April 20, 2025

S&P 500 price action continues to consolidate after putting in a potential floor at the 4818 level (chart below). 4818 was very near the S&P 500’s 2022 price high which marked the peak of the post-pandemic, stimulus-fueled bull market. We also note the symmetry of the 27% peak-to-trough decline in 2022 and the ensuing 27% upside move to our 2025 all-time price-high that started in early 2023. The current peak-to-trough drawdown measures at 19.3% just shy of the 20% bear market level. We read the chart as implying support at the 4500-4818 level and we think bullish reversal comes in at 5786 on the S&P 500 chart.

As we’ve mentioned in past notes, we are looking for positive divergence in momentum and relative performance from Growth themes to show us that investor’s enthusiasm for the Value/Safety and Ex-US equity trades are drying up. The current consolidation is a potential pivot, but the direction of resolution is the actual signal for sector positioning.

Growth is short of a Bullish Reversal vs. Value

When we look at the YTD performance of Growth and Value factors there’s a very clear pivot point on the chart that has been tested several times throughout March and April. However, even April 11th’s >8% Growth-led up day couldn’t push Growth stocks through resistance (chart below) and the current technical setup favors a retest of the lows in the near-term. In the context of positive divergence, we need to see Growth stocks outperforming above relative highs from March and April. If not, it’s a sign that Value could be more than a short-term haven.

Firming Commodities Support Value Stock Outperformance

We’ve mentioned many times that the Value factor is comprised of a broad coalition of disparate stocks from low vol., high income paying Utilities and Staples co.’s to Banks to Commodities adjacent industries. With that in mind, technical drivers of Value stock outperformance are typically contributors to rising rates, inflation and late cycle dynamics that elevate recession probabilities. Tariffs contribute to many of these drivers by raising barriers to the most efficient ways of operating global businesses. More infrastructure and more regional sourcing raise input prices and create geographic scarcity. With more demand for credit, borrowing costs rise. This is often balanced out by increased probability of recession and its concomitant demand destruction which raises appetite for safety assets and puts downward pressure on rates. The two conflicting dynamics in the feedback loop make it hard to discern a clear trend.

However, over the past 6 months there are clear signs of firming commodities prices when we compare them to the performance of global equities. The chart below shows the 6-month bullish reversal of commodities prices relative to equities.

Strengthening commodities prices would be a tailwind to Value stocks and could percolate sustained Value leadership even if equity prices recover. We think that is a big piece to getting sector positioning correct going forward. Sector performance has favored Low Vol. stocks to this point in 2025. Comm. Services and Financial stocks have held up as the best of the rest while Tech and Consumer Discretionary have seen the heaviest selling. If Value stocks lead a bullish pivot, we would expect that Industrials, Materials and Energy stocks would get a boost. If it’s Growth, we’d expect Semiconductors and Mag7 stocks to show bullish reversal.

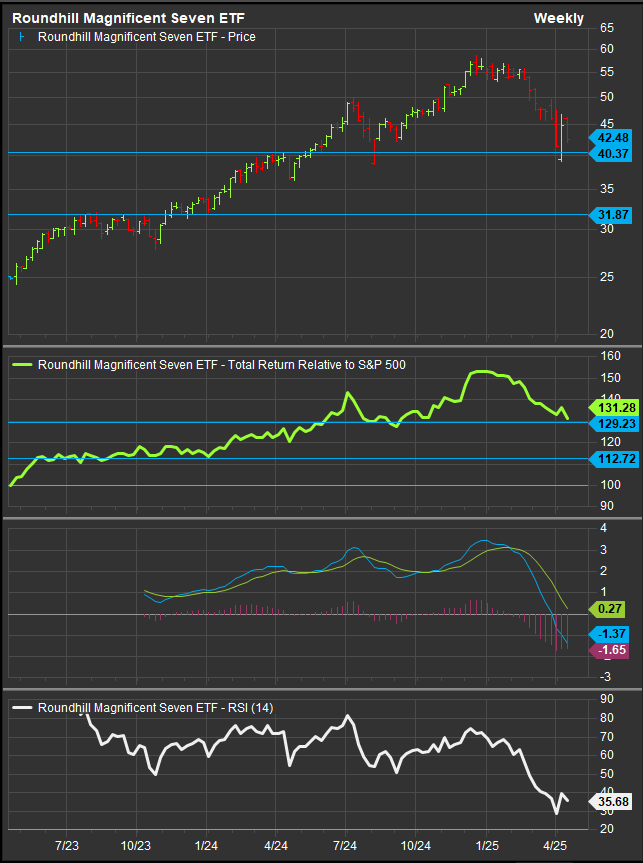

While commodities are showing a bullish pivot, we aren’t seeing any clear strength of bottom-fishing in the Mag7 ETF (chart below). Given the material discounting in prices, the current lack of enthusiasm has us considering deeper downside scenarios. We can see on the chart that price has corrected to intermediate-term support, but if the financial condition remain a headwind to Growth, there’s potential that investors could discount the mega Cap. cohort further. We think it’s an open question at this point given how many things remain unresolved on global trade. Better to cue off the charts than to be heroic in our opinion.

Conclusion

Rapidly changing circumstances surrounding global trade dynamics have created a lot of uncertainty around the direction of global equities and leadership themes. We are seeing evidence of firming commodities prices over the intermediate-term which could be a potential tailwind to the Value trade. There is less evidence that investors are bottom-fishing Growth stocks in the near-term, and we would want to see more evidence of buyer interest there before we rotate for a Growth recovery.

Patrick Torbert, Editor & Chief Strategist, ETFSector.com

Data sourced from FactSet Research Systems Inc.