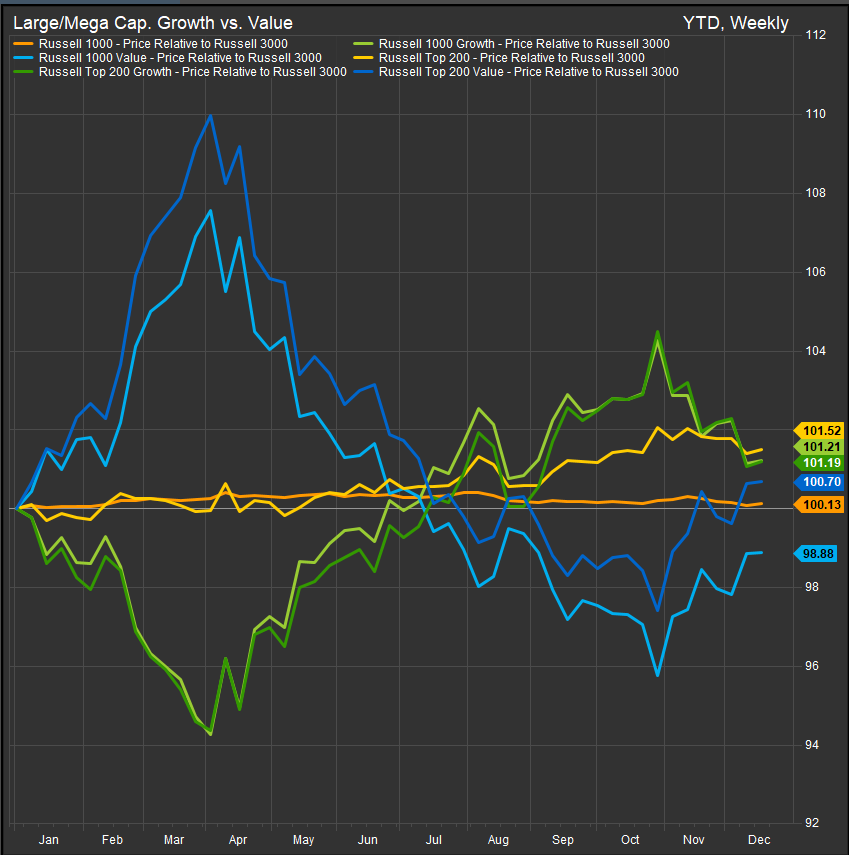

Factor Friday | Real Yields and the Rotation: What’s Driving U.S. Large-Cap Growth vs. Value?

Growth and Value leadership often hinges on real yields. When inflation-adjusted rates rise, Value historically gains the edge; when they fall, Growth regains momentum. Understanding real yield regimes helps investors anticipate style rotations and position portfolios as macro conditions evolve.