September 7, 2025

We’ve seen several developments over the past six weeks that may signal a reprieve from the dominant Mega Cap. Growth and AI trade that has underpinned the equity bull trend since 2023. We’ve mentioned Warren Buffets move to bottom-fish UNH and several prominent homebuilders. The US Government has taken a 10% stake in Intel, and the Fed has signaled an intent to start lowering rates as soon as their September 20th meeting.

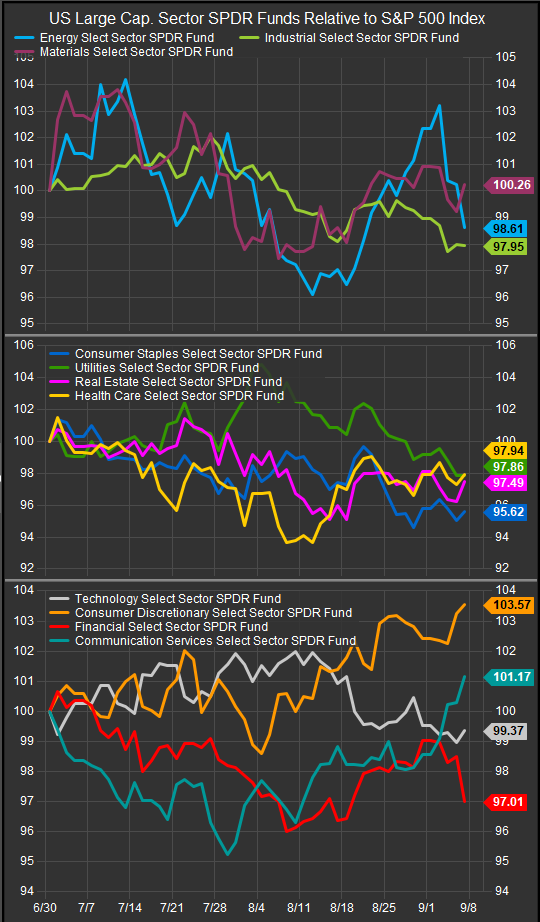

At the sector level, the Fed’s signal has enlivened Discretionary stocks in the near-term and we’ve seen some firming in lower vol. names as well. Tech. and Industrials stocks have retraced some gains as investors have taken some profits in leading sectors as well (chart below).

We’re also seeing a bullish pivot in Small Cap. stocks as both the S&P 600 and Russell 2000 Indices have executed bullish pivots over the past 2-months (charts below). As the tariff situation evolves and friction over base metals threatens some of the early optimism around deal-making, investors are beginning to speculate on an acceleration of onshoring, M&A and increased regional traffic as global supply chains contract.

S&P Small Cap. 600

Russell 2000

While Large Cap. stocks remain bifurcated by Growth/Value dynamics, Small Cap. Growth and Value performance remains highly correlated with very little dispersion. The chart below shows the uniformity of the Russell 2000 style indices and their performance vs. the broad market R3K.

Among themes animating Small Cap. stocks, Banks and Biotech stocks have seen near-term improvements. Those are two of the largest industries in the Russell 200 index representing about 25% of the stocks in the index. Auto components, Homebuilders, Networking and Communications Equipment, Machinery, Mining and Electronics industries have seen notable improvement.

Conclusion

For most of this cycle a core gripe has been the lack of breadth supporting the bull trend and only a narrow cohort of very large stocks powering earnings growth and valuation expansion for equities. Tariffs come with cost pressures, and they decrease efficiency, but we are seeing them act as a catalyst for adaption which is giving a broader array of companies a path towards new business opportunities. We think this is potentially a very constructive development for the sustainability of the bull market as realignment offers new opportunities both obvious and speculative.

Patrick Torbert, Editor & Chief Strategist, ETFSector.com

Data sourced from FactSet Research Systems Inc.