September 14, 2025

Equities finished yesterday notching another all-time high on the S&P 500. The August CPI report came in cool enough to support the Fed’s policy intentions with the market pricing in a 100% chance of a 25bp rate cut at next week’s meeting and a further 50bps of cuts into year end.

From a technical perspective, bullish sentiment around policy rate easing has driven the S&P 500 (chart below) towards near-term overbought conditions. Our technically derived price target for the index is at 6800 just a stone’s throw away from today’s 6587. We would expect garden variety corrections to be accumulated at or above the S&P’s February high of 6147, though we should remain vigilant for emergent risks.

If we had a concern for the bull market it would be that optimism around the Fed’s ability to manage interest rates lower has given cover to some near-term deterioration in the employment picture. The past week’s rise in jobless claims, for example, cemented conviction that the Fed will cut next week. In past cycles we might have seen more serious concerns, but the new normal we find ourselves in changes the math. Just as the AI trade has aggregated more and more of the marginal earnings growth at the stock level, the long-term bull trend in equity has concentrated wealth.

In February, The Wall Street Journal reported the top 10% of Americans by net worth account for 49.7% of all consumer spending up from 36% in 1989. In India, the top 10% account for 66% of total consumer spending according to The News Minute. What this means practically is that traditional economic measures like employment are de-emphasized while financial conditions, interest rates, sentiment and cost of capital are likely to be more impactful on earnings and equity prices. This also explains why mass market consumer brands are losing ground on main street and on Wall Street.

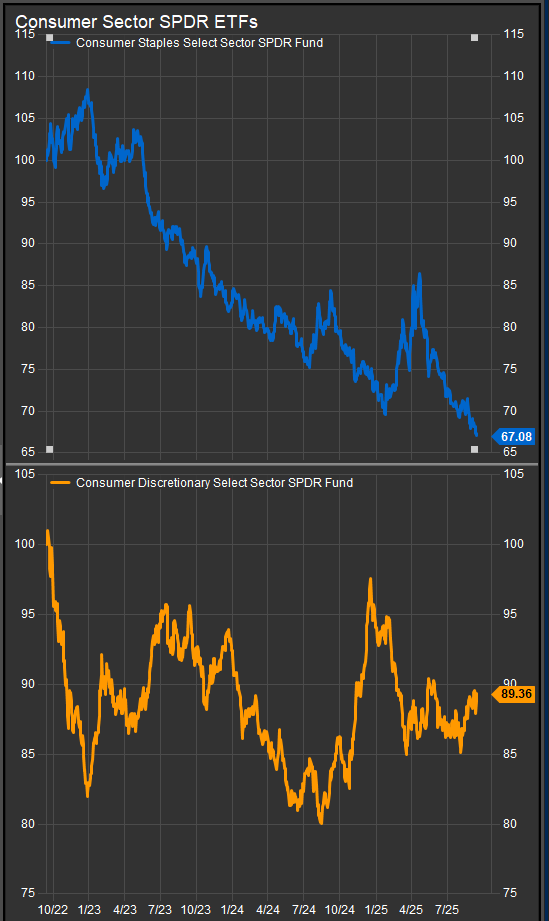

Given these developments it’s hard to be surprised that Consumer Staples and Consumer Discretionary sectors have been laggards in aggregate during this bull market (chart below). Those large cap. public companies have generally built large mass market followings on middlebrow to mid-luxe brands that target broad swaths of the populace. Concentration of growth in AI (Tech) and hyper-scaler companies (Tech/Comm. Services) have pulled investment dollars away from slower growing companies and they are also creating a change in how branding and marketing target consumers.

No one’s a role player anymore, everyone’s a star of their own big or small stage. The competent mom with the stain-fighting laundry detergent and the dad the chooses Alpo aren’t a thing anymore, but the companies that make up these sectors are modally the same as they have been for decades delivering reliable consistent product that conforms to established expectations. We think this changes the nature of the Discretionary sector in particular. The sector used to be a source of Growth and innovation, but at this particular point in time many of the companies that underpin the sector (NKE, HD, LOW, SBUX, MCD) are fairly conservative business lines that aren’t innovation hubs. AMZN and TSLA have accounted for much of the sector level out performance in recent years with only episodic support from other areas. Names like DASH and RDDT (charts below), have been positive standouts in 2025, but charts with strong price momentum are hard to find in the sector these days.

RDDT

DASH

Given economic dynamics that are burdening the broad middle of the consumer market place in particular, we would expect Discretionary stocks to be a key beneficiary of Fed interest rate interventions in the second half of the year. Homebuilders and Autos have shown intermediate-term bullish reversals on their price charts and lower rates are a tailwind to the mass market as they are a benchmark for mortgages, consumer loans and credit card rates.

Softening economic data in the near-term likely drives increased consensus on the depths of the Fed’s rate cuts. We’re seeing around 70 bps of cuts priced in through the end of the year at present, but that could grow with more signs of economic softness, and investors would likely see that as favorable.

Conclusion

We think investors should focus on financial conditions and market internal strength over economic data prints in the near-term. The tailwind from a dovish Fed will likely boost this Growth led bull more than consumer woes will drag it down. It should also provide a marginal boost to Discretionary stocks in the near-term. We think they are a good intermediate-term bet for sector investors into the end of the year, but it’s less clear they can keep pace with the AI innovation sectors (Techology/Comm. Services) as presently constituted unless more innovative business models are established in the sector.

Data sourced from FactSet Research Systems Inc.