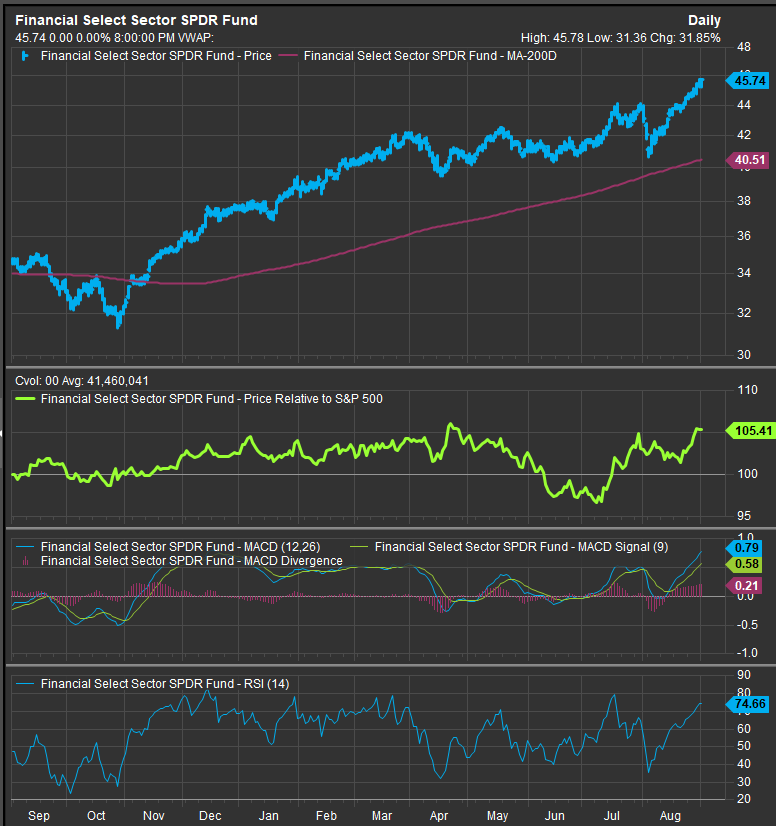

Financials held onto July gains in August despite market level volatility. The Sector is showing strong performance, breadth and momentum characteristics and is top ranked in our Elev8 Model for September

Price Action & Performance

XLF, and the broad market generally, began August with a swift 10% correction. The sector proceeded to rally throughout the remainder of the month to finish at all-time and as the best performing sector over the past 12 months.

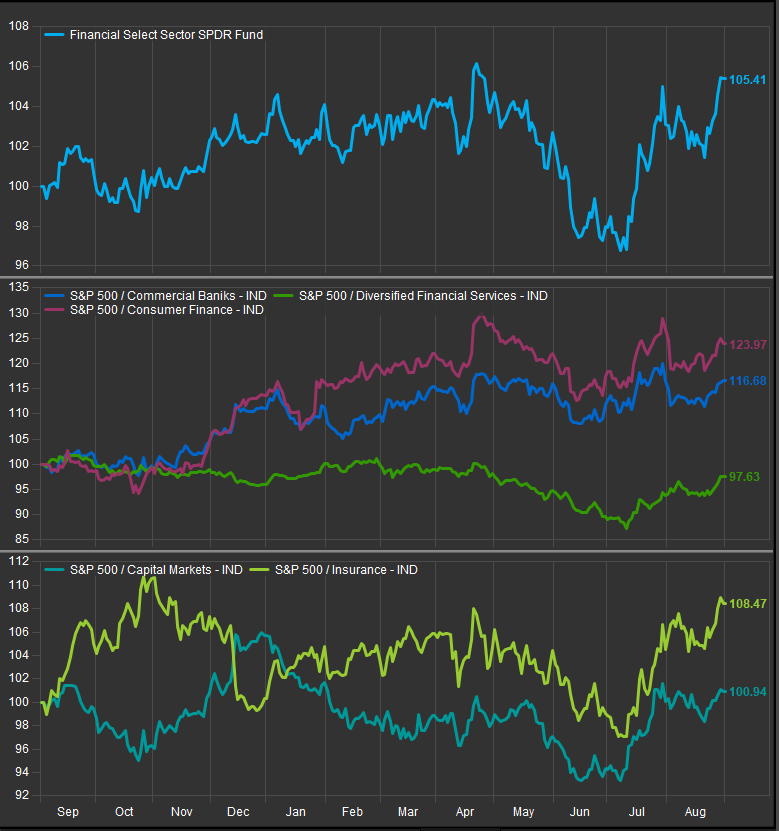

Outperformance is broad at the industry level with 4 of 5 GICS Industries outperforming the S&P 500 over the past 12 months. Banks and Consumer Finance Co.’s have led the advance. The Insurance Industry has also been a source of strength, especially in the near-term. Capital Markets stocks have also joined the party in the past 3-months.

At the stock level, our favorite names are JPM, BRK.B, FI, AXP, KKR, MCO, ACGL, AFL, AJG, BRO, HIG and PGR. However, unlike several other sectors, there are many other attractive charts beyond these within the sector.

We would also point out that Financials were devastated in Q1 of 2023. The bank run that closed SBNY and SIVB was a product of abrupt Fed policy manipulations that led to prolonged and elevated interest rate volatility. Financials potentially have a longer ramp of reflation still in front of them.

Economic and Policy Drivers

Lower inflation readings have helped reflate many bank balance sheets which had been over-indexed to the long end of the curve back in 2022. Investors have pivoted to expecting interest rate policy easing from the Fed. in the 2nd half of 2024. That has sparked rotation away from Mega Cap. Growth. It also increases the value of bank balance sheets which tend to hold a large amount of fixed income, particularly government debt, on their balance sheets. As the curve moves broadly lower in response to Fed. policy guidance, this is a tailwind to Book Value and should improve the fundamental attractiveness of banks moving forward.

Financials will likely benefit from any momentum the Trump campaign can gain as election season ramps given his legacy of cutting taxes for the wealthiest and easing regulatory hurdles for businesses. Interest rates remain a key pivot as broadening upside participation in the equity market may spark bets on a reemergence of inflation, but so far that concern is not visible in the data.

Foreign policy in a new administration will likely have some bearing on Financial Sector performance as well. Isolationist policy which is favored by many in the MAGA conservative camp is inherently inflationary as it would likely continue disaggregation of the global supply chain and create barriers to trade. This has potential to put upwards pressure on interest rates and the USD. That would be a potential risk as we move forward

In Conclusion

The XLF has found its footing and now looks like one of the most attractive sectors within the US equity market from a technical perspective. Rotation into cyclicals due to expectations of policy easing in the 2nd half of 2024 has been a benefit and we expect it will continue to be in September. Our Elev8 Sector Model continues with an OVERWEIGHT Position in XLF of +3.97% vs. the benchmark S&P 500

XLF Technicals

- XLF daily (200-day m.a. | Relative to S&P 500 | MACD | RSI )

- Relative-curve is back near highs for the year. We expect some momentum to carry forward amidst bullish oscillator readings

XLF Relative Performance | XLF Industry Level Relative Performance | 1yr

- XLF is where the strength is now that Mag7 and Mega Cap. Growth are in a holding pattern

Data sourced from FactSet