September 1, 2025

Last week, we detailed the emergence of the Fed as a key player in the 2nd half of the year after Powell signaled intent to lower rates. The stated goal is to support the softening employment picture. Tariffs have added some cost pressure which factored into the Fed’s decision but haven’t registered as inflationary. At the top line price action following these developments has been muted as proxied by the S&P 500 (chart below). August saw the S&P 500 register fresh all-time highs. The only concerning development from the technical lens has been negative momentum divergence (oscillator makes lower highs as price makes higher highs) as seen in the MACD and RSI studies. We think this sets up potential correction which we project would be accumulated between the 5786 and 6147 levels.

Easing typically supports a bid for laggard stocks and sectors in its early stages. We are seeing that develop in the price action of the Russell 2000 in the near-term (chart below). Small Cap. stocks, in theory, derive some benefit from tariffs as trade barriers constrict supply chains and support the development of regional networks rather than global ones. M&A activity is one form the tailwind takes as larger companies look to shore up means of production in the new alignment. In this cycle there is less Growth and Tech in the small cap. indices relative to the S&P 500 and that may help them outperform major benchmarks if we see rotation out of the AI trade and into a more mundane set of companies. The breakout in absolute terms for the Russell 200 measures to a target near 2880 for >20% upside.

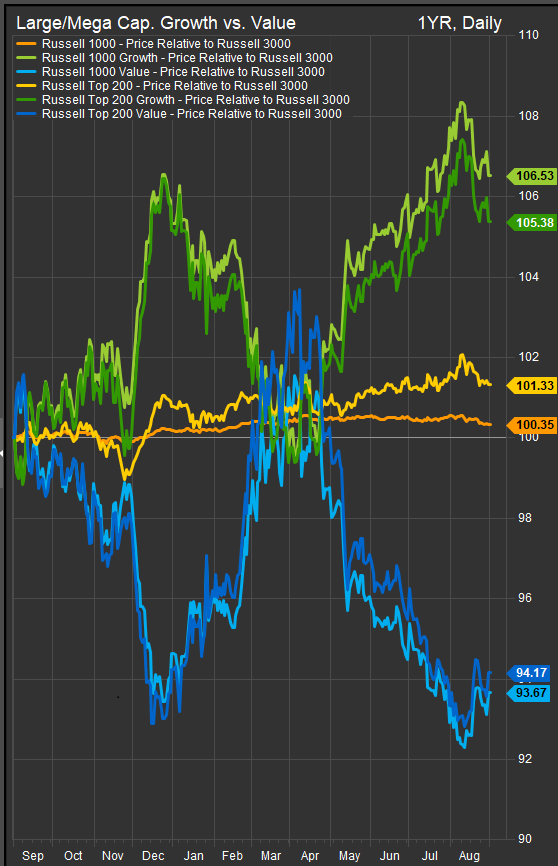

Small Cap. stocks have been structural laggards in this cycle, but Value stocks generally have as well. Looking at Large Cap. Growth and Value performance over the past 12 months (chart below), we can see the bullish pivot for Value that establishes a trading range between the two factors. We’re expecting Value to close the gap on performance in the near-term given renewed dovish expectations.

At the sector level, if we continue to think about dovish policy supporting laggards, we’d expect low vol. stocks to fair better than they have recently. Easing was on the table from May through October of 2024 and low vol. sectors firmed (chart below, middle panel). Beyond rate sensitive sectors, we would expect Financials, Energy and Discretionary stocks to improve. Materials stocks have been bitten hard by tariff implementation, so their path is less clear to us. Tech and Comm. Services sectors may see some profit taking in the near-term if investors move to bottom-fish with financial conditions set to ease.

Conclusion

Softening rates along with some selling in AI leaders sets up potential for deeper rotation in the near-term. A dovish Fed supports an impulse to bottom-fish laggard stocks and lower rates in the near-term support dividend payors in the lower vol. sectors. Investors should add some exposure to lower vol. sectors in the near-term but keep an eye on AI names for accumulation opportunities. We think a dovish Fed, easing financial conditions and some loss of momentum in the AI trade elevates the chance of near-term rotation away from Growth leaders.

Patrick Torbert, Editor & Chief Strategist, ETFSector.com

Data sourced from FactSet Research Systems Inc.