September 21, 2025

The past week was dominated by the Federal Reserve’s September policy meeting, which delivered a widely expected 25 bp rate cut and a dovish dot plot signaling another 50 bp of easing by year-end. Chair Powell characterized the move as a “risk management” cut in response to signs of labor market softening, though he emphasized there was little support for a larger 50 bp move. Markets largely looked through the nuances, taking comfort in the fact that the Fed is resuming its easing cycle. Historically, resumption of rate cuts after a pause of six months or more has been especially supportive for equities, often producing stronger returns than the start of a typical easing cycle. That narrative helped offset some lingering hawkish elements in the projections and Powell’s acknowledgment of ongoing inflation risks.

Economic data reinforced the bullish backdrop. Weekly jobless claims normalized sharply lower after the Texas fraud-driven spike the prior week, a sign the labor market may not be weakening as quickly as feared. The Philadelphia Fed manufacturing index surged to its highest level since January, with new orders and shipments moving decisively higher while price indicators softened—a rare combination of stronger activity and disinflationary pressure. Retail sales and the control group also surprised to the upside, underscoring consumer resilience, especially online and in services spending. Offsetting these positives was further evidence of housing market strain: August housing starts and permits both missed expectations and Lennar’s earnings highlighted pressure on volumes and margins. Still, the balance of data was enough to keep investors leaning toward the “soft landing” and “run it hot” narratives.

Market action reflected those crosscurrents. The S&P 500 and Nasdaq pushed to fresh record highs (chart below), while the Russell 2000 finally broke through its November 2021 peak, validating the view that small caps stand to benefit most from Fed easing. Treasury auctions were strong, though yields steepened later in the week. Equity flows were supportive, with U.S. equities seeing nearly $60B of inflows, the largest since December. Hedge funds were active buyers of technology stocks, with notional net buying in global Info Tech ranking in the 99th percentile of the last five years. At the same time, investors continue to sit on record cash balances of $7.7T, which provides ample dry powder for further equity rotation.

In terms of sector outlook, I see Information Technology as the most likely outperformer in the near term. The reasoning rests on three pillars. First, the easing backdrop favors long-duration growth assets, and technology—particularly semiconductors and software—has historically been one of the main beneficiaries when the Fed resumes cutting. Second, earnings momentum remains strongest here: Oracle reported a 359% surge in AI-driven backlog, Nvidia confirmed continued hyperscaler demand, and CrowdStrike laid out a multi-year revenue acceleration plan. These are not just one-off beats but signs of structural capex and adoption trends tied to AI infrastructure and cybersecurity. Third, flows confirm the story: hedge funds and global allocators are rotating back into tech at the fastest pace in months, suggesting positioning is again building behind the AI theme. Risks remain, notably China’s directive to ban purchases of Nvidia chips and the possibility of export controls expanding, but the fact that tech has shrugged off such headwinds shows the strength of the underlying trend.

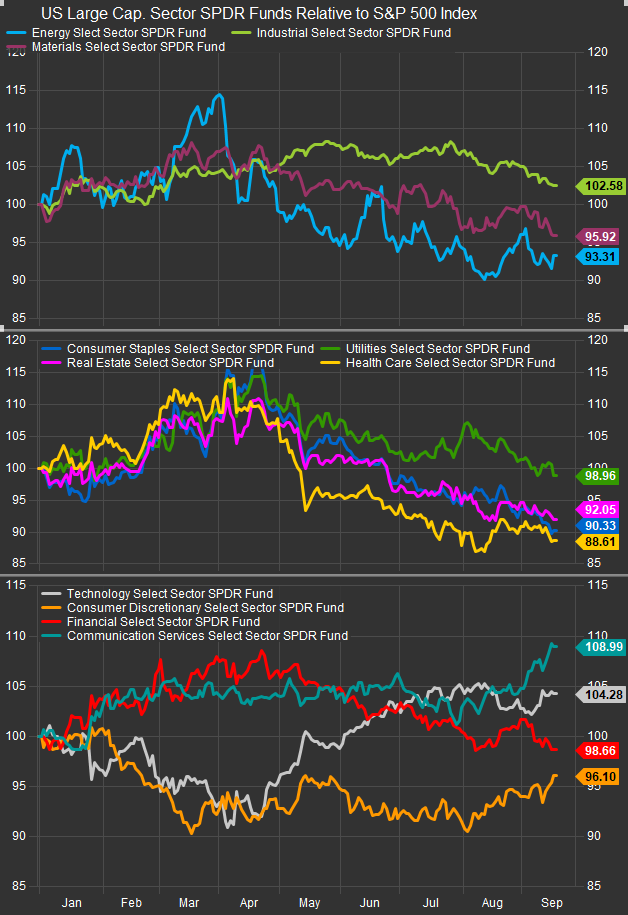

Communication Services sits as a secondary beneficiary, given the combination of AI monetization (Google’s Gemini, Meta’s new smart glasses) and resilience in cloud and ad spending. Industrials could also see relative strength, supported by the surge in the Philly Fed index and evidence of stronger orders and shipments, though housing-linked sub-industries remain challenged. Financials, particularly in payments and asset management, stand to benefit from higher equity prices, IPO re-openings, and strong inflows, though banks remain sensitive to curve volatility. The sector chart below illustrates the tailwinds to sector like Technology and Comm. Services with high concentrations of Growth stocks.

While falling interest rates (chart below) have eased some of the pressure on rate-sensitive sectors, Real Estate, Utilities, and housing-linked Consumer Discretionary still look vulnerable. Mortgage rates remain elevated relative to Treasuries, limiting affordability gains, and August housing data along with Lennar’s guidance suggest demand softness persists despite lower funding costs. Utilities, traditionally beneficiaries of declining rates, are struggling with competition from higher-growth sectors and questions around capital spending efficiency, leaving them less able to capture investor flows. In Consumer Discretionary, homebuilders and housing-adjacent names may not see meaningful relief until lower rates translate into improved affordability and demand, which typically lags by several quarters.

Conclusion

We expect the direction of rates to have a big impact on sector level leadership moving forward. We had been calling for a near-term move into lagging sectors like Utilities and Discretionary on the resumption of dovish interest rate policy, but with rates showing early signs of a pivot higher that bump from low rates may be short lived. Despite an absence of inflation, mortgage rates remain high enough to constrain lending and that may eventually drag economic activity to contractionary levels. We don’t thin, the consumer will hold up over the longer-term if rates stay high.

Data sourced from FactSet Research Systems Inc.