April 7, 2025

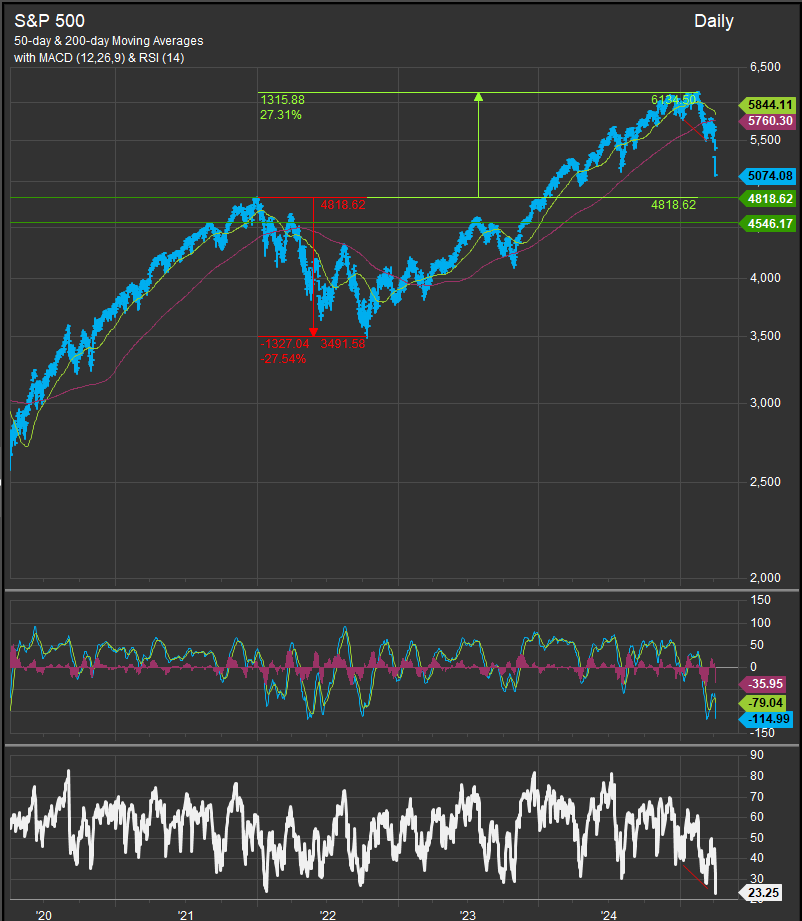

Anyone else already tired of the word “tariff”? Tariffs have been slapped on trading partners, residual tariffs are coming back our way. If one puts on one’s bowtie and reads from the economic textbook, this is a bad setup. Tariffs are inflationary to the extent that they raise prices, but more precisely they are “stag-flationary” because they raise prices without the benefits of efficiency. This is a setup that is problematic for the V-bottom crowd because some serious impediments to growth exist while the tariff regime is operating. Prices are surely going down fast enough, but investors need to hear about goals and outcomes in order to assess whether what’s happening is on a time line with an end point and we don’t have those information components available to us at present. The other way this ends is through policy pronouncement. Someone, presumably our President, will need to get up and walk some of the bad news back, but now that the policy has gone multi-lateral, there’s a bit of a toothpaste tube dynamic at play. Looking at the long-term chart of the S&P 500, the 2022 price high is not too far away to the downside. In the absence of clearer information about trade-war games, we think price structure offers support in the 4500-4800 range as seen on the chart below. We also can’t help but note that the bull market advance above the 2022 high was almost the exact magnitude of 2022’s peak-to-trough decline. That kind of proportional reciprocity is at the heart of classic technical analysis (chart below).

We can see from looking at some of our performance charts that the rotation across equities has favored ex-US equities over domestic ones. Part of that asset flight will no doubt reverse at some point and at some level as there have clearly been animal spirits at work on the S&P 500. However, trading partners are getting a preview of a new opportunity set and it may be hard to recuperate the previous status quo. Look at our global equity performance chart below. Equity investors have a clear bet on where the benefits of the current situation are headed. Each performance curve that is taking off like a rocket ship in the near-term is the EM index and the performance is driven by Chinese shares. EAFE equities are also improving with core European equity markets showing strength.

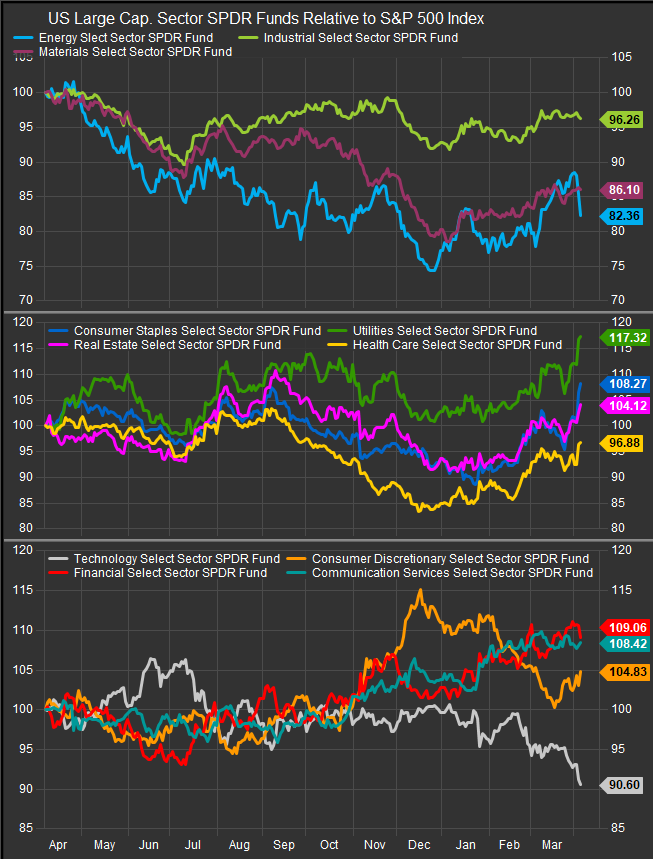

A lot can change very quickly given the nature of the situation we’re dealing with. Policy pronouncements will be coming from the executive branch rather than the legislature so there is potential for things to change on a dime. The S&P 500 is also 17% off its February all-time high and has sold off 10% in the last 2 days. We are expecting elevated near-term volatility to continue. We want to see positive divergence in the performance of high-beta sectors, industries and themes to gain conviction that the bull still has an agenda and that there is interest in accumulating the best among the previous leaders in the market. At the sector level, the performance of Technology (particularly Semiconductors) and Discretionary stocks (we think homebuilders will be a tell) will be a gage for seeing the bottom coming. In the near-term money has flowed to defensive sectors (chart below, middle panel), if they break higher from these levels, we know the opportunity set is truly constrained.

Patrick Torbert, Editor & Chief Strategist, ETFSector.com

Data sourced from FactSet Research Systems Inc.