January 25, 2026

If markets were judged by sentiment alone, we’d already be ordering champagne. The latest data suggest investors are about as optimistic as they’ve been in years, cash levels are thin, and confidence in continued expansion is widespread. But beneath the surface, recent events are quietly reminding investors that this is a market that rewards judgment, not enthusiasm.

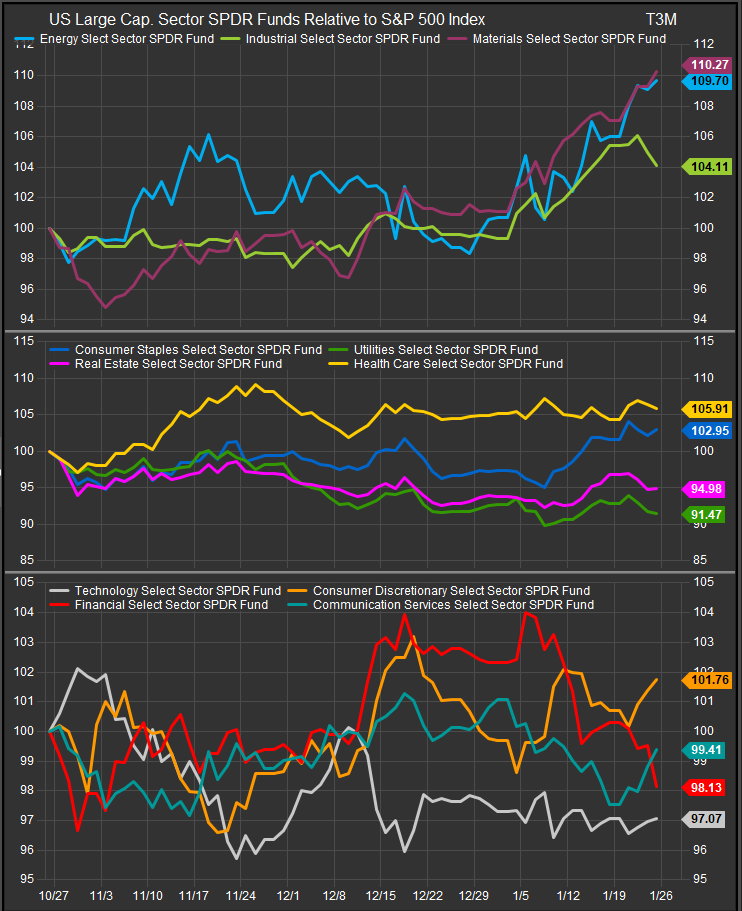

In other words: the bull case is intact, but it’s no longer forgiving. We’re filtering through the latest weekly developments to give you our take on the longer-term implications for sectors based on all the moving parts between Geopolitics, AI sentiment, Central Bank moves and other potential headwinds and tailwinds. The near-term has been market by a clear rotation towards commodity linked exposures and, cyclicality with some lower vol. perking up as well, basically everything that isn’t the Mega Cap. and AI-linked Growth trade that dominated most of 2025. We think rotation away from the AI and Tech theme is healthy, but we think there is a high likelihood of continued shifts between Growth, Value and Risk-off positioning as this cycle continues with new potential catalysts.

Everyone’s Bullish — Which Is Exactly the Problem

The latest Bank of America Fund Manager Survey reads like a victory lap taken slightly too early. Equity allocations are elevated, cash balances are scraping the floor, and global profit expectations are the strongest since 2021. Even commodities have become crowded again, which usually only happens when investors are feeling particularly comfortable.

The twist is that geopolitics has now overtaken “AI bubble” fears as the top perceived tail risk. That’s an awkward pairing: maximum optimism alongside maximum acknowledgment that something could go wrong. Historically, this is when markets stop rewarding “own everything” and start asking harder questions about what you actually own.

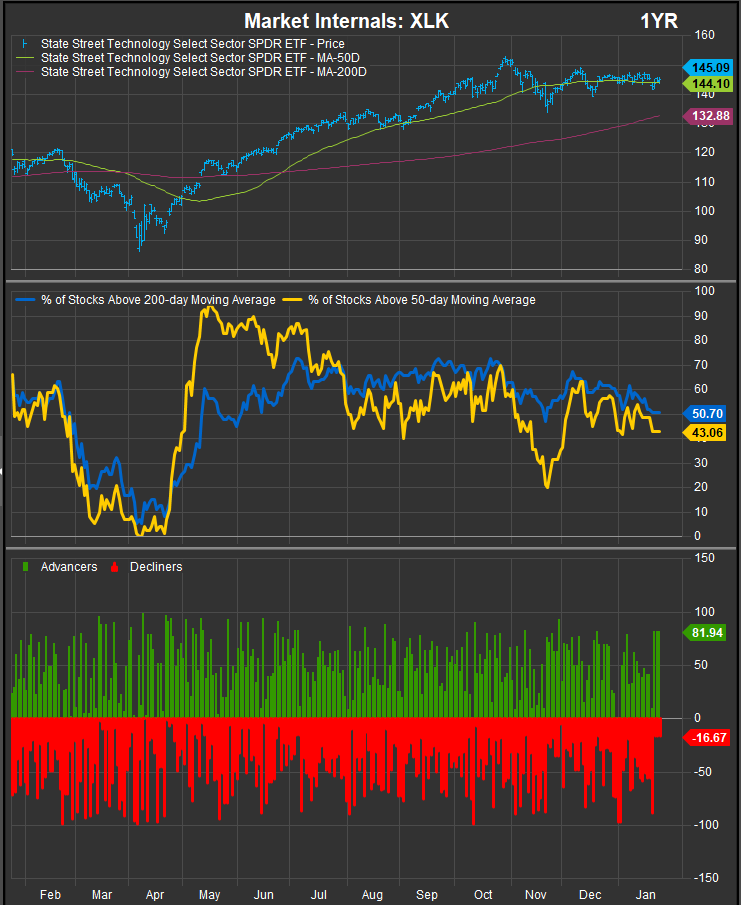

Technology: Still the Star Player, But the Margin for Error Is Shrinking

Technology remains central to the long-term narrative, but recent events have made it clear that this isn’t a frictionless glide path.

Intel’s weak Q1 outlook was a useful reminder that even in an AI-driven world, execution still matters. Demand may be there, but supply constraints, manufacturing challenges, and rising input costs don’t politely step aside for narratives. Add to that renewed policy dependence around advanced chips—highlighted by reports that China may approve Nvidia’s H200 imports with strings attached—and the takeaway is straightforward: Technology earnings are increasingly shaped by geopolitics and industrial policy, not just innovation.

This doesn’t kill the Tech story, but it does mean expectations need to be managed. In a market this bullish, disappointment travels faster than good news.

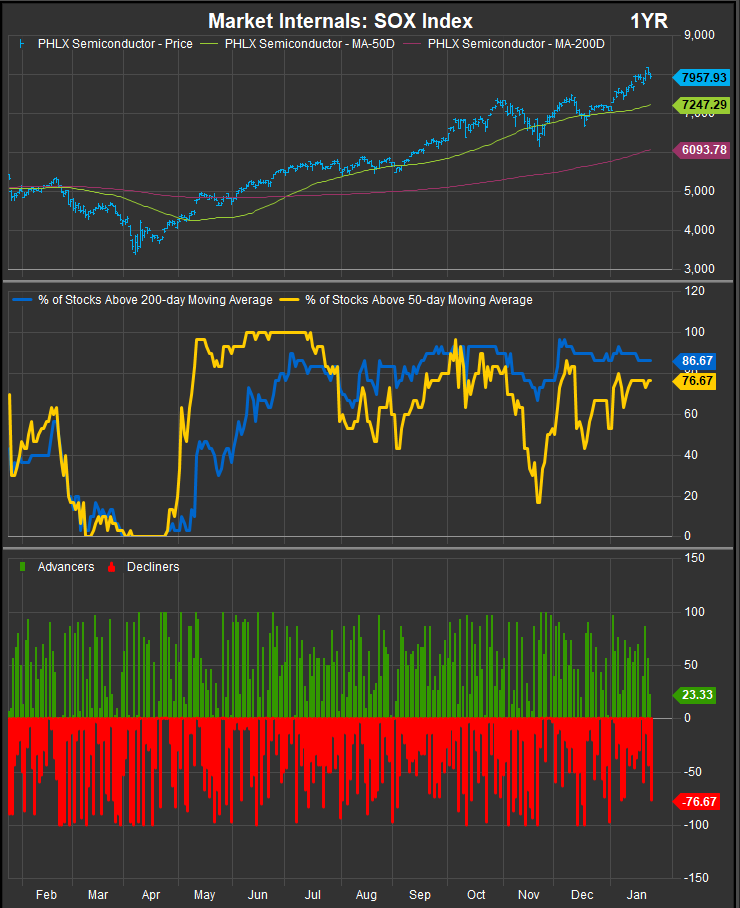

We’re showing the internal trends within the XLK Technology Sector SPDR and the Philadelphia Semiconductor Index (SOX) below. There’s been a clear shift away from broader Tech. exposure, but the demand for Semiconductors remains strong. We think strength in the latter is a “tell” that the AI trade continues to percolate in the background even as investors switch focus from AI’s potential to other concerns in the near-term.

XLK Internals

SOX Index Internals

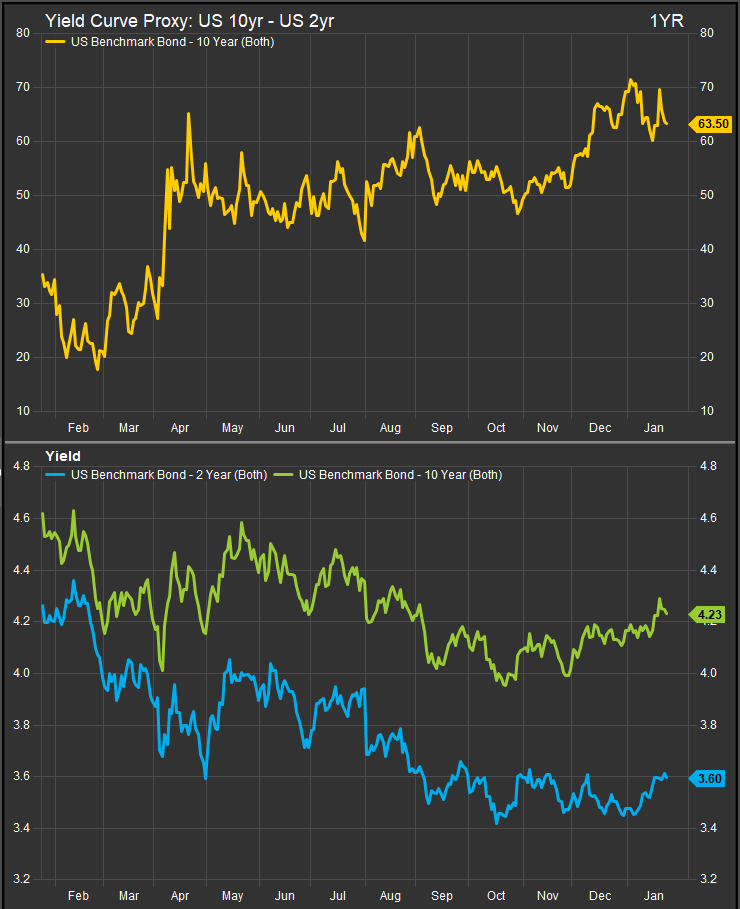

Financials: Boring in the Best Possible Way

Financials continue to benefit from being neither fashionable nor fragile. Earnings this season haven’t been flawless, but capital markets activity is improving, trading desks are busy, and capital return remains generous. Higher-for-longer rates haven’t been a headwind so much as a slow, steady tailwind, and stable labor data have kept credit fears largely theoretical. The 10yr – 2y Treasury spread widening out over the past 12-months has been a catalyst for a better NIM environment for banks and other asset managers. Sentiment matters, but structurally these conditions have historically supported credit expansion.

Even the growing chatter around Fed leadership—however speculative—has reinforced the idea that policy outcomes may eventually tilt friendlier to financial assets, without requiring near-term rate cuts.

In a market obsessed with optionality, Financials would be well positioned to take in assets from some of the more momentum driven areas of the domestic equity market. Mining, Small Cap. stocks, Energy names and Industrials are in favor at present, but many of those exposures have trouble sustaining outperformance over the longer-term. Financials may eventually be seen as a haven, particularly if inflation concerns keep longer-term yields elevated.

Industrials and Materials: Policy-Driven, Volatile, but Relevant

Industrials and Materials are increasingly tied to government priorities rather than pure economic cycles. Tariff threats tied to Greenland, critical-mineral diplomacy, and resource-security initiatives all reinforce a simple reality: industrial capacity and raw materials are now strategic assets.

That doesn’t make these sectors smooth performers—far from it—but it does mean they’re swimming with the policy current rather than against it. The surge in Japanese bond yields earlier in the week and renewed discussion of fiscal dominance globally only add to the appeal of sectors linked to real assets and infrastructure.

Expect volatility, but also persistence.

Energy: No One’s Favorite, Still Everyone’s Hedge

Energy continues to do what it does best: quietly benefit from geopolitical uncertainty, inflation sensitivity, and policymakers’ sudden rediscovery that electricity and fuel are, in fact, essential. The push to keep coal plants operating, invest in domestic supply, and prioritize energy security over elegance has reinforced the sector’s relevance.

Energy doesn’t need a perfect macro backdrop—just an imperfect one. Recent events qualify.

Consumers: Staples Eat First

The consumer is holding up, helped by improving sentiment, resilient employment, and the prospect of larger tax refunds later in the year. But earnings commentary and pricing data suggest discretionary spending is becoming more selective, especially as tariffs begin to creep into prices.

Consumer Staples, meanwhile, continue to do what they’ve always done in these moments: pass through costs, defend margins, and stay dull enough to work.

Defensives: The Fire Extinguisher, Not the Fireplace

Utilities, Healthcare, and other low-volatility sectors aren’t leading the market, and that’s fine. Their job isn’t to win the race; it’s to be nearby when someone trips. With sentiment stretched and geopolitical risk elevated, they remain useful ballast—even if no one’s bragging about owning them.

What Would Bring Leadership Back to Growth-Focused Sectors?

For all the reasons Value is working today, it’s worth being clear about what would have to change for Growth to reclaim leadership. Growth doesn’t need a miracle—it needs the rulebook to shift back in its favor.

First, rates would need to fall convincingly, not hypothetically.

Growth leadership typically follows a clear downtrend in real yields, not just optimism about future easing. Markets would need evidence that inflation is decisively contained and that the Fed is comfortable delivering multiple cuts without risking credibility. As long as policy remains “patient,” Growth’s valuation premium stays under pressure.

Second, policy risk would need to recede rather than rotate.

Growth sectors thrive when rules are stable and global. A durable pullback in tariff threats, less politicization of trade and industrial policy, and fewer earnings-relevant headlines tied to geopolitics would materially improve the backdrop for Technology and other Growth-heavy sectors.

Third, earnings breadth within Growth would need to widen.

Right now, Growth performance is concentrated in a narrow group of AI-linked leaders. A broader set of software, consumer, and innovation-oriented companies delivering upside surprises—without margin erosion—would signal that Growth is once again being driven by fundamentals rather than hope.

Fourth, capex confidence would need to turn into capex productivity.

Markets are increasingly skeptical of “spend now, monetize later.” Clear evidence that AI, automation, and digital investment are translating into measurable margin expansion and free-cash-flow growth would go a long way toward restoring investor confidence in long-duration assets.

Finally, sentiment would need to cool before it can re-ignite.

Ironically, Growth tends to perform best when it is not the most crowded trade in the room. A reset in positioning—through time, consolidation, or selective disappointment—would lower the bar for upside and make renewed leadership more sustainable.

Bottom Line

Recent events haven’t undermined the bullish case for equities, but they have raised the standard for Growth-style leadership. Until rates fall meaningfully, policy risk eases, and earnings delivery broadens, the market is likely to continue favoring Value-oriented sectors that offer cash flow, pricing power, and execution certainty.

Most favored today: Financials, Energy, Industrials, select Materials

Waiting for better conditions: High-multiple Technology, Consumer Discretionary

Still earning their keep: Staples, Utilities, Healthcare

Or, put simply: Growth will get its turn again — just not on goodwill alone.