February 16, 2025

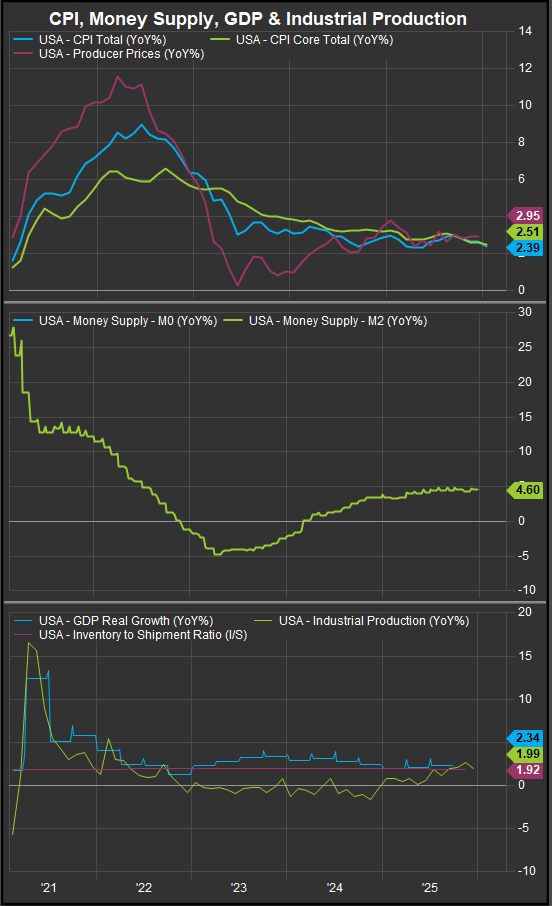

Markets enter mid-February with a macro backdrop that is neither overheating nor breaking. January CPI delivered a modest relief: headline inflation rose 0.2% month over month and 2.4% year over year, while core CPI increased 0.3% month over month and 2.5% year over year. Shelter remains the largest contributor but is trending lower sequentially. At the same time, January nonfarm payrolls increased 130,000, the unemployment rate ticked down to 4.3%, and average hourly earnings rose 0.4% month over month. The economy is clearly slowing from peak expansion, but it is not signaling imminent contraction. (Source: FactSet Research Systems; BLS)

That equilibrium—cooling inflation alongside a still-functional labor market—creates a constructive but selective environment for equities. The Federal Reserve now appears positioned to ease later this year if disinflation persists, with futures markets increasingly centering on June as the next plausible inflection point. Monetary conditions are not restrictive enough to force a downturn, but they are tight enough to expose weak business models and overextended consumers.

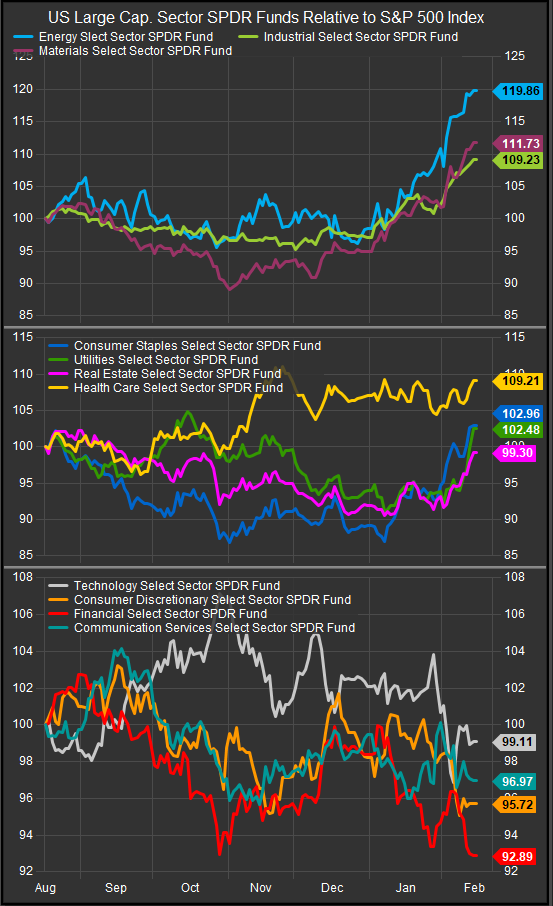

The more interesting shift is thematic rather than cyclical. Headlines reveal a widening debate over artificial intelligence: productivity gains appear measurable in early adopter industries, yet the market is increasingly scrutinizing the return on massive AI infrastructure spending. Mentions of AI disruption on earnings calls have surged, and capex intensity among mega-cap technology companies has raised questions about durability of margins and free cash flow conversion. This tension is visible in sector performance dispersion. According to FactSet, Information Technology earnings remain among the strongest in the S&P 500, but multiples have become more sensitive to execution risk.

The result is a market that rewards quality growth while penalizing speculative extensions of the theme. Semiconductor and infrastructure-levered names continue to demonstrate revenue resilience, but the broader software complex faces heightened competitive pressure and pricing uncertainty. Technology exposure remains warranted, but selectivity is essential. Companies with clear monetization pathways, pricing power, and balance sheet flexibility are better positioned than those dependent on perpetual capital spending narratives.

Consumer data reinforce a similar two-speed dynamic. December retail sales were flat month over month, with the control group declining 0.1%. Weakness was broad across discretionary categories, while essential and value-oriented segments showed more stability. Household delinquency rates have edged higher, now reaching 4.8% of outstanding debt in some stage of delinquency. However, wage growth remains positive and average work hours improved, suggesting the consumer is strained but not collapsing. (Source: FactSet Research Systems; NY Fed)

Sector positioning should reflect this nuance. A modest overweight in Technology and Communication Services should start to be cultivated as selling in certain areas like Software has become extreme. Industrials also warrant constructive positioning, particularly where exposure aligns with productivity improvement, defense spending, and domestic infrastructure investment.

Materials and Energy continue to serve a dual purpose: participation in global industrial demand and hedge against geopolitical and tariff-related shocks. Real-asset exposure has benefited from renewed interest in supply constraints and physical infrastructure buildout. FactSet flow and performance data show consistent investor demand for natural resources and metals-linked ETFs, underscoring the durability of the theme. Natural resource exposure continues to be the strongest near-term rotation beneficiary but we see some signs of consolidation in the precious metals trade that has led commodities prices higher. For the time being resource themes remain a clear long for sector investors, but overbought conditions should have us planning contingencies.

Financials present a mixed picture. Large banks benefit from stable credit and capital markets activity, but rising consumer delinquencies and margin sensitivity to future rate cuts temper enthusiasm. Exposure here should favor well-capitalized institutions with diversified revenue streams.

Consumer Discretionary warrants caution. Earnings commentary highlights price sensitivity among lower-income cohorts and increasing trade-down behavior. Premium segments remain resilient, but broad discretionary beta lacks a clear catalyst absent stronger income growth.

Defensive sectors—Health Care, Utilities, and Consumer Staples—should function as portfolio stabilizers rather than core drivers. In a soft-landing environment, outright defensiveness risks opportunity cost; however, maintaining ballast against volatility remains prudent. If the commodities trade takes a timeout, we’d expect rotation into lower vol. sectors to pick up.

Recession probability appears elevated relative to last year but does not represent the base case. Labor markets remain intact, inflation is easing, and corporate earnings expectations for 2026 continue to imply mid-teens growth. That combination supports a cautiously bullish stance. Yet the margin for error is narrower than it was earlier in the cycle.

The appropriate posture is constructive with guardrails: lean into sectors with earnings visibility and structural tailwinds, maintain exposure to real assets as insurance against policy and geopolitical shocks, and avoid overexposure to consumer segments most vulnerable to balance-sheet fatigue.

In short, this is not an environment for maximal risk or maximal defense. It is an environment for disciplined selectivity—where macro stabilization provides opportunity, but only fundamentals justify conviction. We think Industrials currently retain the most durable tailwinds based on the macro and geopolitical setup. We still see the credit markets in a constructive position. If inflationary shocks can be avoided in the near-term, we think the cycle can sustain expansion and the pendulum could swing back towards Growth exposures which have been rapidly de-rated in the near-term.