October 19, 2025

Last week we got our first inklings of potential problems underneath the surface within the banking sector in 2025. Equities have faced some corrective price action in the past week and risks around trade, credit and government funding are starting to claim more attention. We wanted to use our weekly letter to discuss some of the core concepts underpinning the current bull market and what kind of warning signs we’d be looking for to change our long-term outlook from positive to negative. For the present we remain aligned with the bull trend and long Growth exposures.

Growth at a Crossroads: The Risks and Rewards of Staying Long in 2025

The U.S. equity market has once again converged around a familiar theme: the dominance of growth. Led by the artificial intelligence (AI) complex and mega-cap technology names, growth exposures have powered the S&P 500’s gains through 2025. Yet as financial conditions tighten and questions about economic resilience mount, investors face a critical inflection point. Remaining long growth exposures offers both extraordinary potential and rising risk. History, fundamentals, and behavioral studies all suggest the next phase of this cycle will hinge on whether the economy bends or breaks—and how long investor momentum can defy gravity.

Momentum and the Behavioral Core of Growth Investing

Decades of academic research show that momentum—the tendency for assets that have recently outperformed to continue outperforming—is among the most persistent anomalies in financial markets. Seminal work by Jegadeesh and Titman (1993, Journal of Finance) demonstrated that U.S. stocks with the strongest 6–12-month trailing returns beat laggards by roughly 1% per month on average. Subsequent global studies, including Asness et al. (2013), confirmed that the effect persists across regions, asset classes, and time periods.

In 2025, growth equities—especially those tied to AI infrastructure, semiconductors, and software—are classic momentum leaders. The Nasdaq 100 has returned about 21% year-to-date, outpacing the equal-weighted S&P 500 by nearly 900 basis points. ETF flow data from EPFR show that global investors have added over $45 billion to technology and AI-focused funds since January, while cyclical sectors like energy and materials have experienced net outflows. Momentum investors argue this concentration is rational: the growth trade has a fundamental engine—AI-driven productivity gains—and until that narrative is challenged, technical leadership can persist.

However, momentum’s power cuts both ways. When the trend reverses, returns decay quickly. The same studies that proved momentum’s persistence also documented its “momentum crash” risk—sharp drawdowns that typically occur when macro conditions shift from deflationary and stable to reflationary or contractionary. A study by Daniel and Moskowitz (2016, Review of Financial Studies) found that momentum portfolios underperformed the market by up to 30% annually during the worst reversal years, particularly around economic regime changes. In other words, momentum works—until the macro regime changes.

Growth in Recessionary vs. Non-Recessionary Periods

Historically, growth stocks have outperformed in non-recessionary slowdowns but struggled in actual recessions. In soft-landing environments—such as 1995, 2016, and 2019—falling yields and moderate disinflation supported valuation expansion. But during outright contractions, the growth premium typically collapses.

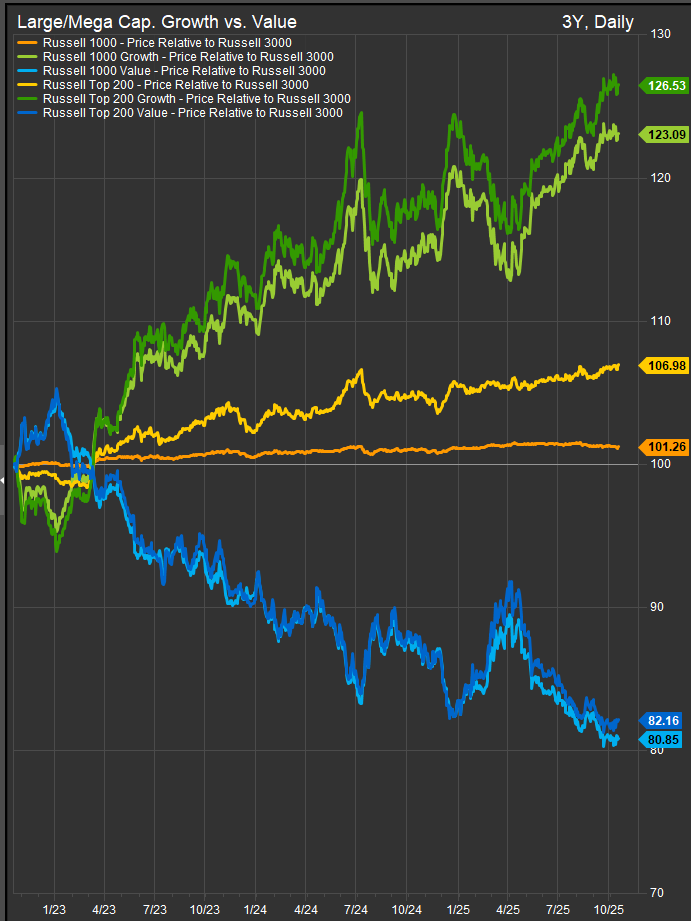

S&P Dow Jones Indices data show that during the past five U.S. recessions, the Russell 1000 Growth Index underperformed its value counterpart by an average of 11 percentage points in the 12 months surrounding the recession peak. In contrast, in late-cycle slowdowns that avoided recession (for example, 2012 or 2016), growth beat value by about 7 points. The distinction lies in earnings durability versus valuation risk: in mild slowdowns, falling interest rates boost present values faster than earnings are cut; in recessions, earnings revisions overwhelm rate effects.

The current macro backdrop is ambiguous. Real GDP growth has decelerated toward 1.2% annualized, and credit availability has tightened, but unemployment remains historically low near 3.9%. If the U.S. achieves another “rolling slowdown” without an outright contraction, growth valuations could remain resilient. But should regional-bank stress or global trade shocks spill into credit markets, growth stocks’ long-duration exposure could amplify downside volatility.

Fundamentals of the AI Trade: Still Expanding, But Maturing

The AI boom remains the structural engine of today’s growth premium. Global corporate AI spending is projected to exceed $325 billion in 2025, up from $240 billion last year (IDC). Semiconductor capital expenditures have surged nearly 60% since 2022, led by NVIDIA, TSMC, and ASML, while cloud providers have more than doubled GPU procurement budgets. Earnings follow-through has been substantial: as of Q3 2025, the S&P 500 Information Technology sector posted EPS growth of +28% y/y, far outpacing the +6% gain for the broader index.

However, the rate of acceleration is slowing. Consensus forecasts call for just 10–12% EPS growth for tech in 2026, suggesting the AI buildout is entering a more mature, capital-efficiency phase. Some hyperscalers are re-evaluating ROI on large-scale AI infrastructure after sharp cost inflation in chips and power. That cooling could narrow the performance gap between growth and the rest of the market over the next year.

Another key difference from past innovation cycles is labor dynamics. The U.S. unemployment rate remains near a five-decade low, and job openings per unemployed worker are still around 1.4—well above pre-pandemic norms. Historically, major innovation waves—such as the dot-com boom (1999–2000) or post-GFC mobile revolution (2010–2012)—occurred during periods of labor slack, when productivity gains did not threaten employment. In contrast, today’s AI adoption is happening amid tight labor markets and rising wage expectations. That dynamic may temper the short-term cost-saving narrative and delay visible productivity payoffs, particularly in service industries where labor is harder to automate.

Valuation and Positioning Risk

Valuations remain a central concern. The forward P/E of the S&P 500 Growth Index stands at roughly 27×, compared with 17× for value and 20× for the overall market—near the widest gap since the late 1990s. Such premiums are sustainable only if earnings growth remains structurally higher and rates stay contained. Any uptick in inflation, bond yields, or discount-rate expectations could compress multiples rapidly.

Positioning adds to the fragility. According to Goldman Sachs’ prime-broker data, hedge-fund net exposure to the “Magnificent 7” AI leaders is in the 97th percentile of the past decade, while systematic strategies are near record long in growth factors. In practice, that means even small macro shocks can trigger mechanical de-risking. As the 2020–2021 momentum unwind showed, crowding turns from friend to foe once volatility rises.

The Case for Staying Long Growth

Despite these risks, growth exposures still offer compelling advantages. Corporate balance sheets across the tech and communication services sectors remain among the strongest in the S&P 500, with net cash equal to roughly 8% of market cap, versus net debt of 25% for value sectors. Profit margins are also structurally higher—over 23% for tech versus 10% for the index. For investors seeking earnings resilience in an environment of slowing nominal GDP, these fundamentals are hard to replicate.

Moreover, the long-term AI story remains credible. Productivity growth in the U.S. non-farm business sector has accelerated from 1.3% annualized (2010–2019) to 2.1% (2020–2024), with economists attributing a growing share to digital automation and machine-learning diffusion. Even if AI investment growth slows, the structural integration of generative models into enterprise workflows suggests the earnings cycle still has multiple years of expansion left.

The Balanced View

The decision to remain long growth exposures in late 2025 hinges on one judgment: whether the U.S. economy can sustain a slowdown without sliding into recession. In non-recessionary scenarios, history suggests that momentum and duration trades continue to outperform as yields fall and liquidity remains sufficient. But if credit conditions tighten meaningfully or policy credibility erodes, high-multiple growth stocks could become the epicenter of a correction rather than its refuge.

For investors, the prudent stance may not be abandoning growth, but rebalancing within it—favoring profitable, cash-flow-rich leaders over speculative AI entrants; emphasizing quality balance sheets; and maintaining exposure to secular productivity gains while hedging valuation risk through barbell positions in value or defensive sectors.

In a market defined by both innovation and fragility, growth remains the engine of long-term return—but one that demands disciplined risk management as momentum, macro, and valuation forces converge.

Conclusion

At ETFsector.com, our Elev8 model remains constructive on Growth and Technology stocks. We acknowledge that the nature of momentum investing is weathering near-term drawdowns that are sometimes quicker and sharper than we’d like to have in an ideal world, but the prize is typically robust excess returns when the primary trend for equities remains higher. We think Value exposures have potential to rally in the near-term if investors become uneasy with the government shutdown, or if we have a Q3 earnings hiccup on top of recent negative developments in regional bank credit. That said, the AI wave remains a powerful motivating force for the bull. Earnings growth has been robust, and the trade has redounded to the benefit of many industries both within the Technology sector and without. We are concerned about narrowing market leadership, but while the economy remains near full employment, we expect near-term weakness to be accumulated and we remain constructive on the bull trend.

Bibliography / Sources

- Jegadeesh, Narasimhan, and Sheridan Titman. “Returns to Buying Winners and Selling Losers: Implications for Stock Market Efficiency.” Journal of Finance, 1993.

- Asness, Clifford, Tobias Moskowitz, and Lasse Pedersen. “Value and Momentum Everywhere.” Journal of Finance, 2013.

- Daniel, Kent, and Tobias Moskowitz. “Momentum Crashes.” Review of Financial Studies, 2016.

- S&P Dow Jones Indices, Russell 1000 Growth vs. Value Historical Performance, 1980–2025.

- Federal Reserve Bank of St. Louis (FRED), Unemployment Rate and GDP Growth Data, 1980–2025.

- International Data Corporation (IDC), Global AI Spending Guide, 2025.

- Goldman Sachs Prime Brokerage, Hedge Fund Positioning and Crowding Monitor, Q3 2025.

- Bureau of Labor Statistics (BLS), Nonfarm Productivity and Employment Data, 2010–2025.

- McKinsey Global Institute, AI Adoption and Corporate Productivity Trends, 2024.

- EPFR Global, ETF and Mutual Fund Flow Data, 2025.

- FactSet, S&P 500 Sector Earnings and Valuation Metrics, September 2025

Additional data sourced from FactSet Research Systems Inc.