Equities finished Tuesday trading mixed with the Nasdaq adding 0.56% and the S&P 500 following up 0.11% while the Dow gave up -0.30%. A somewhat soft ISM was seen as a catalyst for the mixed results with 10yr yields continuing to move lower in the near-term and Crude Oil down on the day.

As of this writing, large cap. stock futures are modestly higher with the Nasdaq e-mini in the lead up +12 bps as of this writing as share finished the Monday on a positive note off worst levels. The JOTS report along with Durable Goods, Factory and Cap. Goods orders are on the economic release calendar for Tuesday.

Eco Data Releases | Tuesday June 4th, 2024

| Date Time | Event | Survey | Actual | Prior | Revised | |

| 06/04/2024 10:00 | JOLTS Job Openings | Apr | 8350k | — | 8488k | — |

| 06/04/2024 10:00 | Factory Orders | Apr | 0.60% | — | 1.60% | 0.80% |

| 06/04/2024 10:00 | Factory Orders Ex Trans | Apr | 0.50% | — | 0.50% | 0.40% |

| 06/04/2024 10:00 | Durable Goods Orders | Apr F | 0.70% | — | 0.70% | — |

| 06/04/2024 10:00 | Durables Ex Transportation | Apr F | 0.40% | — | 0.40% | — |

| 06/04/2024 10:00 | Cap Goods Orders Nondef Ex Air | Apr F | 0.30% | — | 0.30% | — |

| 06/04/2024 10:00 | Cap Goods Ship Nondef Ex Air | Apr F | — | — | 0.40% | — |

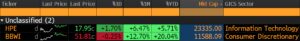

S&P 500 Constituent Earnings Announcements by GICS Sector | Tuesday June 4th, 2024

It’s a light earnings calendar for Tuesday with most of Q2 earnings season behind us. A few software names still to report, but the bull market looks to have made it through mostly intact, albeit with some deterioration apparent in the Consumer Discretionary space and within the Software and Medical Equipment Industries in particular. However, BBWI is a promising chart and looks set to outperform based on the 12-month pattern.

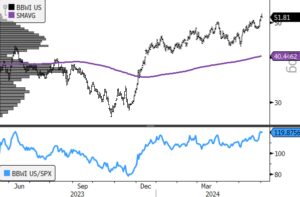

- BBWI (200-day m.a.| Relative to S&P 500)

- BBWI is tracing out a multi-year base pattern that projects to a retest of 2021 highs near $80 over the longer-term.

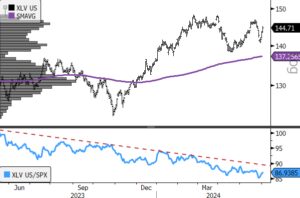

Tactical Tuesday: Lower Rates + Oversold conditions = Tactical Buy on Defensive Exposures XLP and XLV

Summer seasonals are typically among the weakest months, hence the old investing saw, “sell in May, go away”. We’vre pointed out in previous notes that the worst summer month is typically August, but we also want to point out that two of our most reliable defensive sectors historically, Healthcare and Staples, are currently oversold with rates moving lower. That is often a setup for outperformance as long as the equity aren’t rocketing higher. With the Consumer encumbered by higher interest rates and a mounting debt burden, along with typical election year consolidation we think XLV and XLP may do a bit better than expected over the near-term and we’ve added both to our Elev* Sector Model this month.

- XLV (200-day m.a.| Relative to S&P 500)

- This isn’t usually the kind of chart we would recommend, but the key word here is “tactical”. Any time-out in the bull market advance would likely spur rotation into laggard sectors, especially with rates moving lower

Sources: Bloomberg