir (PLTR): +23.5%, Q3 beat and raised FY24 guidance with strong growth in AI and U.S. government revenue.

- Payoneer (PAYO): +20.9%, strong Q3 earnings; raised FY24 guidance with notable B2B volume growth.

- GlobalFoundries (GFS): +14.9%, Q3 earnings exceeded estimates; positive on automotive share growth.

- Cirrus Logic (CRUS): -7.1%, Q3 guidance fell short amid headwinds in iPhone growth.

- NXP Semiconductors (NXPI): -5.2%, Q4 guide below expectations due to European and American macro weakness.

- Teradata (TDC): -14.7%, Q4 EPS guidance weak despite beating Q3 estimates; cloud migration growth expectations tempered.

Communication Services

- Bowlero (BOWL): +12%, revenue exceeded expectations; raised FY25 guidance, with growth in F&B revenue and acquisitions.

Industrials

- Cummins (CMI): +8.9%, Q3 results outperformed, driven by Power Systems and Distribution; FY24 guidance maintained.

- Emerson Electric (EMR): +7.2%, strong Q4 earnings; raised FY25 guidance and announced a dividend and buyback increase.

- Timken (TKR): -12.9%, Q3 results fell short; lowered FY24 guidance due to challenges in Engineered Bearings sales.

- AGCO Corp (AGCO): -7.8%, Q3 missed estimates with guidance lowered due to conservative dealer and farmer spending.

Consumer Discretionary

- Yum! Brands (YUM): +1.5%, Q3 missed estimates; positive on Q4 trends.

- Ferrari (RACE): -7.4%, Q3 revenue slightly light with shipment volumes below expectations.

Financials

- Apollo Global Management (APO): +7.1%, Q3 beat on key metrics; positive fee-related earnings and strong spread-related earnings.

- Marqeta (MQ): -42.5%, significant decline as Q4 revenue guidance fell short, triggering downgrades due to customer migration and regulatory challenges.

Materials

- Louisiana-Pacific (LPX): +7.3%, strong Q3 results; raised FY guidance with solid siding and OSB performance.

- DuPont (DD): +4.7%, Q3 earnings beat and raised FY guidance; expecting continued recovery in water and medical packaging.

- Celanese (CE): -26.3%, Q3 missed expectations; cut dividend and idled production due to auto/industrial demand issues.

Energy

- Marathon Petroleum (MPC): +3.2%, Q3 beat with strong refining performance; robust buyback activity.

- Diamondback Energy (FANG): -2.3%, Q3 missed estimates; positive on improved efficiencies and Q4 guidance despite earnings miss.

Consumer Staples

- Restaurant Brands International (QSR): -2.6%, Q3 earnings missed; comps below consensus, though October trends showed improvement.

Health Care

- Hologic (HOLX): -5.9%, Q4 earnings in line but organic growth lagged; guidance slightly below estimates.

Eco Data Releases | Wednesday November 6th, 2024

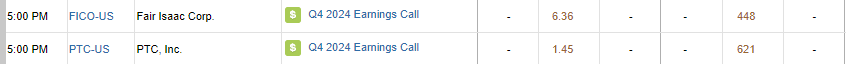

S&P 500 Constituent Earnings Announcements | Wednesday November 6th, 2024

Data sourced from FactSet Research Systems Inc.