April 27, 2025

At the risk of oversimplifying, conciliatory developments on global trade this week have coincided with a developing early-stage bullish reversal in the S&P 500 and US equity outperformance vs. rest of world equities (chart below).

S&P 500 price has moved above the 5504 level which is our minimum threshold for bullish reversal price action. Confirmation would come with a move above 5786. Based on our interpretation of the chart, that level is the neckline of a potential top for the index. It is also above the 50 and 200-day moving average levels which are typically where swing traders put their sell orders in. Point being, above that level, the buyer demonstrates control of the tape. Oscillator work is showing a tactical buy signal on the MACD study while the S&P 500 price relative to the MSCI All-Country World Index has begun to tick higher again after a sharp initial bounce on April 9.

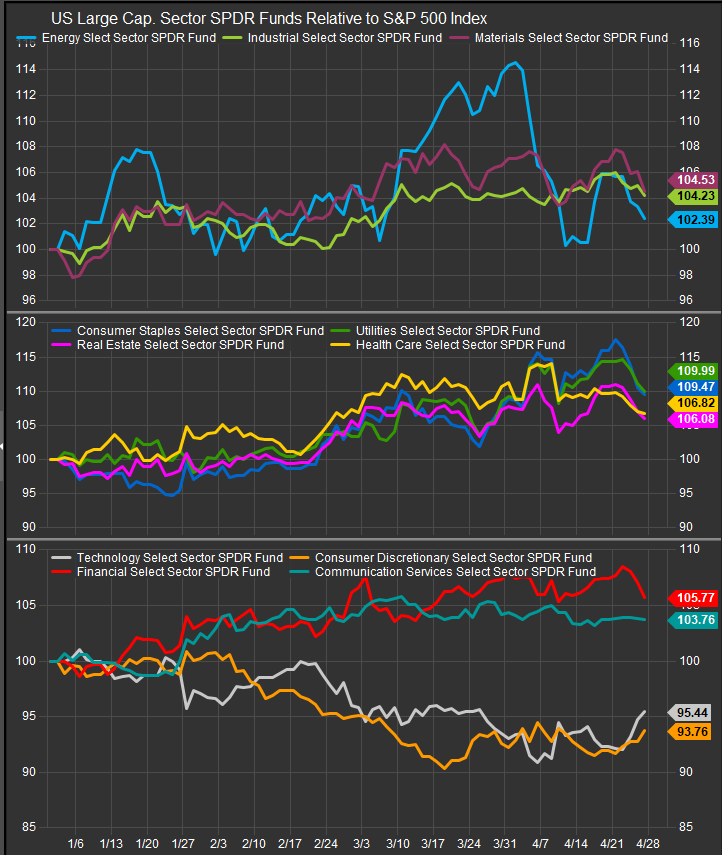

From a sector perspective, and with an eye on outperforming the index, we are looking to add risk-on exposure if prices continue higher or if prices retrace gains, but Growth and high-beta exposures are outperforming min vol. and Value exposures.

Our sector performance chart (below) shows the early stages of rotation back into Growth focused sectors, Consumer Discretionary and Information Technology (panel 3). Commodities sectors (panel 1) and lower vol. sectors (panel 2) have generally been outperforming the S&P 500 YTD. Financials (red line, panel 3) have been outperforming as well as the sector tends to represent the Value bucket. We interpret continued outperformance from Tech and Discretionary sectors as supporting higher risk appetite and bullish convictions about positive resolution to global trade issues.

The Mag7 cohort of Mega Cap. Growth stocks is a big driver of the sector dynamics we are evaluating. The Roundhill Magnificent Seven ETF (MAGS, chart below) is attempting to form a bullish reversal of its own, but Mega Cap.’s haven’t been the tip of the spear on this bullish reversal. It’s been a move into the average Growth stock, rather than the biggest names that has lifted higher beta sectors in the near-term. Regardless, we would expect Mag7 to reflate with the broader Growth trade absent new exogenous downside catalysts.

If we can be allowed a moment to consider other things besides tariffs, we should consider the level and direction of interest rates. Prior to the big correction around trade war concerns, investors were considering the more slow moving threat of sticky inflation as the Fed tried to juice a slowing business cycle. Equity investors are breathing a sign of relief that prices are no longer taking the elevator down, but they may end up taking the stairs lower nonetheless if rates don’t move lower and open action on the housing market.

We think the 10yr Yield chart will re-emerge as an important indicator. Looking back over the past 2 years of action, we see the range between 4.1 and 4.5% as the congestion zone while above that level the chart reflects inflationary concerns and below that level we’ve seen the S&P 500 bounce. We think the direction of rates will determine whether the economic cycle can continue to expand.

We think higher rates are the most likely driver of recession in the intermediate term, whether caused by tariff cost increase and deteriorating credit, or general inflation from an overheating economy. If the tariff stuff is truly in the rearview mirror and prices continue to cool off over the longer-term, we see a way forward without a lot of financial market pain.

Patrick Torbert, Editor & Chief Strategist, ETFSector.com

Data sourced from FactSet Research Systems Inc.