ETF Insights | February 2, 2025 | S&P 500

Price Action & Performance

The S&P 500 had a volatile January but finished the month near best levels and above its 50-day moving average. The index managed a new all-time high on January 24, though the RSI study rolled over short of an overbought reading. We’ve highlighted key support on the chart at the 5784 level and we give the uptrend the benefit of the doubt while prices remain above it.

S&P 500 Breadth

Internal strength has recovered somewhat since wash out levels to start the year. However there continues to be a negative divergence between the index price and the % of stocks above their respective 50 and 200-day moving averages. Cracks in the AI theme may shift the environment in favor of the average stock, and that is something we will be watching closely as February unfolds.

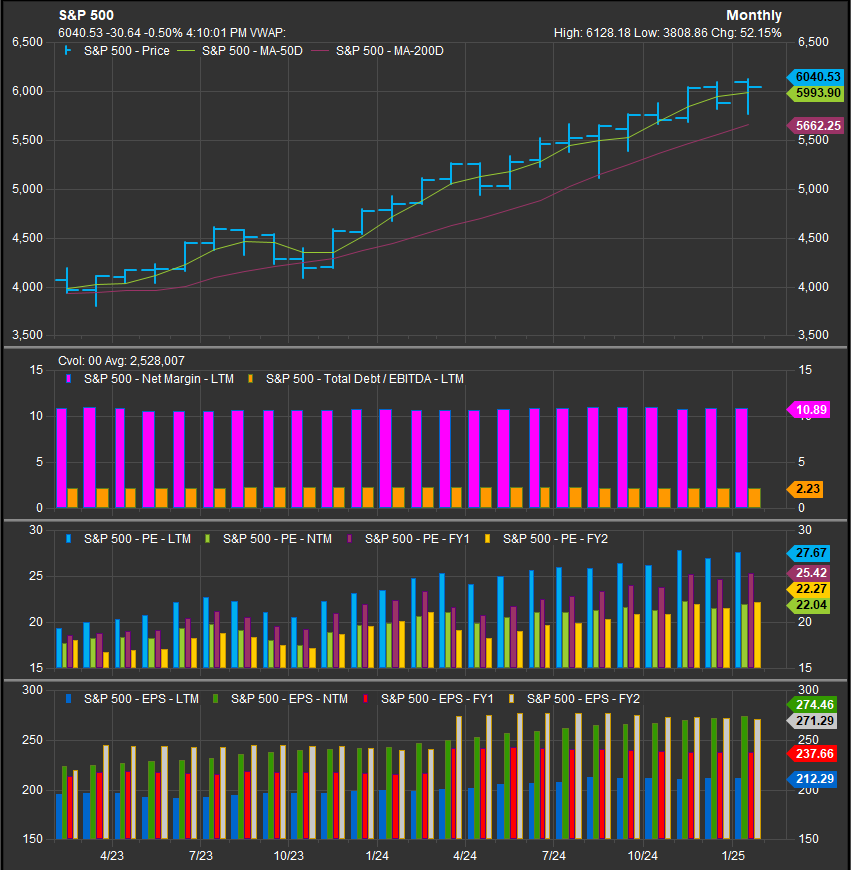

S&P 500 Fundamentals

The chart below shows S&P 500 with Margins, Debt/EBITDA, Valuation and Earnings. Margins and Debt ratios stayed steady throughout 2024 while valuation has crept higher with current and forward multiples above long-term historical averages. To be clear, these multiples aren’t extreme for a bull market, but they are priced for continued good news with double-digit earnings growth projected in forward years.

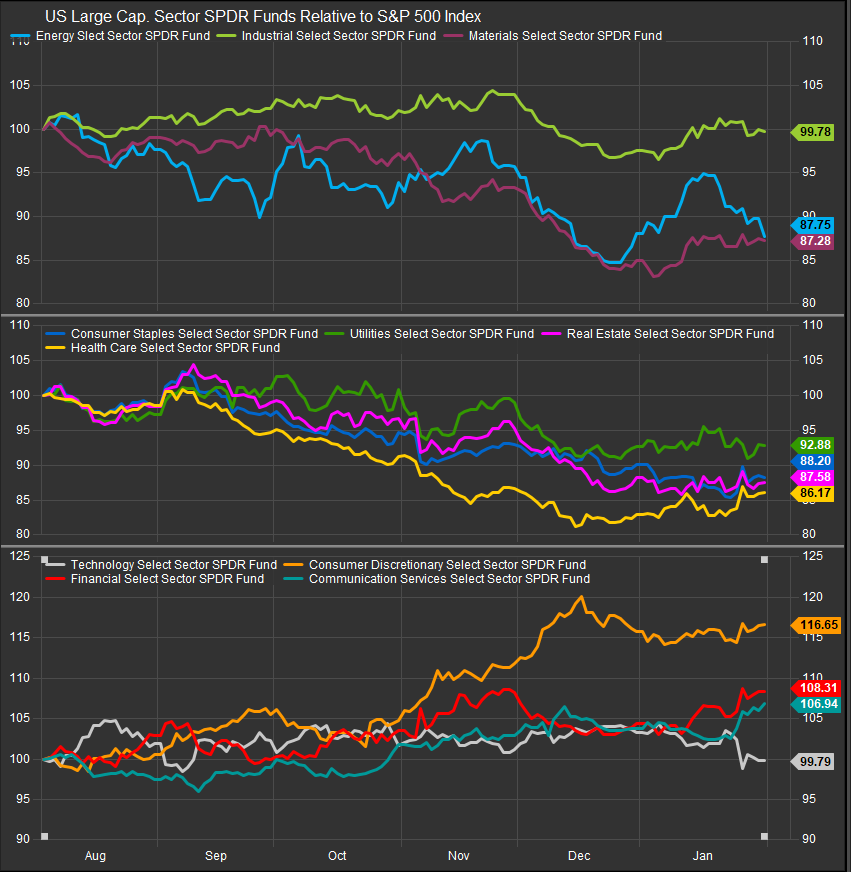

Sector Leadership

Most sectors outperformed at the expense of the Technology sector in January. The Energy Sector retraced most of its gains in the back half of the month as rates couldn’t sustain move higher and cooler economic data shifted focus away from commodities exposures in the 2nd half of the month. Healthcare stocks showed improved performance while other defensive exposures continued to lag. Discretionary, Financials and Comm. Services stocks have shown out as clear leadership over the past 6-months.

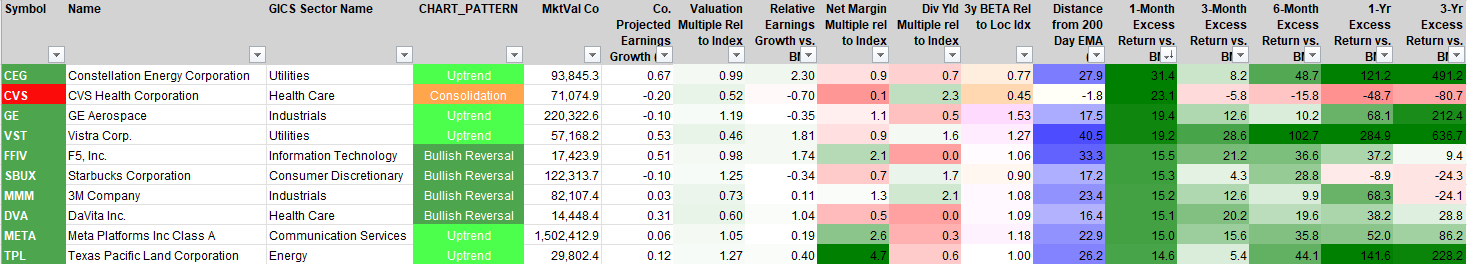

Top 10 Stock Performers

Except for META, it was a different list of stocks leading the market in January. However, the top 10 was generally comprised of stocks that have been outperforming over the longer-term. Only CVS made the list from a position of sustained weakness.

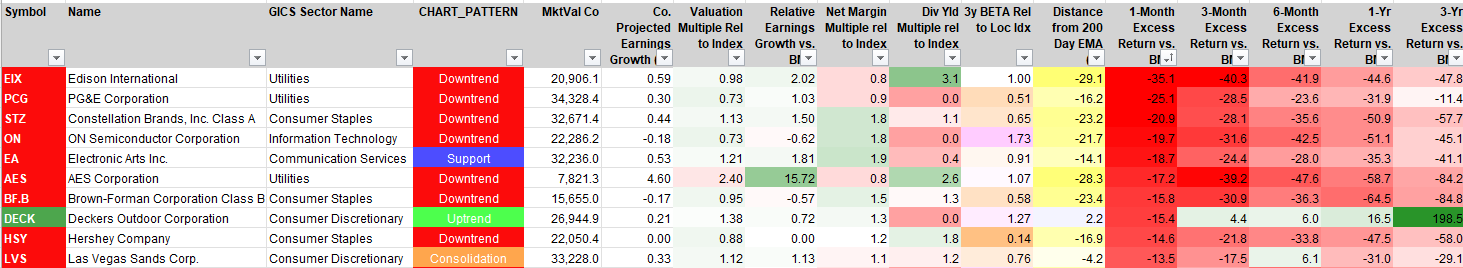

Bottom 10 Stock Performers

Legacy defensive names dominated the bottom performers list, but NVDA came in just outside the top10 decliners with a -13% move in January. DECK missed earnings to the tune of a 15% decline and we would point out when strongly trending apparel stocks show cracks there is usually a reckoning ahead.

Economic & Policy Developments

Macroeconomic data showed a cooling but still-expanding economy. Fourth-quarter GDP growth slowed to 2.3%, slightly below expectations of 2.4%, down from 3.1% in the third quarter. Consumer spending remained a bright spot, growing at an annualized 4.2%, the strongest pace in nearly a year. Core PCE inflation, the Federal Reserve’s preferred metric, rose 2.8% year-over-year, matching expectations but still above the previous quarter’s 2.2%, suggesting inflation remains somewhat sticky. The labor market remained tight, with initial jobless claims falling to 207,000, the lowest in four weeks, though continuing claims edged higher to 1.86 million. Housing data was weaker, with pending home sales unexpectedly declining by 5.5%, ending a four-month streak of gains.

Federal Reserve policy remained a major focus. The FOMC meeting concluded with no changes to interest rates, and while the official statement leaned hawkish, Fed Chair Jerome Powell struck a more dovish tone. The market had initially priced in a March rate cut, but expectations have since shifted to June as inflation remains above target. Bond markets reflected this uncertainty, with the 10-year Treasury yield fluctuating around 4.5% throughout the month.

The new Trump administration introduced significant policy shifts that will likely impact markets in the months ahead. The president reaffirmed plans for 25% tariffs on Canada and Mexico, scheduled to take effect on February 1, despite speculation about possible exemptions or a phased approach. There were also reports that additional tariffs on semiconductors, oil, gas, steel, and aluminum could be implemented by mid-February. The administration moved quickly on regulatory changes, rolling back Biden-era environmental rules and issuing executive orders to expand domestic energy production. Federal grant spending was temporarily frozen, creating uncertainty for state and municipal budgets.

Tariff speculation added volatility to the market, particularly for industrials, materials, and energy sectors. Crude oil ended the month lower, with WTI crude down 2.0% at $73.17 per barrel, as investors weighed the impact of potential trade restrictions. Meanwhile, the technology sector saw renewed scrutiny after reports emerged that the White House was considering restricting Nvidia’s sales of its H20 chips to China. Microsoft and OpenAI also launched an investigation into whether Chinese AI startup DeepSeek had improperly accessed OpenAI data.

Financial stocks reflected mixed conditions in credit markets. Loan growth slowed while credit costs rose, and net interest margins remained under pressure as deposit costs stayed high. Regional banks faced ongoing challenges from commercial real estate exposure, while consumer credit card debt levels increased but remained manageable. Energy stocks were impacted by falling oil prices and policy uncertainty, with Trump’s stance on tariffs and OPEC production cuts creating additional risks. Consumer discretionary stocks showed resilience, with strong retail sales, but some companies expressed concern about inflationary pressures on lower-income spending.

February Outlook

Looking ahead to February, markets will closely watch inflation data, particularly the February 12 Consumer Price Index report. With rate cuts now expected no sooner than June, investors will assess whether upcoming economic releases—including ISM manufacturing and services data, JOLTS job openings, and nonfarm payrolls—suggest inflation remains persistent. The continuation of earnings season will be another key driver, with major reports from Disney, Uber, Coca-Cola, ExxonMobil, and Chevron offering further insight into consumer trends, industrial demand, and corporate margins.

The implementation of Trump’s trade policies remains an unknown factor. If tariffs on Canada and Mexico take effect as scheduled, markets will be watching for potential supply chain disruptions and retaliatory measures. With additional tariffs on key industrial commodities being considered for mid-February, businesses in affected sectors may adjust their forecasts accordingly.

Sector rotation will be another focus. If interest rates remain higher for longer, growth stocks—particularly technology—could face renewed pressure, while defensive sectors like healthcare, utilities, and consumer staples may attract increased investor interest.

While January ended on a weaker note, the underlying economic backdrop remains supportive for equities. Strong consumer spending and relatively resilient corporate earnings have kept the market from retreating significantly. However, uncertainty around Fed policy, trade tensions, and inflation trends could contribute to increased volatility in February. Investors will be closely watching for signals on how these macroeconomic and policy developments will shape market performance in the months ahead.

In Conclusion

January saw notable developments that were potentially negative for the domestic AI complex, but the bull trend remains intact for US equities and we continue to be constructive on its ability to continue. Our Elev8 Sector rotation model starts February with overweight positions in Financials, Comm. Services, Discretionary, Healthcare and Industrials sectors. We are short Staples and Real Estate sectors, and we are out of Energy, Materials and Utilities with zero-weight positions to start the new month.

Data sourced from Factset Research Systems Inc.