December 31, 2025

Sector performance in 2025 was defined by an unusual combination of disinflation, resilient economic growth, shifting policy expectations, and the maturation of the artificial intelligence investment cycle. While headline equity indexes posted solid gains, leadership beneath the surface was far less stable. Rotations between growth and cyclicals, defensives and offensives, and inflation hedges versus duration assets occurred repeatedly throughout the year. By year-end, performance dispersion widened, underscoring that sector outcomes were increasingly driven by earnings durability, balance-sheet quality, and exposure to structural growth, rather than broad macro beta.

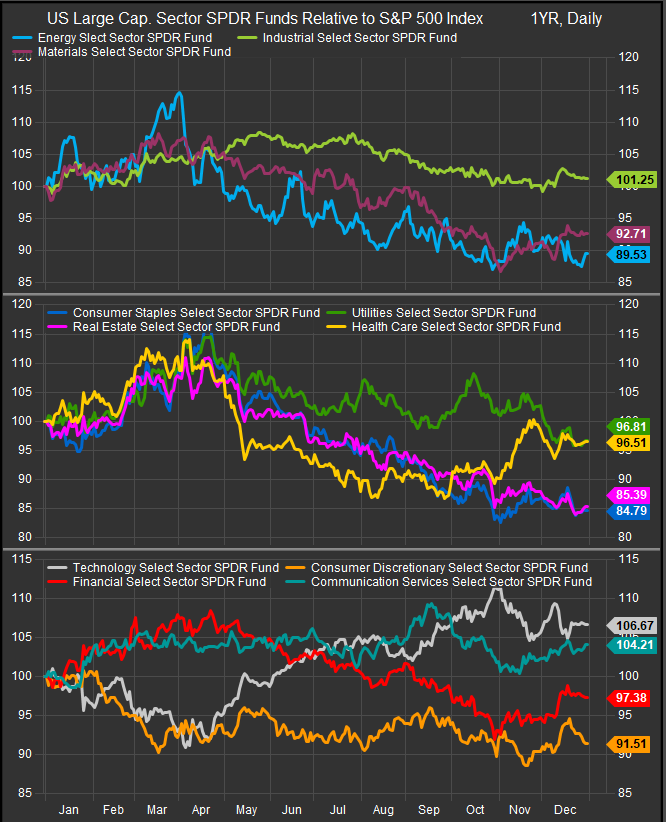

Large Cap. Sector Performance vs. the S&P 500

Artificial intelligence remained the dominant secular theme of 2025, but its influence evolved meaningfully over the course of the year. Early optimism surrounding AI infrastructure gave way to more discriminating analysis as investors focused on capital intensity, power constraints, and returns on invested capital. Capital expenditures tied to data centers, semiconductors, and networking equipment expanded rapidly, yet equity performance became increasingly concentrated among firms with proven pricing power and scale. This dynamic favored mega-cap Technology and select Communication Services companies, while smaller or highly levered “AI-adjacent” names struggled as markets demanded clearer monetization pathways. The narrowing of AI leadership was a defining feature of sector performance in the second half of the year.

Inflation dynamics played a central role in shaping relative sector returns. Goods inflation cooled meaningfully in 2025 as supply chains normalized and inventory overhangs cleared, while services inflation—particularly housing- and labor-related—proved stickier. Core inflation trended lower over the year, but progress was uneven, keeping policy uncertainty elevated. This environment benefited long-duration growth sectors, especially those tied to productivity and automation, while weighing on rate-sensitive defensives such as Utilities and Real Estate. Periodic rebounds in energy and industrial metals prices reintroduced inflation tail risk late in the year, briefly supporting Energy and Materials, though neither sector sustained leadership without confirmation of a broader inflation re-acceleration.

The U.S. consumer demonstrated notable resilience in 2025, though spending patterns were increasingly bifurcated. Higher-income households continued to support travel, leisure, and premium discretionary categories, while lower-income consumers exhibited heightened price sensitivity and a greater reliance on promotions. Real consumer spending growth remained positive for much of the year, supported by rising nominal wages and still-available credit, but credit card delinquencies and loan growth trends began to attract attention late in the year. This divergence helped explain why experiential and value-oriented consumer segments outperformed, while mass-market discretionary and housing-linked categories lagged.

Monetary policy expectations were a persistent source of volatility. Markets entered 2025 anticipating an aggressive easing cycle, but those expectations were gradually pared back as economic growth remained firm and labor market softening proved modest. By year-end, futures markets were pricing fewer than two rate cuts through 2026, reflecting confidence in economic momentum but uncertainty around the inflation path. This “higher-for-longer” rate outlook supported Financials with asset sensitivity and pressured sectors reliant on falling discount rates. It also reinforced investor preference for companies with strong free cash flow generation rather than balance-sheet leverage.

Fiscal and industrial policy added another layer of sector differentiation. Continued emphasis on energy security, reshoring, defense, and domestic manufacturing provided tailwinds to Industrials and select Energy companies. Meanwhile, trade policy uncertainty and tariff risk created intermittent volatility for Materials, Technology hardware, and consumer goods manufacturers with global supply chains. Geopolitical developments periodically boosted commodity prices and defense-linked equities but did not materially disrupt broader equity market trends.

Looking ahead to 2026, sector positioning will hinge on whether the economy settles into a soft-landing disinflation scenario or re-accelerates amid fiscal stimulus, infrastructure investment, and AI-driven productivity gains. Equity valuations remain elevated relative to history, implying limited tolerance for earnings disappointment. The primary upside catalysts include clearer evidence of AI-related productivity gains, sustained disinflation without growth erosion, incremental monetary easing, and a revival in housing activity if mortgage rates decline. Conversely, risks include valuation compression, continued scrutiny of AI returns, policy miscalibration, and signs of consumer fatigue should labor market conditions deteriorate.

The next phase of AI investing is likely to be less about infrastructure build-out and more about measurable economic impact. Investors are increasingly focused on whether AI can translate into operating leverage, margin expansion, and durable cash flow growth. In this environment, companies that convert AI spending into tangible productivity gains are likely to command premium valuations, while those reliant on perpetual capital investment may face diminishing returns.

In summary, sector investing in 2025 rewarded selectivity over broad exposure. Scale, pricing power, balance-sheet strength, and earnings visibility proved more important than thematic enthusiasm alone. As markets transition into 2026, dispersion across sectors and styles is likely to persist, reinforcing the importance of disciplined, top-down sector allocation combined with bottom-up quality assessment. We look forward to bringing you all the latest developments in 2026!

Charts and additional data sourced from FactSet Research Systems inc.