November 14, 2025

The knives are out for the AI trade in the near-term. Morgan Stanley QDS (Quantitative Derivatives Strategy) calculates that momentum unwinds typically last 25 trading days going back to 2021, so by that frame, the current selling could continue into month-end.

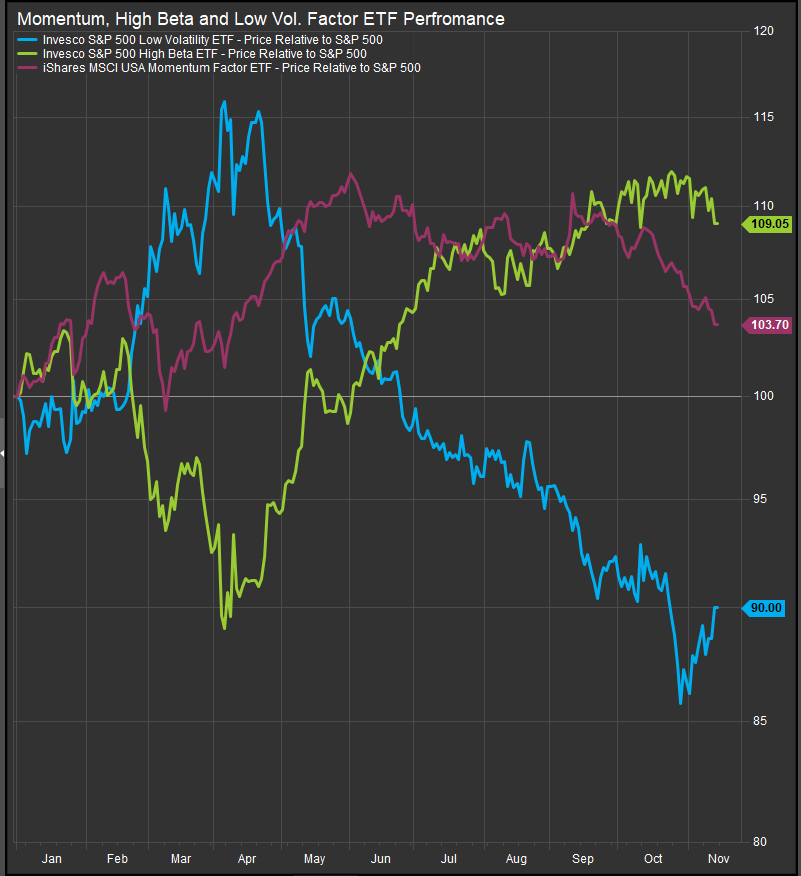

The sharp momentum unwind has forced investors to reassess the balance between Growth and Value leadership. Thursday’s selloff was particularly brutal: Goldman Sachs’ High Beta Momentum Pair fell 6.4%, its second-worst day of 2025, while Morgan Stanley’s long–short Momentum pair is now down 14% since October 15, with the long leg off nearly 19%. Yet this correction has occurred with the VIX still near 20—well below panic levels—and bond volatility (the MOVE Index) only about 20% above late-October lows. The message from markets is not panic, but recalibration: positioning was crowded, valuations were stretched, and the macro backdrop has turned less forgiving. A preference for lower vol. is seen in our equity risk ratios as well (chart below, top panel).

Macro Conditions: Less Cushion, More Uncertainty

The fundamental picture is mixed. Several Federal Reserve officials—including San Francisco’s Daly and Cleveland’s Hammack—signaled that monetary policy should remain restrictive, pushing December rate cut odds down to roughly 47%, according to CME FedWatch. Labor data remains soft but inconclusive: jobless claims eased, but ADP’s weekly data suggest slowing hiring, and Challenger’s October report logged 153,000 layoffs, with Verizon’s 15,000 job cuts underscoring that pressure is spreading to large corporates. The University of Michigan’s consumer sentiment index fell to its lowest reading since mid-2022, while PricewaterhouseCoopers’ survey showed expected holiday spending down 5% year over year, contradicting the National Retail Federation’s more optimistic +4% forecast.

The reopening of the government should help the data flow normalize, but the lack of October CPI and jobs data leaves the Fed effectively “flying in the fog.” Until clarity returns, investors should expect further swings in both rate expectations and equity risk premia.

AI Complex: From Euphoria to Earnings Discipline

The market’s largest and most crowded trade—AI—has entered a necessary cooling phase. Oracle’s stock is down nearly 30% in a month, punished for heavy borrowing to fund AI infrastructure that has yet to produce proportional returns. Reports of widening tech credit spreads, longer data-center buildout timelines, and balance-sheet leverage at companies like CoreWeave have amplified scrutiny. Meanwhile, SoftBank’s sale of its entire Nvidia stake was interpreted as a signal that the “AI capital cycle” has entered a more mature phase.

Still, the secular drivers of AI remain intact. Microsoft (MSFT) and Amazon (AMZN) continue to expand capacity prudently, backed by strong cash flow. Apple (AAPL) has emerged as a quiet beneficiary, with iPhone 17 sales up more than 20% year over year in China, and Tencent agreeing to a 15% fee on WeChat purchases through Apple’s ecosystem—an important data-point for app-store monetization. Palantir (PLTR), meanwhile, is scaling its defense and government business in the UK, reflecting how AI demand is diversifying beyond hyperscalers. The market’s tone has simply shifted: investors are now distinguishing between “AI spending” and “AI profitability.”

Growth vs. Value: Rotation, Not Reversal

Growth sectors—Technology, Communication Services, and Consumer Discretionary—face valuation and rate headwinds but retain powerful long-term earnings engines. FactSet reports S&P 500 earnings growth of 13.1% and revenue growth of 8.3% in Q3, with 82% of companies beating EPS estimates, well above the five-year average. However, the market’s reaction has been subdued, rewarding guidance over results. Jefferies notes that upward EPS revisions are now at their highest since 2021, but the index’s price response has lagged, suggesting investors are focused on durability, not surprise.

By contrast, Value and Cyclical sectors—Energy, Financials, Industrials, and select Materials—have emerged as relative havens. ExxonMobil (XOM) and Chevron (CVX) are outperforming as oil prices remain steady despite Russia’s Black Sea port attack that temporarily halted 761,000 barrels per day of exports. Boeing (BA) shares rose after striking workers approved a labor deal, ending a three-month walkout, while Lockheed Martin (LMT) and Palantir continue to benefit from the rise in defense spending. In Financials, Allstate (ALL), JPMorgan (JPM), and Morgan Stanley (MS) have outperformed as credit quality remains stable and capital markets activity improves.

Meanwhile, consumer-facing companies and staples are feeling the pinch of cautious spending. Trade policy may help at the margin: the Trump administration’s new tariff exemptions on food imports—bananas, coffee, and beef—could ease input costs for retailers and restaurants, but PricewaterhouseCoopers’ survey showing weaker consumer intent signals a more muted holiday season.

Market Context: Earnings Strength, Sentiment Fragility

Despite this sentiment volatility, the corporate fundamentals remain solid. Over 90% of the S&P 500 has now reported Q3 results, and the blended EPS growth rate of +13.1% represents the fourth consecutive quarter of double-digit profit expansion. Bank of America highlights that twice as many companies have issued positive guidance as negative, a 2:1 ratio versus a long-term average of 0.8:1. Yet investors have punished misses far more harshly than usual, reflecting a higher bar for optimism amid elevated valuations.

Strategists at Morgan Stanley argue that an earnings recovery is already underway, with 2026 setting up for a stronger profit cycle once temporary tariff and Fed overhangs clear. UBS’s 2026 S&P 500 target of 7,500 implies 11.5% upside from current levels, a view predicated on continued double-digit earnings growth in Technology and Industrials, modest expansion in Financials, and resilient margins in Energy.

Tactical Frame: Adjusting Exposure Through Sector Funds

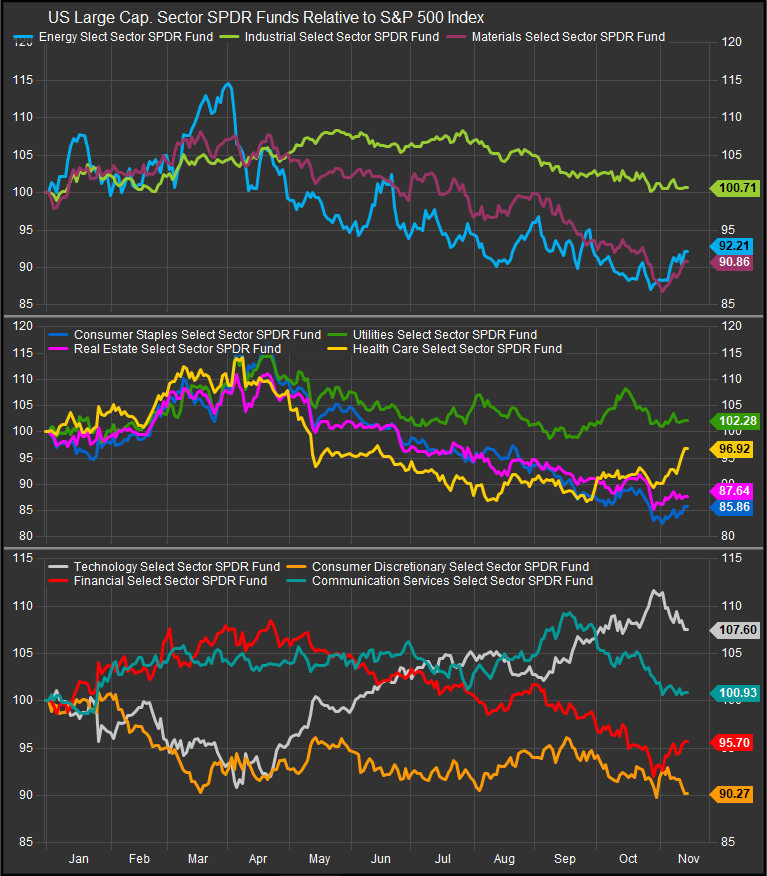

From a tactical standpoint, the recent rotation calls for refinement rather than retreat. Growth is not broken, but investors should migrate from speculative, debt-funded AI names toward higher-quality, cash-flow-generating technology and communications leaders. For investors expressing this view through sector ETFs, the Technology Select Sector SPDR (XLK) and Communication Services Select Sector SPDR (XLC) remain core holdings, but with a tilt toward the top-weighted mega-caps—Microsoft, Apple, Alphabet, and Meta—that maintain balance-sheet flexibility and pricing power.

Value exposure can be balanced through the Energy Select Sector SPDR (XLE), which benefits from stable oil prices and robust shareholder returns, and the Financial Select Sector SPDR (XLF), where banks and insurers continue to post resilient profitability despite slower rate-cut expectations. The Industrial Select Sector SPDR (XLI) provides exposure to the defense, logistics, and automation segments that are emerging as secular beneficiaries of supply-chain reconfiguration and government spending.

For diversification, investors can maintain a modest position in the Health Care Select Sector SPDR (XLV), which combines defensive earnings resilience with innovation-led growth, and use the Materials Select Sector SPDR (XLB) to capture upside from metals and chemicals tied to the commodity rebound. The Utilities (XLU) and Real Estate (XLRE) funds remain tactical laggards in a higher-for-longer rate regime.

The tactical allocation, then, is not a wholesale shift from Growth to Value but a barbell—anchoring portfolios with cash-returning cyclicals on one end and cash-rich secular growers on the other. Historical analogs show that momentum unwinds of this magnitude tend to last around 25 trading days, and we are approximately three weeks into that process. As the data stream resumes and Fed rhetoric normalizes, volatility should fade, allowing quality Growth and disciplined Value alike to reassert leadership into year-end.

Bottom Line: Balance Sheet Strength Over Beta

The narrative dominating markets this month is not the death of Growth but its return to financial discipline. AI remains a transformative secular theme, but the market is demanding proof of earnings scalability and cost efficiency. Value is back in focus, but its durability depends on whether the soft-landing narrative holds. For now, the opportunity lies in owning strength—companies and sector funds with clear cash flow visibility, moderate leverage, and exposure to tangible economic drivers.

As sentiment oscillates between hawkish Fed rhetoric and earnings optimism, investors should use this period of uncertainty to rebalance toward quality, maintain exposure to both sides of the Growth–Value spectrum, and prepare for the next phase of leadership once the data—and the Fed—clarify the path forward.

We continue to be constructive on the AI trade over the longer-term. Enthusiasm and profit-taking are the push and pull of strong trends. Rallies in the Value trade improve equity market breadth and keep investors honest about the amount of risk in their portfolios. That said, earnings growth trends in the AI complex are very strong across the globe. We think interest rates and inflation readings will be pivotal to determining the path forward for the business cycle, but we’re expecting continued moderation on that front due to crosscurrents from an economy near full employment and continued digestion of global trade policy. We think the overall macro picture can still support Growth outperformance, but sector allocations should be balanced out in the near-term.

Other Data sourced from FactSet Research Systems Inc.