XLV Healthcare SPDR June Outlook—Looking for some tactical mean-reversion performance after a brutal 15-months for the sector

Price Action & Performance

XLV has continued its steady march lower from 2023 into 2024. However, we are finally seeing some positive momentum divergence in the relative downtrend, and we are entering the seasonally weak summer period of the domestic calendar where XLV out performed in both the bull market environments of 2021 and 2023. Not too much to get excited about at the industry level, but similar to the aggregate sector performance, a case can be made that 4/5 Healthcare Industries are also stabilizing performance. Typically, the key to outperforming in Healthcare is to be an opportunistic buyer, and with the XLY looking even weaker from a performance perspective we are allocating to XLV in our new 8 Sector model.

Economic and Policy Drivers

The emergence of GLP1 drugs has had a profound impact on the Healthcare sector. While the chart of Eli Lily (LLY) is still one of the strongest in S&P 500, success of that product has potentially cannibalized several other prominent healthcare business lines. As investors bet on a reduction in the number of various surgeries required, cases of diabetes, traditional weight loss, and many other areas associated with a broad reduction in obesity and related illness, many other stocks in the sector have seen their prospects deteriorate. The emergence of inflation in 2022 helped the sector by arresting the advance of the broad market and allowing some of the more stable business lines in the sector like managed care (UNH, ELV, MOH) and Pharmaceuticals to add value to investor portfolios. There are several strong stocks in the Sector like LLY, MRK, BSX, VRTX, but many equipment and supply names are struggling. This is more a play on tactical rotation into laggard stocks than a cue to accumulate for the long-term.

How Can XLV Help?

XLV can help by offering the ability to pivot quickly if inflation morphs from a somewhat concern to a full-blown problem like we had in 2022. That year the HC sector outperformed in 11 out of 12 months. I’m not expecting that to happen at this point, but it shows that things can change quickly and the low cost, highly liquid XLV is a great way to put a placeholder in a portfolio if/when trends change. As is, we’ve mentioned several strong individual stocks that are still in a good position and oversold defensive shares are typically a good thing to own when equities correct. Historically the lead up to presidential elections has manifested in stock market consolidations and the summer seasonals are typically weak as well.

In Conclusion

The XLV has continued to deteriorate and has been a large underweight in our process since the bull market started in early 2023. However, our work also suggests that oversold defensive shares can be a good tactical add to a portfolio and that’s what XLV shares are this month. Our Elev8 Sector Model debuts with an OVERWEIGHT position in XLV of + 1.02%

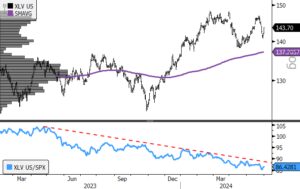

Chart | XLV Technicals

- XLV 12-month, daily price (200-day m.a. | Relative to S&P 500)

- Even in years of weak performance XLV typically outperforms in the weak seasonal period from June through October