January 30, 2026

NOTE: This is an opinion article from ETFSector.com Managing Director Mike Cronan, the opinions and analysis are his own and independent of the models and analysis we cover editorially at ETFSector.com

President Trump’s nomination of Kevin Warsh as the next Federal Reserve Chair marks a decisive moment for U.S. monetary policy. Warsh brings a rare combination of experience, having served as a Fed governor from 2006 to 2011, worked at the White House, and navigated some of the most turbulent economic periods in recent history, including the 9/11 aftermath and the 2008 financial crisis. This blend of market and policy experience positions him as a steady, credible leader capable of guiding the Fed through complex economic conditions.

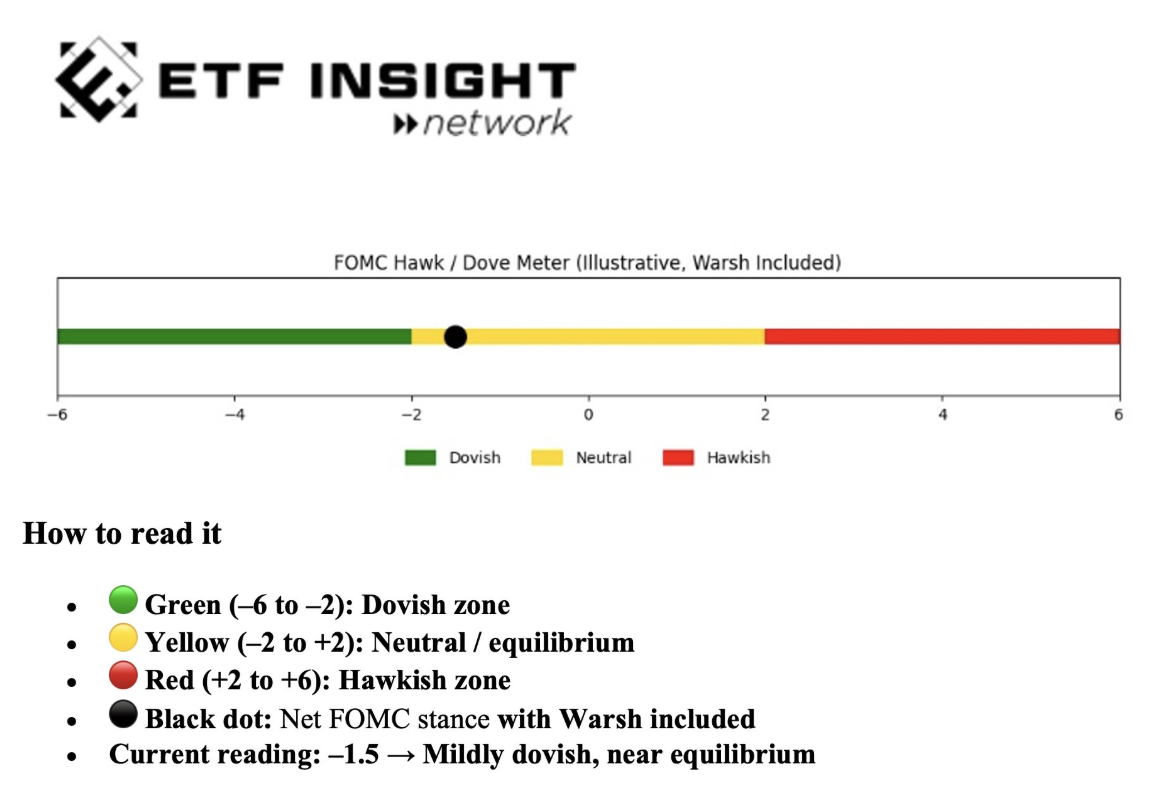

The Federal Open Market Committee (FOMC) comprises 12 voting members with diverse perspectives, ranging from hawks focused on inflation control to doves prioritizing growth and employment. While the Chair traditionally carries significant influence, policy outcomes depend on the collective deliberations of the Committee. Warsh’s track record suggests he can speak credibly to both camps, fostering collaboration and helping unify policy debates around data-driven, pragmatic solutions.

Warsh’s policy views are nuanced. He has supported interest-rate flexibility to respond to growth dynamics while maintaining a disciplined approach to inflation and the Fed’s balance sheet. This balanced perspective reassures doves that growth and employment concerns will be considered, while hawks can trust in his commitment to controlling inflation.

Beyond technical expertise, Warsh’s experience across public and private sectors has honed his consensus-building skills. These will be crucial in navigating political pressure while preserving the Fed’s independence. His nomination signals a focus on steady, pragmatic leadership — one that prioritizes Main Street outcomes without compromising long-term economic stability.

As he moves toward Senate confirmation, Warsh has the potential to not only lead the Federal Reserve effectively but also bridge the Committee’s philosophical divides, ensuring that policy decisions reflect broad, balanced judgment at a critical time for the U.S. economy.

Having worked at Medley Global advisors as an executive, I had the benefit of consuming knowledge to understand the complex narrative from some of the best analyst who were educating our hedge fund and banking clients, these are my views alone and I created this chart. If you agree or disagree post your comments below.

Mike Cronan,

Managing Director | ETFSector.com