May 18, 2025

The S&P 500 (chart below) approaches another marker in its bullish reversal, the 6017 level. This marks the neckline of the November-February top in the index. We approach with our MACD study is above highs of the past 12 months while our RSI study is on the cusp of the 70 level which is the classic “overbought” level. The upcoming week will be an opportunity for skeptics of the rally to sell out near all-time highs for the index. This represents a chance for investors to show their true colors. Are they ready to push prices to new highs despite the advent of tariff regimes? Or is there conviction that added costs will be too much for the US Consumer and cause economic growth to stagnate? As can be seen on the chart there are two key support levels below the current price. 5786 is the near level which is proxied by the 50-day moving average and 5504 level,1% below the 200-day moving average. Long story short, if the buyer defends the 50-day moving average, we think it’s very likely we’re going to new highs sooner than later. We also think the 5504 level would be an ideal accumulation point for anyone late to enter off the early April low.

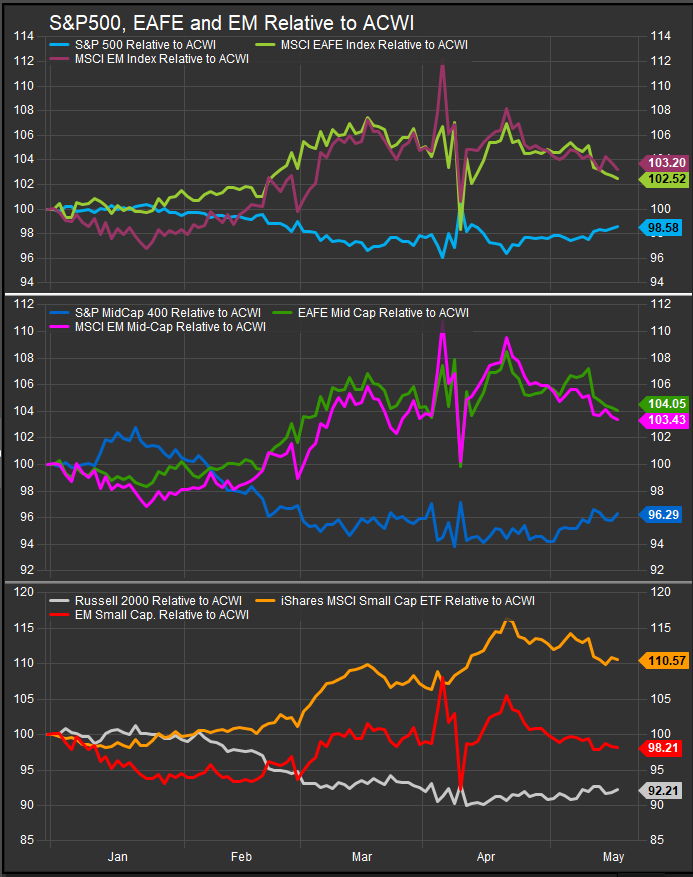

US vs. Rest of World

Ex-US equities were big outperformers during the Feb.-April correction. That relationship has gone into retracement across all cap. tiers (chart below). YTD spreads are still wide in favor of ex-US. Bullish confirmation involves continued US outperformance.

Rising US Treasury Yields a Potential Concern

The US 10yr Yield has backed up from lows below 3.9% and currently sits at 4.48% (chart below). We’ve seen moves above 4.7% precipitate equity market consolidations in both 2023 and 2024. We’re concerned enthusiasm about recovery will erode if interest rates continue to move towards cycle highs.

Commodities Prices aren’t Confirming Rising Rates

While US 10yr yields have backed up towards longer-term resistance levels over the past month, Commodities prices have not responded similarly. The Bloomberg Commodities Index (chart below) sits in the middle of its long-term trading range between 95 and 108. We think an upside violation of the trading range would be bearish for the Growth trade and domestic outperformance. We note the index has moved lower in the near-term despite some reflation in the price of crude which moves a third of the index inputs with it.

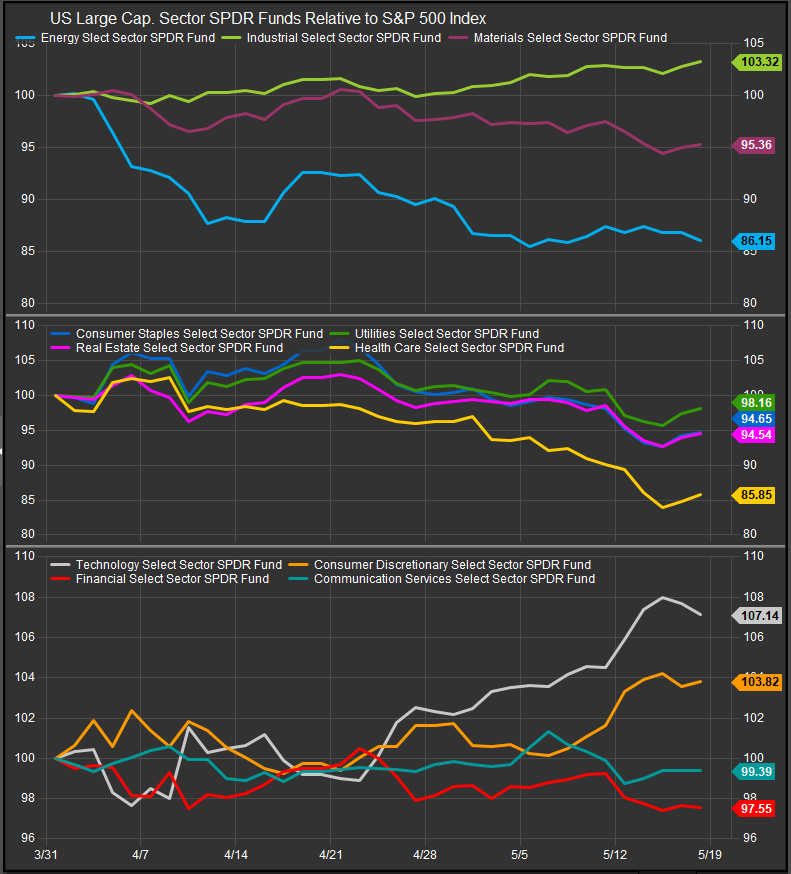

Sectors: Likely some near-term rotation back into Low vol. Exposures

Looking at the YTD relative performance of the 11 Select Sector SPDR ETFs, we can see the Info Tech sector has led off the early April low (chart below, QTD). As the S&P 500 hits near-term overbought conditions, we’d expect some give back from high beta sectors in the near-term. Our indicators are directing us to accumulate pullbacks in expectation of a continued bull market, so we are preparing to fade low vol. sectors on a near-term rally in their performance.

Conclusion

If interest rates stay contained, we see a constructive setup for US equities developing over the intermediate term. The S&P 500 is close to overbought conditions, but we would fade rotation into defensive sectors unless US 10yr rates move above 4.7% on firming commodities prices.

Patrick Torbert, Editor & Chief Strategist, ETFSector.com

Data sourced from FactSet Research Systems Inc.