With November CPI confirming a clear downshift in inflation—core inflation slowing to its weakest pace since early 2021—and multiple Fed officials openly acknowledging that policy remains restrictive, disinflation has become the dominant macro force shaping sector leadership. History suggests that periods of falling inflation do not lift all boats equally. Instead, they tend to reward sectors with long-duration cash flows, operating leverage to easing financial conditions, and pricing stability rather than pricing pressure. The recent news flow reinforces many of those historical playbooks.

Technology: The Classic Disinflation Winner—With a Caveat

Historically, Technology has been the primary beneficiary of disinflation, as lower inflation typically compresses discount rates, supports valuation multiples, and improves financing conditions for growth-oriented business models. The current environment fits that template. Cooling shelter inflation, moderation in goods prices, and a Fed increasingly open to additional cuts into 2026 have already eased financial conditions at the margin.

However, the recent earnings cycle shows that this is not a blanket endorsement of the entire tech complex. Disinflation helps long-duration assets, but it does not excuse weak cash conversion. The mixed reaction to Oracle and Broadcom underscores this point: investors are differentiating between AI exposure that is capital-efficient versus AI exposure that amplifies free-cash-flow burn and balance-sheet risk. By contrast, Micron’s sharp rally following its earnings beat illustrates the more traditional disinflation dynamic at work—falling inflation combined with supply tightness and visible pricing power drove a strong equity response.

The takeaway is consistent with history: Technology tends to outperform in disinflationary periods, but leadership narrows toward companies with improving margins, pricing leverage, and credible monetization paths.

Healthcare: Disinflation’s Quiet Compounder

Healthcare has also historically performed well during disinflationary regimes, particularly when inflation slows without tipping the economy into recession. Lower input-cost pressure, stable demand, and reduced wage inflation support margins, while declining interest rates enhance the present value of steady, long-lived cash flows.

Recent data reinforce this setup. Job gains remain concentrated in healthcare even as broader labor indicators soften, underscoring the sector’s non-cyclical demand profile. At the same time, disinflation reduces political and reimbursement pressure, particularly as medical inflation moderates alongside shelter and services prices. In prior cycles—most notably in the mid-2010s—Healthcare outperformed during extended periods of low and falling inflation precisely because it offered earnings durability with growth optionality.

Given today’s combination of easing inflation and rising macro uncertainty, Healthcare once again fits the historical mold of a disinflation-friendly overweight.

Consumer Staples: Historically Supported, but Less Compelling This Cycle

Consumer Staples have traditionally benefited from disinflation because lower input costs and stable pricing environments help protect margins, while defensive demand profiles attract capital when growth slows. The current data partially support this—goods inflation has cooled, and pricing pressure in categories like food and household products is easing.

That said, the news flow suggests a more nuanced outcome this time. Several consumer-facing companies are highlighting ongoing affordability stress and discount-driven purchasing behavior, which limits operating leverage even as inflation cools. Historically, Staples outperform most cleanly when disinflation coincides with a sharp growth slowdown or recession risk. Today’s environment looks more like disinflation with still-positive growth, which may cap relative upside for the sector compared with longer-duration assets like Technology and Healthcare.

Industrials: A Secondary Disinflation Beneficiary via Rates

Industrials are not classic disinflation winners in isolation, but they have historically benefited once disinflation feeds into easier monetary policy. Falling inflation lowers borrowing costs, supports capital investment, and eventually stabilizes order books. The recent improvement in earnings revisions, stronger breadth, and renewed cyclical outperformance following the December Fed cut are consistent with this historical pattern.

Importantly, inflation is cooling without collapsing demand, which historically creates a window where Industrials can outperform as financing conditions improve ahead of a full economic reacceleration. This mirrors past soft-landing periods, where Industrials lag early in disinflation but begin to outperform as rate cuts become visible.

Energy and Materials: Typically, Disinflation Laggards—Unless Supply Shocks Intervene

Historically, Energy and Materials tend to lag during pure disinflationary periods, as falling inflation is often associated with weaker commodity pricing. The year-to-date performance of oil and broader commodities fits this pattern. However, the recent rebound in oil prices driven by geopolitical risks highlights an important exception: supply-driven shocks can override the usual disinflation playbook.

In prior cycles, these sectors have outperformed during disinflation only when supply constraints or geopolitical disruptions dominate demand effects. The current environment—cooling inflation but elevated geopolitical risk—suggests Energy and Materials offer optionality rather than a structural disinflation tailwind.

Financials: Mixed Historical Signal in Disinflation

Financials historically show mixed performance during disinflation. Lower inflation and falling rates can support valuations and credit quality, but net interest margins often compress. The current data reflect this tension: improving capital markets activity and easing policy expectations are positives, while uncertainty around long-term rates and regulatory direction remains a constraint.

As in past disinflationary periods, Financials tend to perform best later in the cycle, once rate cuts translate into renewed loan growth rather than just margin compression.

Bottom Line: Disinflation Favors Duration, Quality, and Margin Stability

History is clear that disinflation rewards sectors with long-duration cash flows, pricing stability, and limited balance-sheet stress. The current news flow strongly supports that framework. Technology and Healthcare align most cleanly with past disinflation winners, with Industrials emerging as a secondary beneficiary as easier policy feeds through. Consumer Staples offer partial support but less upside, while Energy and Materials remain more dependent on exogenous supply shocks than inflation trends.

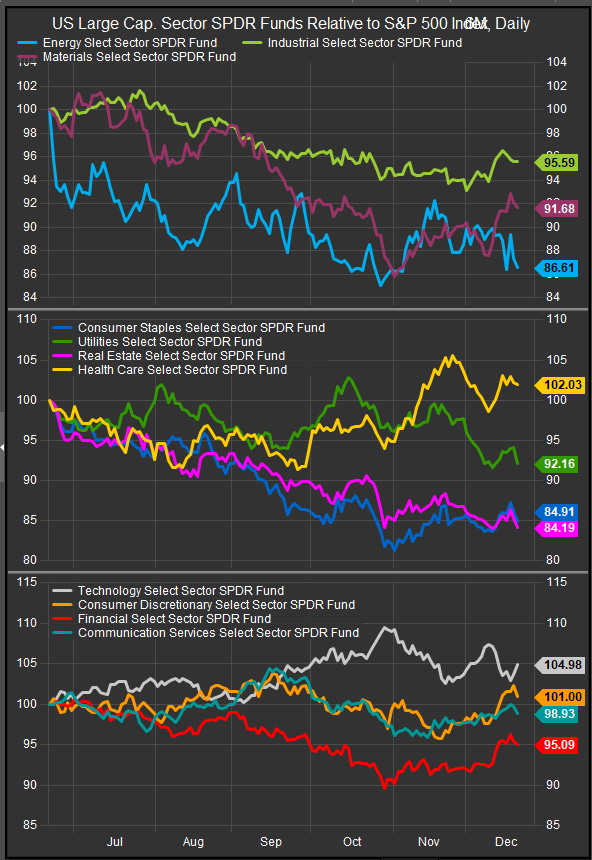

For sector investors heading into 2026, disinflation supports Growth stocks with clear tailwinds and strong balance sheets. Mag7 stocks and AI majors are likely to benefit from the ability to buyback shares and fund expansion at reasonable rates. We want to keep a close eye on commodities prices as falling rates have sparked optimism in the past and increased risk appetite often cuts against the deflationary impulse. Rising rates and commodities prices are the structural risk to the bull market at present as the consumer is in a late cycle posture. We think Technology, Comm. Services and Healthcare are in favorable positions based on the macro environment. Financials, Industrials and Discretionary stocks have rallied near-term on the Fed’s December actions. But, historically lower rates in an expansionary cycle have supported Growth and Low Vol. exposures.

Charts and additional data sourced from FactSet Research Systems inc.