August 24, 2025

On Friday, we talked about the retracement of Growth shares playing out over the near-term and concluded with the point that the Fed would play a pivotal role in the 2nd half of the year. We only needed to wait hours for Powell’s Jackson Hole speech to move the markets. This time, it was a positive reaction to the suggestion that easing is close at hand due to concerns about rising unemployment.

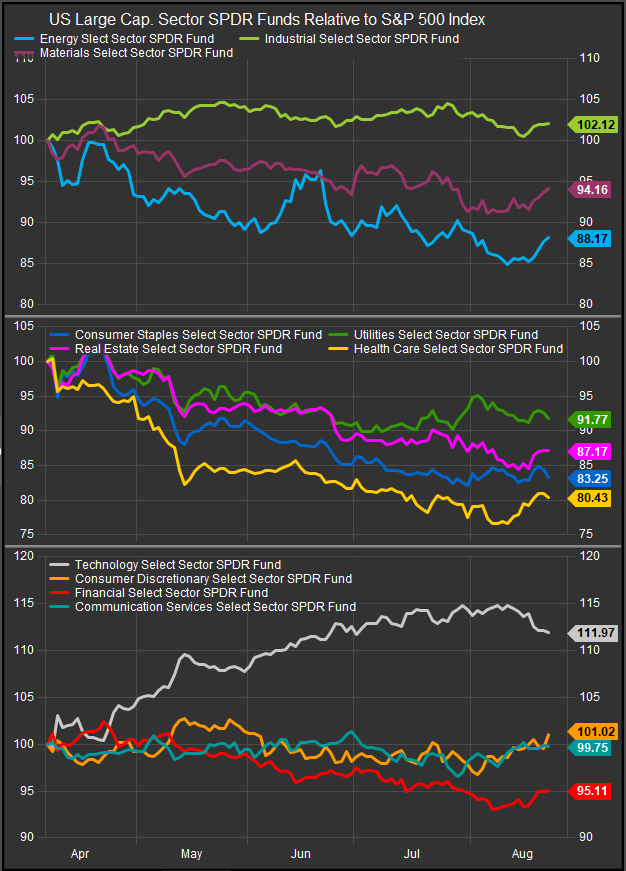

Coincident beneficiaries during the day were cyclical with Consumer Discretionary, Financials, Energy and Materials stocks (chart below) leading on the news. Low vol. sectors paused their recent gains while Tech Sector performance remained muted on the news.

The bigger takeaway is that the narrative driving the bull market has entered a new phase. Re-emergence of AI enthusiasm drove buying off the April lows. Now, with near-term buying in AI related themes showing signs of fatigue, the Fed becomes the central pivot for stocks. AI is a wonderful growth concept to anchor a speculative bull market, but the economic cycle has to be robust enough to support the narrative, and the Fed will be pivotal in managing the credit markets appropriately to achieve that outcome. After all, despite some near-term deterioration, unemployment remains very low by historical standards. A tweak to interest rates could be quite salubrious for the consumer.

We can see the near-term effects of softer rates, now buttressed by Powell’s recent pronouncement on the S&P 500 Homebuilding Sub-Industry (below). Housing is a pivotal component of the consumer eco-system and is extremely rate sensitive. With homebuilders trading towards YTD highs in both absolute and relative terms (chart below), we get a good look at how the “feedback loop” between recession concern and dovish policy works to prolong the bull cycle.

While homebuilding is a specific example of an industry that swings into action on rate cut expectations, we can see from our S&P 500 market internals chart (below), that dovish policy expectations are perceived to help a broader mix of stocks. Both our short and long-term breadth series improved noticeably on Friday with the longer-term series (% of stocks above their 200-day moving average) trading to fresh YTD highs (chart below, bottom panel, blue line).

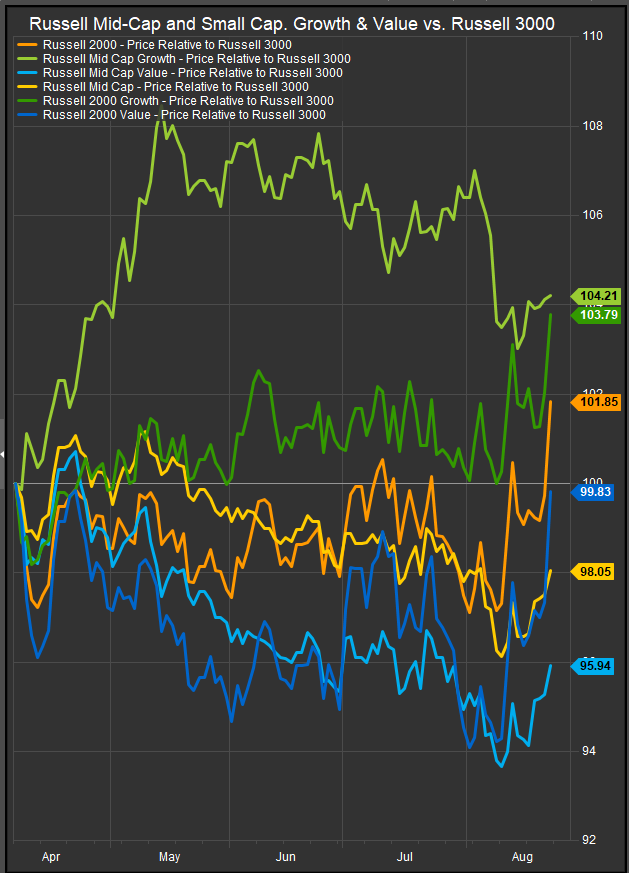

Further evidence of broadening participation can be seen in the performance of Small Cap stocks (chart below). Russell 2000 stocks regardless of style (Growth, Value) have surged in the near-term while MidCaps have hooked higher as well. These rotations occur on expectations of improving financial conditions that should allow for positive earnings and economic surprises as we move forward.

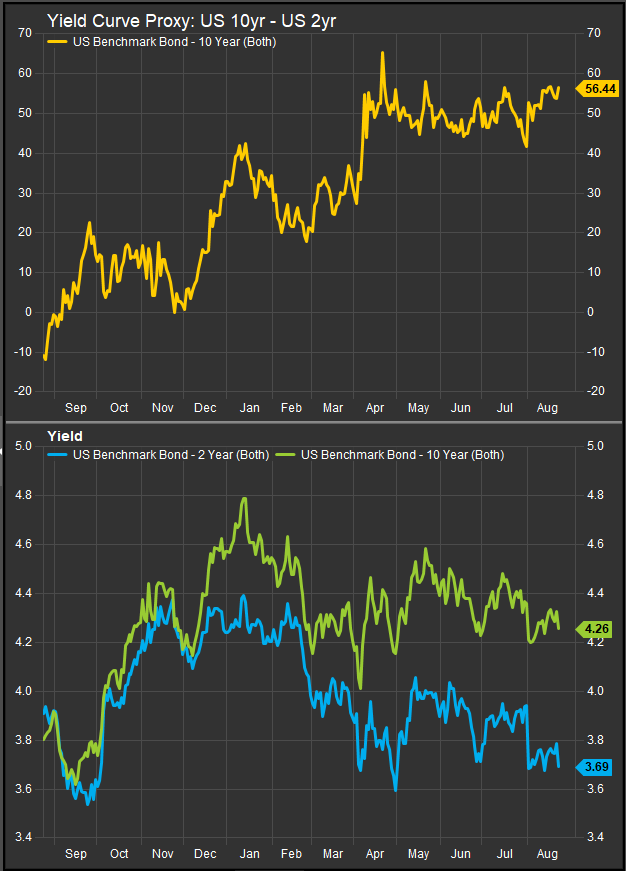

At the macro level, the result is that US yields are moving lower at the front and back end of the curve in a bull steepener (chart below). These conditions should support expansion of credit (in theory) while they are playing out and should allow the cycle to continue absent other exogenous negative developments. The other interesting dynamic to consider when looking at the 10yr-2yr “yield curve” proxy. Historically, equities register their strongest performance when the 10yr-2yr spread is CONTRACTING from a wide stance.

Historically, the 10yr-2yr spread peaks at a level between 200-300bps. With the current spread slowly ticking higher from 56bps, it appears unlikely that the current cycle will mimic the past. However, if global circumstances remain informed by an overhang of inflation expectations and the economic cycle remains sluggish but not contractionary (as it is now), we could eventually get to a point where the Fed eases more significantly and materially steepens the curve in doing so.

Just to keep it interesting, dovish policy talk has also put a near-term bid under commodities prices. This is 3rd dimension in our game of market chess. Our view is that commodities prices will signal a bearish change in inflation outlook with a move over the 108 level (chart below). We have breathing room at present, but that level has contained input prices since early 2023. A move above 108 would signal that investors are discounting more inflationary developments.

Conclusion

Sector investors are now faced with a more open-ended set of circumstances than we had from April to July when the equity market backdrop was one of relief and performance tailwinds were all lined up behind the AI complex and Technology shares. Easing opens up a path higher for a much broader group of stocks as our charts demonstrate. Sector allocation entering September should be more inclusive of both lower vol. and Commodities exposure given the move lower in interest rates in the near-term and the wide performance spread off the April lows between Information Technology and other sectors.

Patrick Torbert, Editor & Chief Strategist, ETFSector.com