December 11, 2025

S&P futures are down 0.6% Thursday morning following Wednesday’s broad cyclical rally led by machinery, industrials, regional banks, housing, transports, and retail. Asian markets were mostly weaker overnight, with notable declines in China’s Shenzhen Composite and Japan’s Nikkei. Europe is slightly higher (~0.1%). Treasuries are little changed after Wednesday’s bullish steepening that delivered the largest two-year yield drop in two months. The dollar is down 0.2%, gold up 0.5%, Bitcoin off 2.3%, and WTI crude down 1.5%.

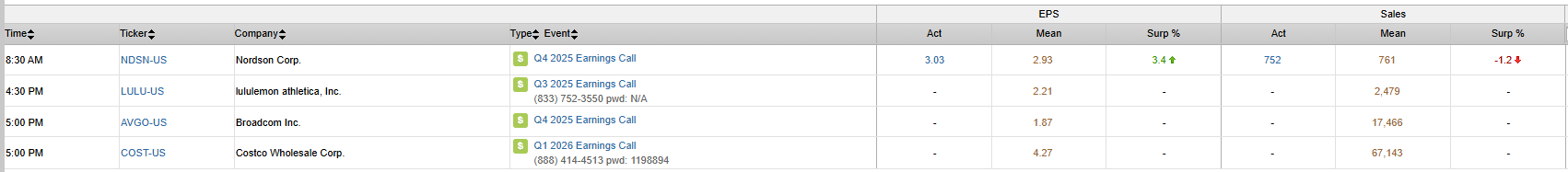

The tone has shifted risk-off, largely due to ORCL’s disappointing results, which added to concerns around AI infrastructure demand despite management emphasizing an otherwise strong AI backdrop. Markets now look to AVGO earnings after the close as the next key input on AI sentiment. Otherwise, the tape remains quiet as investors digest Wednesday’s FOMC—where a less-hawkish-than-feared outcome helped alleviate some recent macro overhang heading into a favorable seasonal stretch.

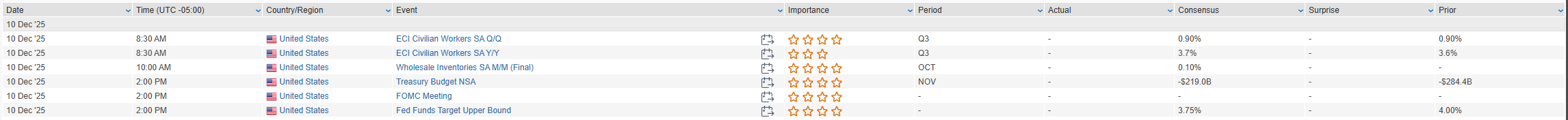

Today’s calendar includes initial jobless claims for the week ending 6-Dec and the September trade balance, plus a $22B 30-year bond auction. No data Friday, though Fedspeak resumes with Paulson, Hammack, and Goolsbee. Markets are also preparing for a heavy macro week beginning 15-Dec, with November NFP (16-Dec) and November CPI (18-Dec) likely to take on added significance following Powell’s comments about payroll data potentially overstating job growth by ~60K per month.

Company news:

- ORCL sharply lower after a fiscal Q2 miss on revenue and operating income, –$10B FCF, only slightly above-Street RPO growth (even with a 440% surge), and a $15B increase to FY capex.

- ADBE reported a mostly in-line fiscal Q4 with FY26 guidance broadly consistent; commentary suggested little change to the broader narrative.

- MTN fiscal Q1 largely in line; noted modest improvement in season-pass sales but still down ~2%.

- OXM plunged after guiding Q4 more than 85% below consensus and citing a softer start to the holiday season.

US equities rallied Wednesday (Dow +1.05%, S&P 500 +0.67%, Nasdaq +0.33%, Russell 2000 +1.32%), closing just off session highs as Industrials, cyclicals, and value-tilted areas led the charge. Industrial conglomerates, machinery, transports, regional banks, private equity, credit cards, homebuilders, autos, travel & leisure, industrial metals, chemicals, and pharma all outperformed. Big Tech was mixed, with MSFT a notable laggard. Quantum computing, nuclear, rare earths, hospitals, and networking trailed. Treasuries strengthened with a bull-steepening move—front-end yields fell 7–8 bp and the long end by 2–4 bp. The dollar fell 0.6%, gold slipped 0.3%, Bitcoin futures rose 0.4%, and WTI crude gained 0.4% amid the US seizure of a Venezuelan tanker.

The Fed delivered a widely expected 25 bp “hawkish cut” to 3.50–3.75%, accompanied by three dissents, a tweak to forward guidance, and—most market-moving—a plan to begin buying $40B/month in Treasury bills to maintain ample reserves. While headline policy shifts were broadly anticipated, the balance sheet support and Powell’s tone were viewed as slightly less hawkish than feared. The meeting followed weeks of rising global yields driven by a hawkish global monetary impulse. AI narrative remained anchored in power-consumption themes, with strong GEV updates ahead of ORCL earnings (after the close), AVGO results tomorrow, and the expected release of a new OpenAI model. Corporate capital return was another major theme, with more than $20B in new buyback authorizations hitting the tape. Consumer and credit commentary from the GS Financial Services Conference leaned more constructive despite ongoing affordability concerns.

The Fed’s SEP (Summary of Economic Projections) showed one cut penciled in for 2026, unchanged from September, and signaled modest improvements in unemployment and inflation projections. Powell emphasized that policy is now within a plausible range of neutral, noted risks around delayed data, and downplayed concerns over reported payroll overstatements. Markets now assign ~75% probability to a January hold. Initial claims and September trade balance arrive Thursday alongside a $22B 30-year auction. No major data Friday, though Fedspeak returns. The next heavy macro week begins 15-Dec with NFP (16-Dec) and CPI (18-Dec).

Sector Highlights

Leadership broadened significantly: Industrials (+1.84%), Materials (+1.77%), Consumer Discretionary (+1.52%), Healthcare (+1.45%), Financials (+1.13%), and Energy (+1.11%) all outperformed as cyclical and value segments responded to a more benign post-FOMC rate backdrop and supportive balance sheet messaging. Laggards included Utilities (–0.11%), Consumer Staples (flat), and Tech (+0.05%), reflecting a rotation away from defensives and mega-cap growth into economically sensitive segments.

Information Technology

- NVDA refuted reports of smuggled Blackwell chips in China.

- MRVL CEO pushed back on claims of customer losses at MSFT and AMZN.

- BRZE surged on a beat-and-raise quarter with accelerating organic growth and strong customer adds.

- PLAB jumped on a major earnings beat, strong U.S. demand, and above-consensus Q1 guidance.

Communication Services

- META reportedly developing a new closed AI model for launch next year.

- WBD gained as PSKY is said to be considering raising its hostile bid to $35/share.

- GME declined after missing on revenue and EBITDA despite an EPS beat.

Consumer Discretionary

- PLAY rose despite weak comps as management pointed to improving trends.

- CHWY beat earnings, with analysts positive on FY26 commentary.

- GME (see above) pressured by falling hardware sales.

Consumer Staples

- PEP upgraded at JPM on margin expansion optimism and FX tailwinds expected in 2026.

Industrials

- GEV rallied after raising multi-year guidance, doubling its dividend, and expanding buybacks ($10B).

- AVAV fell on an earnings miss and lowered guidance, though analysts noted strong bookings and industry demand.

- PLTR won a $448M U.S. Navy contract to support AI-driven industrial base modernization.

Financials

- ALLY announced a $2B buyback (~15% of market cap).

- RF unveiled a $3B repurchase authorization.

- JPM fell on guidance for elevated 2026 expenses and softer Q4 IB expectations.

Energy

- XOM and broader energy benefited from stabilization in crude prices following U.S. seizure of a Venezuelan tanker.

Healthcare

- STAA declined as Yunqi Capital reiterated opposition to its go-shop process and Alcon’s revised offer.

Materials

- Strength in industrial metals and chemicals supported sector leadership; no major stock-specific headlines here.

Eco Data Releases | Thursday December 11th, 2025

S&P 500 Constituent Earnings Announcements | Thursday December 11th, 2025

Data sourced from FactSet Research Systems Inc.