June 15, 2025

Escalations in the Middle East on the heels of a bout of global trade realignment sets up a scenario straight out of an economics case study. Oil prices have risen (albeit from lows of the cycle, while equities in the very near-term have sold off along with US Treasuries at the long end of the curve. Further, Taiwan has banned Huawei and others in China access to its products adding a new layer to watch in the AI trade. The WTI crude price (chart below) has moved abruptly through its intermediate-term price congestion zone ($66-72) and will start the new week near $73, a >25% move from the low of early May. Continued strength in Crude buying projects potential upside to $86, while the downtrend channel will give us an earlier “tell” at $76.

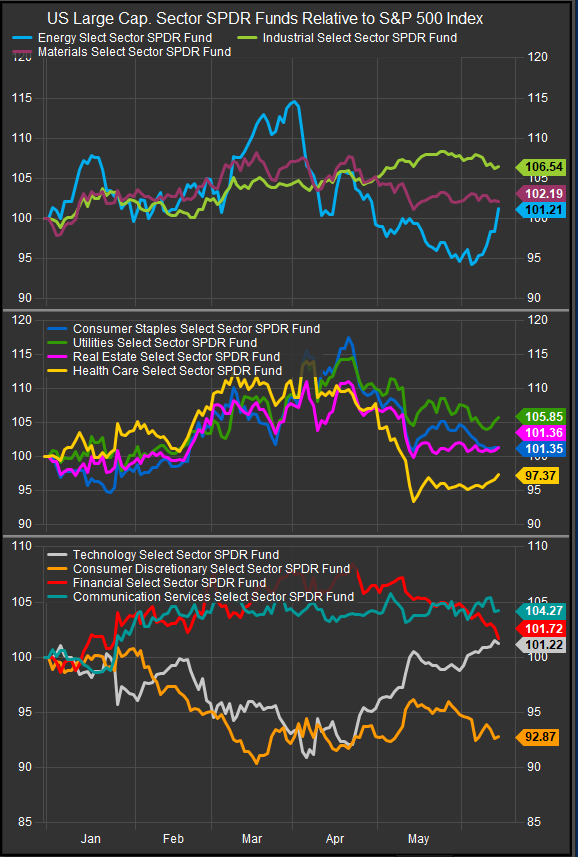

Some near-term short covering is likely appropriate for those under exposed to the Energy Sector. However, we think outperformance over the longer-term is unlikely at this juncture. More broadly, these exogenous shocks typically trigger near-term rotation into under-owned parts of the equity market. We just experienced this from February through April with global trade. When we look at YTD sector performance trends (chart below), we can see Energy shares on a sharp rebound vs. the S&P 500, defensive shares firming in the near-term and Financials and Discretionary stocks retracing YTD gains vs. the index.

To this point, the Info Tech sector has been spared. There is a case to be made that developments between China and Taiwan put domestic AI players on a stronger footing. Chinese competition had been an emerging concern to the domestic trade. From our view, the Tech sector should continue to lead if the bull trend can progress beyond current concerns, so we would view near-term selling as a potential accumulation opportunity. The caveat would be continued upwards pressure on rates.

Inflationary outcomes remain our chief concern for the sustainability of the bull trend. Our guard rail is the 4.75% level on the 10yr Treasury Yield (chart below) and the 108 level on the Bloomberg Commodities Index. However, we need to keep in mind that typically when inflation concerns mount, investors have moved to safety assets like bonds and min vol. securities. This in turn has taken the pressure off by lowering yields and offering an opening for the Fed. This ongoing dynamic has contained interest rates throughout the current bull cycle that started in 2023. It’s a core reason why we suggest measured moves in positioning during the near-term volatility. We think the real opportunity is to continue to accumulate upside exposures on pullbacks.

Crude (WTI)

Bloomberg Commodities Index

The S&P 500 is likely to consolidate. 5786 is very near-term support, while 5504 is the minimum threshold for the index to continue in bullish reversal (chart below). We’d expect bullish accumulation to happen between those levels.

At the stock level, bellwethers like NVDA (chart below) have potential to correct if sentiment swings negative in the near-term. We view $122-128 as a likely accumulation point for the stock on any potential selling.

Taiwan Semiconductor has traded with US shares, outperforming off the Equity market lows on April 9. We’d look to accumulate near the 950 level (chart below) based on our process and outlook.

For those seeking Energy Sector exposure, TRGP (chart below) is a name that has corrected significantly since January and has seen prices firm in the near-term. The stock pays a high dividend and would trigger a bullish reversal signal in our work with a move above the 180 level.

Conclusion

Escalating geopolitical tensions have added to investor’s list of potential concerns in 2025. While we think some short covering in Energy shares is appropriate here, our current outlook emphasizes that the bigger opportunity is to be opportunistic about accumulating longer-term bull market leaders on near-term price weakness. The S&P 500 remains in a clear bullish reversal above the 5504 level, and we have clear levels on the 10yr Yield (4.75%) and the Bloomberg Commodities Index (108) to warn us of inflation pressures. We also need to keep in mind that inflation concerns have led to rotation into safer havens and taken pressure off at previous points in the cycle and that remains a likely outcome for 2025 as well.

Patrick Torbert, Editor & Chief Strategist, ETFSector.com

Data sourced from FactSet Research Systems Inc.