December 7, 2025

The crosscurrents shaping the U.S. equity market today are exactly what investors expect from a late-cycle environment: strong earnings, softening labor, political noise around monetary policy, and a macro backdrop that is neither hot enough to reignite inflation nor cool enough to derail growth. In that setting, sector leadership is no longer uniform or liquidity-driven; it must be earned through structural earnings power, durability, and alignment with multi-year investment cycles.

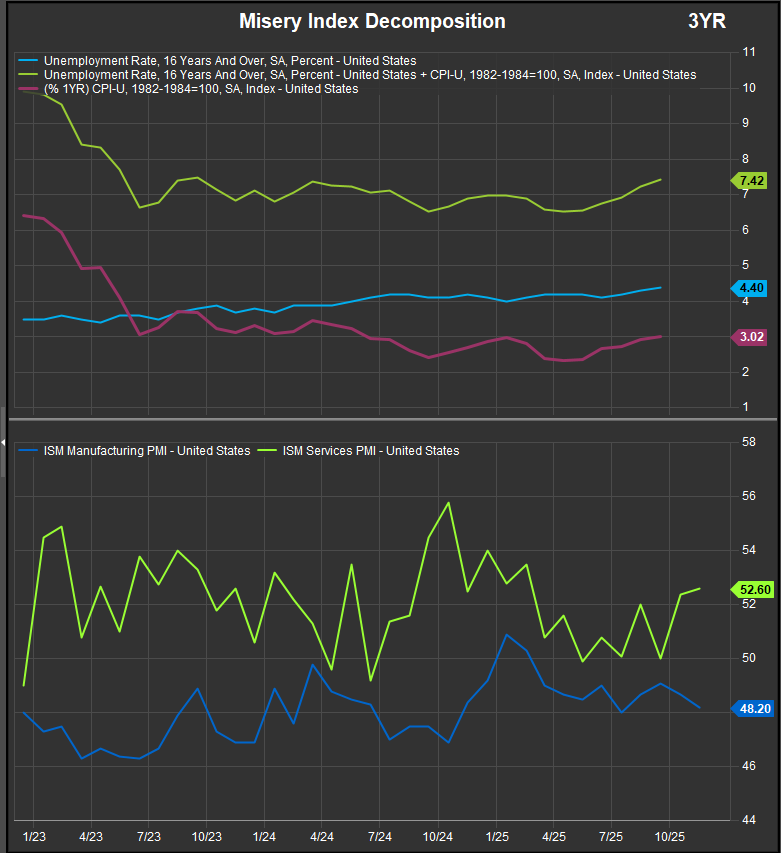

The latest economic data reinforce this bifurcated narrative. The services economy remains in expansion, with the ISM Services index reaching its best level in nine months. Holiday spending meaningfully exceeded expectations, powered by record online volumes and a visible impact from AI-driven shopping tools. Yet the labor market is clearly slowing beneath the surface: ADP payrolls posted their weakest reading since 2023, Challenger layoffs have reached the highest annual level since 2020, and small-business bankruptcies continue to rise. This blend of strong demand and weakening employment leaves the market leaning heavily on the earnings outlook—and corporate America continues to deliver. Third-quarter S&P 500 earnings grew in the low teens year-over-year, Q4 is tracking solidly, and 2025–26 forecasts point to another strong cycle. Earnings-revision breadth across the S&P 500, Nasdaq 100, and Russell 2000 has turned positive for the first time in a year and a half.

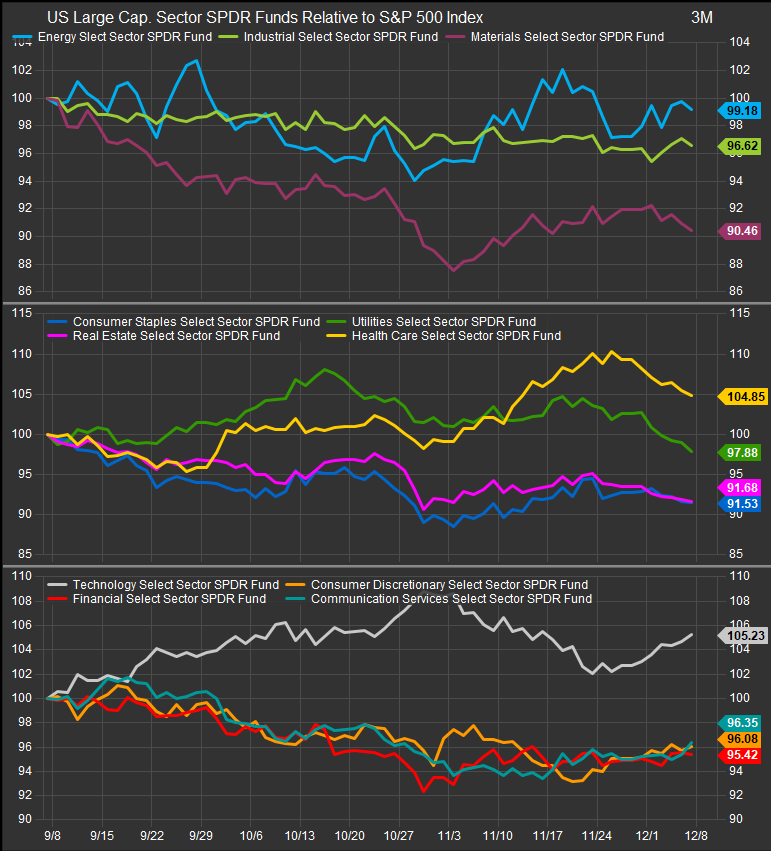

Where this becomes critical for sector positioning is in the interaction between earnings quality and the political backdrop. Markets are increasingly assuming Kevin Hassett will replace Jerome Powell as Fed Chair, raising questions about how aggressively the Fed might ease in 2026. Investors are now forced to anchor on sectors that can perform through both policy volatility and shifting interest-rate expectations. On that score, three stand out—Technology, Healthcare, and, via the commodities channel, Energy and Materials—though for entirely different reasons.

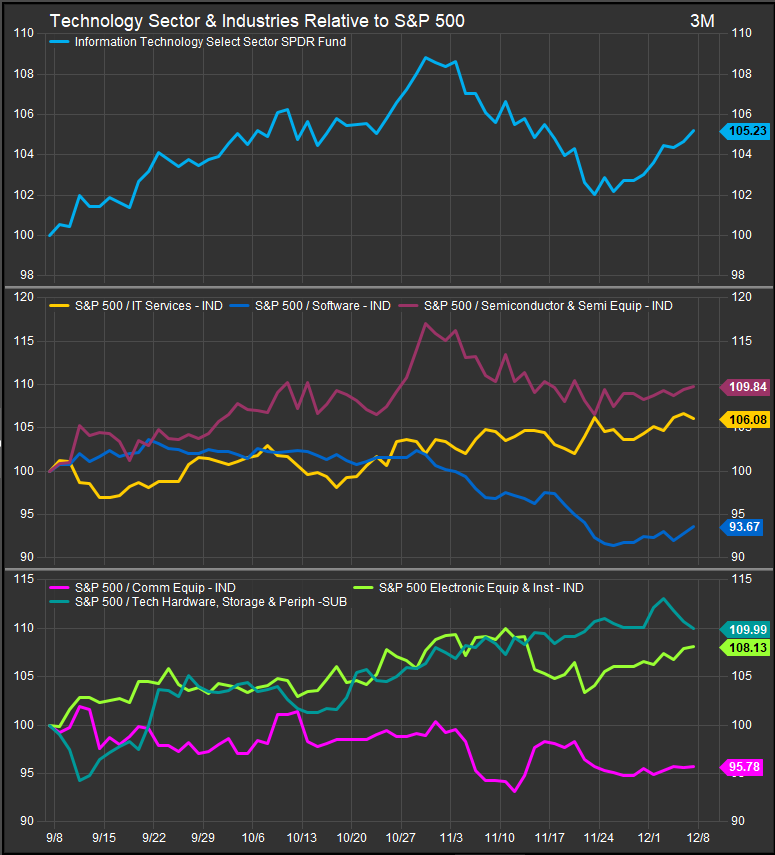

Technology: Still the Center of Gravity

Technology remains the undisputed structural growth engine of the U.S. market. Despite rotation within the sector—OpenAI-linked names lagging as Google’s Gemini gains early traction in downloads, MAUs, and engagement metrics—the core fundamentals remain overwhelmingly supportive. Recent earnings from Marvell, Salesforce, MongoDB, and Credo confirmed that AI infrastructure, cloud spend, and data-center demand remain robust. Semiconductors and high-throughput interconnect components continue to experience powerful order flow tied to both training and inference cycles.

The short-term headwinds—valuation sensitivity and heightened competition among AI platform companies—are real, but they do not undercut the multi-year investment cycle underway. AI capex from hyperscalers continues to rise, enterprise software workloads are accelerating, and the monetization runway for AI-enabled services is broadening. Against a backdrop of moderating inflation and a Fed that is more likely to cut than hike in 2026, Technology maintains one of the strongest risk-reward profiles in the index. It remains the leading overweight.

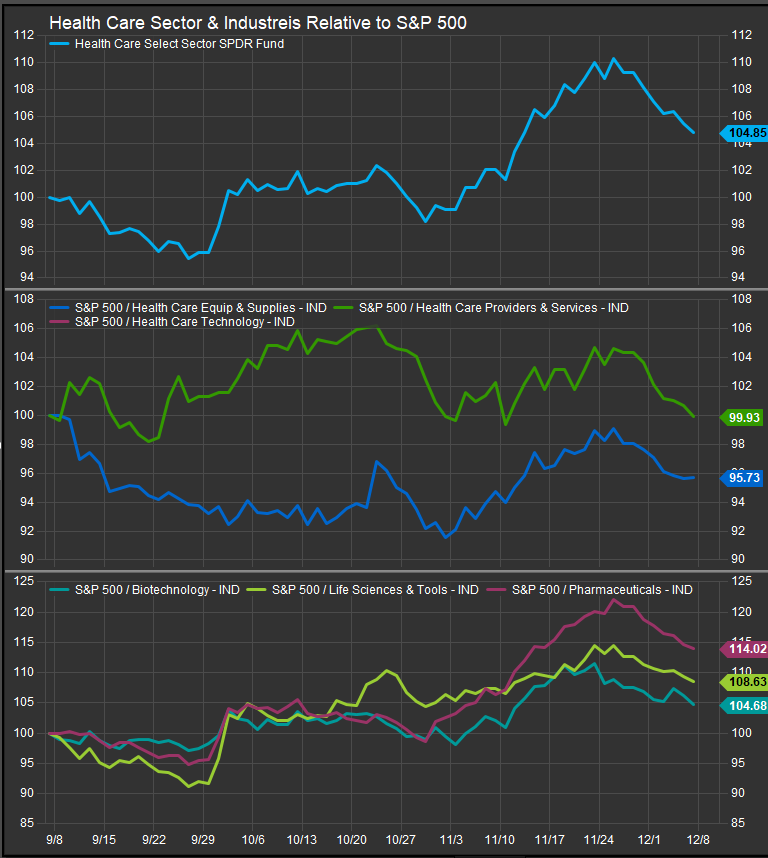

Healthcare: The Quiet Leadership Trade

Healthcare has been steadily regaining leadership, powered by a rare combination of defensiveness and innovation. Wall Street’s rotation into the sector in recent months reflects renewed confidence in its earnings resilience across large-cap pharma, medtech, and healthcare services. Demand is non-cyclical, balance sheets are solid, and the GLP-1/metabolic-disease revolution continues to generate blockbuster growth for leading manufacturers.

Election-year policy noise will persist, but the structural picture is unchanged: healthcare spending growth remains well above GDP, pipeline productivity is strong across oncology and immunology, and the sector has proven to be an effective late-cycle ballast. Unlike Staples—which benefit from affordability trends but face margin sensitivity—Healthcare offers both stability and multi-year earnings momentum. It deserves a meaningful overweight heading into 2026.

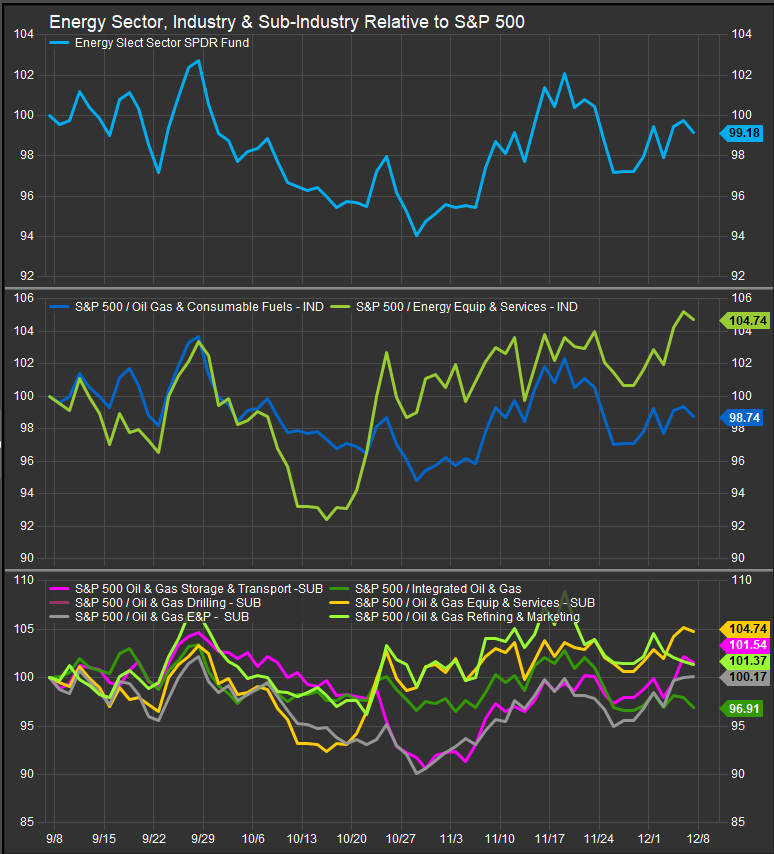

Commodities Are Reawakening—And So Are Energy and Materials

One of the most important but underappreciated shifts in recent weeks is the quiet reacceleration in commodity prices, particularly across oil, natural gas, and certain industrial metals. The drivers are familiar: geopolitical risk in Eastern Europe and Latin America, OPEC+ discipline, and tightening supply expectations heading into winter. But overlaying these dynamics is a more structural theme: the power-hungry nature of the AI build-out.

Data-center electricity loads are rising at a rate not seen in decades. Utilities and midstream operators are reporting accelerating demand from hyperscalers; natural gas consumption is rising; and grid-expansion projects are being repriced upward. That surge in power demand has a direct chain reaction across the commodity complex, lifting Energy and Materials, particularly metals tied to electrical infrastructure.

For investors, that means two important conclusions:

- Energy and Materials are no longer just macro hedges—they are beneficiaries of the AI investment cycle.

Integrated energy companies, LNG exporters, and diversified miners with copper, aluminum, and specialty-metal exposure benefit from both near-term geopolitical risk and long-term structural demand. - Higher commodity prices create sector divergence within cyclicals.

Traditional manufacturing may stay soft, but resource producers outperform when the market’s most capital-intensive growth engine (AI) requires ever-greater physical inputs.

While Energy and Materials remain more volatile than Tech or Healthcare, the risk-reward profile is improving materially. They are not yet top-three outperformer candidates—but they are moving up the ranking and deserve increasing attention as potential tactical overweights, especially if commodity-price momentum persists.

Our Analysis Favors Technology and Healthcare in the Near-term

With the consumer bifurcating, the labor market softening, and political noise shifting Fed expectations day-to-day, the sectors best positioned for sustained outperformance are those with both earnings durability and structural demand. Technology has the strongest secular growth trend in the market, and Healthcare has the most resilient and innovation-rich earnings path. Rising commodities do not supplant these leaders, but they add a compelling supporting thesis for Energy and Materials as late-cycle beneficiaries.

In a market that is becoming increasingly selective beneath the surface, Technology and Healthcare remain the two clearest overweights, while Energy and Materials rise as credible tactical plays riding the convergence of geopolitics, power demand, and commodity tightness.

Charts and data sourced from FactSet Research Systems inc.